United States Architectural Coatings Market Overview

- The United States Architectural Coatings Market is valued at approximately USD 16 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand for residential and commercial construction, rising consumer spending, and a growing focus on sustainable and eco-friendly products. The market has seen a pronounced shift towards water-based coatings due to their lower environmental impact and regulatory compliance.

- Key cities such as New York, Los Angeles, and Chicago continue to dominate the market due to extensive construction activities and large-scale urban development projects. These metropolitan areas have a high concentration of both residential and commercial buildings, leading to increased demand for architectural coatings. The presence of major manufacturers and distributors in these regions further strengthens their market position.

- In recent years, the U.S. Environmental Protection Agency (EPA) has implemented stricter regulations on volatile organic compounds (VOCs) in architectural coatings. These regulations aim to reduce air pollution and improve indoor air quality, pushing manufacturers to innovate and develop low-VOC and zero-VOC products to comply with the new standards.

United States Architectural Coatings Market Segmentation

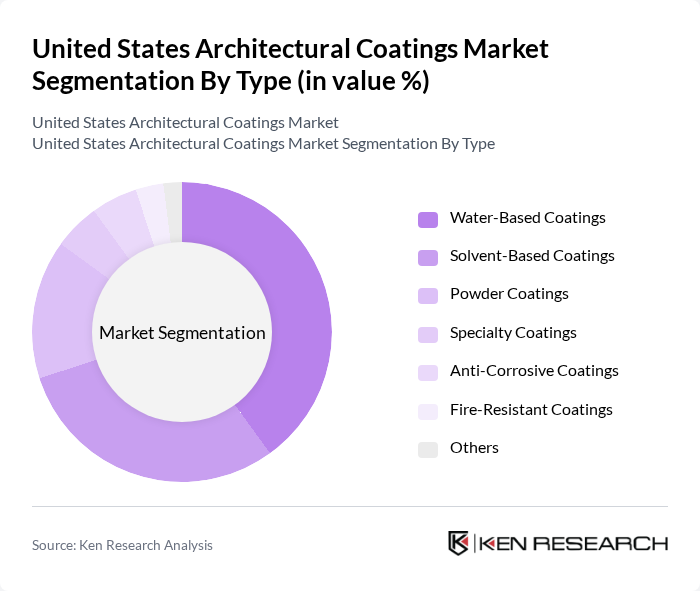

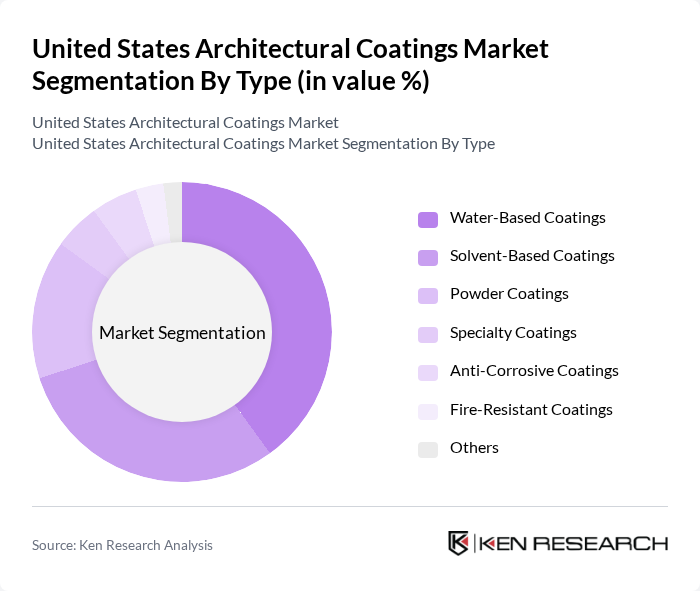

By Type:The market is segmented into various types of coatings, including water-based, solvent-based, powder, specialty, anti-corrosive, fire-resistant, and others. Water-based coatings are gaining traction due to their eco-friendliness, regulatory compliance, and ease of application. Solvent-based coatings remain preferred for their durability and finish, particularly in demanding environments. The powder coatings segment is also witnessing growth, driven by its efficiency, reduced waste, and suitability for metal and specialty surfaces.

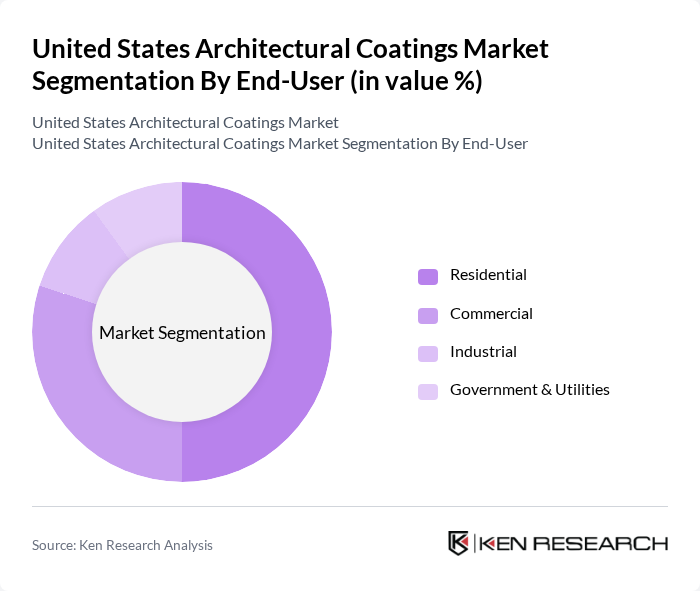

By End-User:The architectural coatings market is segmented by end-user into residential, commercial, industrial, and government & utilities. The residential segment is the largest, driven by ongoing housing development, renovation projects, and consumer preference for aesthetic improvements. Commercial applications are significant, supported by growth in retail, office spaces, and hospitality sectors. Industrial and government sectors also contribute, particularly through infrastructure and public facility upgrades.

United States Architectural Coatings Market Competitive Landscape

The United States Architectural Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sherwin-Williams Company, PPG Industries, Inc., Benjamin Moore & Co., Behr Process Corporation, RPM International Inc., AkzoNobel N.V., Valspar Corporation, Dunn-Edwards Corporation, BASF SE, Asian Paints PPG Pvt. Ltd., Kelly-Moore Paints, Cloverdale Paint Inc., Tnemec Company, Inc., Sika AG, Rust-Oleum Corporation contribute to innovation, geographic expansion, and service delivery in this space.

United States Architectural Coatings Market Industry Analysis

Growth Drivers

- Increasing Demand for Eco-Friendly Products:The architectural coatings market is witnessing a significant shift towards eco-friendly products, driven by consumer preferences for sustainable options. In future, the U.S. market for eco-friendly coatings is projected to reach approximately $3.5 billion, reflecting a 15% increase from the previous year. This growth is supported by the rising awareness of environmental issues and the implementation of green building standards, which encourage the use of low-VOC and water-based coatings in both residential and commercial applications.

- Growth in Residential and Commercial Construction:The U.S. construction sector is expected to grow by 6% in future, with residential construction alone projected to account for $1.2 trillion. This surge in construction activity is a key driver for the architectural coatings market, as new buildings require high-quality coatings for protection and aesthetics. Additionally, renovations and remodeling projects are anticipated to contribute significantly, with an estimated $400 billion spent on home improvements, further boosting demand for architectural coatings.

- Technological Advancements in Coating Products:Innovations in coating technologies are enhancing product performance and expanding application areas. In future, the introduction of advanced coatings, such as self-cleaning and anti-microbial options, is expected to increase market penetration. The U.S. market for technologically advanced coatings is projected to grow to $2 billion, driven by demand from sectors like healthcare and hospitality, where hygiene and maintenance are critical. These advancements are reshaping consumer expectations and driving sales.

Market Challenges

- Fluctuating Raw Material Prices:The architectural coatings industry faces significant challenges due to the volatility of raw material prices, particularly for key ingredients like titanium dioxide and resins. In future, the price of titanium dioxide is expected to rise by 10%, impacting production costs and profit margins for manufacturers. This fluctuation can lead to increased prices for consumers, potentially dampening demand and creating uncertainty in the market.

- Stringent Environmental Regulations:Compliance with stringent environmental regulations poses a challenge for manufacturers in the architectural coatings market. The U.S. Environmental Protection Agency (EPA) has implemented rigorous VOC emission standards, which require significant investment in reformulation and production processes. In future, companies may need to allocate up to $500 million collectively to meet these regulations, impacting their operational costs and pricing strategies, thereby affecting market competitiveness.

United States Architectural Coatings Market Future Outlook

The future of the U.S. architectural coatings market appears promising, driven by a strong focus on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in research and development to create advanced coatings that meet environmental standards. Additionally, the ongoing growth in the construction sector, coupled with increased infrastructure spending, will further stimulate demand. Companies that adapt to these trends will be well-positioned to capture market share and drive profitability in the coming years.

Market Opportunities

- Expansion into Emerging Markets:There is a significant opportunity for U.S. architectural coatings manufacturers to expand into emerging markets, particularly in Latin America and Asia. These regions are experiencing rapid urbanization and infrastructure development, with an estimated $1 trillion in construction projects planned for future. This expansion can lead to increased sales and market share for companies willing to invest in these growing economies.

- Development of Smart Coatings:The rise of smart coatings presents a lucrative opportunity for innovation in the architectural coatings market. These coatings, which can respond to environmental changes, are gaining traction in sectors such as automotive and construction. With an expected market value of $1.5 billion by future, smart coatings can enhance energy efficiency and reduce maintenance costs, appealing to environmentally conscious consumers and businesses alike.