Region:North America

Author(s):Rebecca

Product Code:KRAC0307

Pages:81

Published On:August 2025

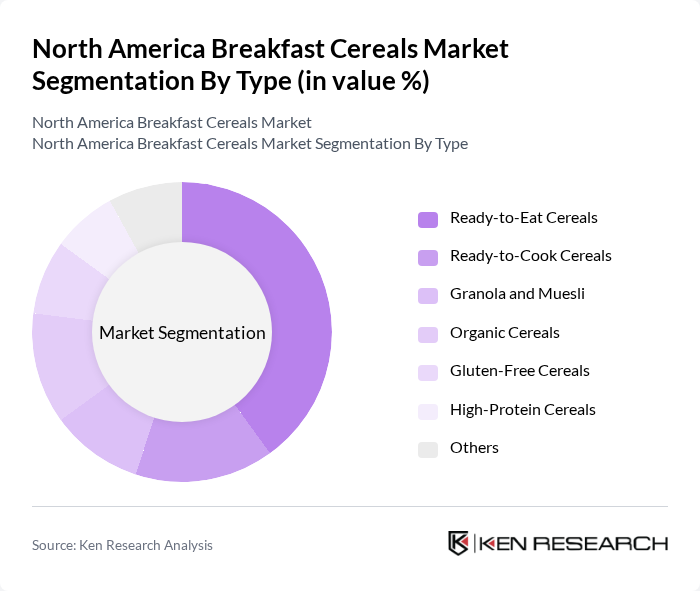

By Type:The breakfast cereals market is segmented into various types, including Ready-to-Eat Cereals, Ready-to-Cook Cereals, Granola and Muesli, Organic Cereals, Gluten-Free Cereals, High-Protein Cereals, and Others. Among these, Ready-to-Eat Cereals dominate the market due to their convenience and wide variety, appealing to busy consumers seeking quick meal solutions. The growing trend towards health and wellness has also led to increased demand for Organic, Gluten-Free, and High-Protein Cereals, reflecting changing consumer preferences for functional and specialty nutrition.

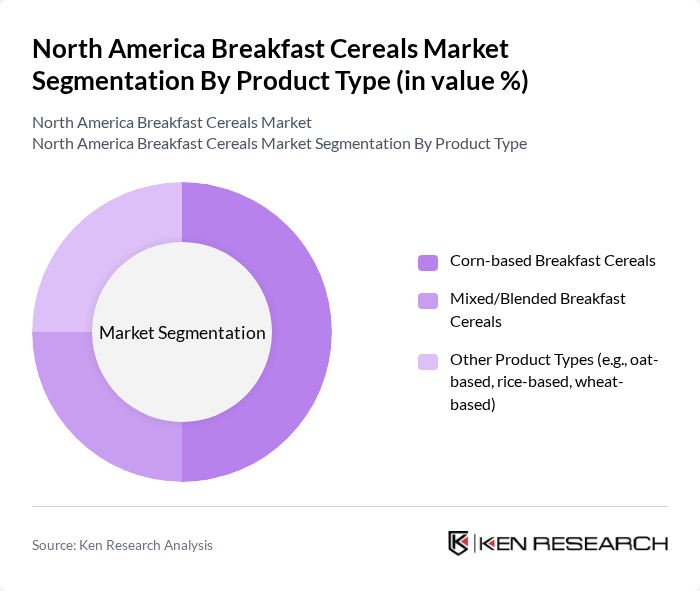

By Product Type:The market is further segmented by product type into Corn-based Breakfast Cereals, Mixed/Blended Breakfast Cereals, and Other Product Types such as oat-based, rice-based, and wheat-based cereals. Corn-based Breakfast Cereals are the leading segment, favored for their taste and texture, while Mixed/Blended varieties are gaining traction due to their nutritional benefits and flavor diversity. The increasing consumer inclination towards healthier options is also driving the growth of Other Product Types, including whole grain, high-fiber, and low-sugar cereals.

The North America Breakfast Cereals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kellogg Company, General Mills, Inc., Post Holdings, Inc., Quaker Oats Company (PepsiCo, Inc.), Nestlé USA, Inc., B&G Foods, Inc., Nature's Path Foods, Inc., Bob's Red Mill Natural Foods, Inc., Kashi Company, Barbara's Bakery, Inc., Cascadian Farm Organic (General Mills, Inc.), Malt-O-Meal Company (Post Consumer Brands), Mom's Best Cereals (Post Consumer Brands), Attune Foods, LLC (Post Holdings, Inc.), Nature Valley (General Mills, Inc.), Annie's Homegrown, Inc. (General Mills, Inc.), Bear Naked (Kellogg Company), Three Wishes Cereal, Purely Elizabeth, Love Grown Foods contribute to innovation, geographic expansion, and service delivery in this space.

The North American breakfast cereals market is poised for continued evolution, driven by consumer preferences for health-oriented and convenient options. Innovations in product formulation, such as the incorporation of superfoods and functional ingredients, are expected to gain traction. Additionally, the rise of e-commerce platforms will facilitate broader access to diverse cereal products, enhancing consumer choice. As sustainability becomes a priority, brands will likely focus on eco-friendly packaging solutions to meet growing environmental concerns among consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Ready-to-Eat Cereals Ready-to-Cook Cereals Granola and Muesli Organic Cereals Gluten-Free Cereals High-Protein Cereals Others |

| By Product Type | Corn-based Breakfast Cereals Mixed/Blended Breakfast Cereals Other Product Types (e.g., oat-based, rice-based, wheat-based) |

| By Form | Flakes Granola Puffed Shredded |

| By End-User | Children Adults Seniors |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience/Grocery Stores Specialist Stores (e.g., natural and organic food stores) Online Retail Stores Other Distribution Channels (e.g., vending machines, food service) |

| By Packaging Type | Boxes Bags Pouches |

| By Price Range | Economy Mid-Range Premium |

| By Flavor | Sweet (e.g., chocolate, fruit, honey) Savory (e.g., cheese, bacon) Plain |

| By Nutritional Content | High Fiber Low Sugar Fortified Cereals |

| By Country | United States Canada Mexico Rest of North America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Breakfast Cereal Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Breakfast Choices | 120 | Health-conscious Consumers, Families with Children |

| Market Trends in Organic Cereals | 80 | Organic Product Managers, Nutrition Experts |

| Impact of Marketing on Breakfast Cereal Sales | 60 | Marketing Directors, Brand Managers |

| Distribution Channel Effectiveness | 70 | Logistics Coordinators, Retail Analysts |

The North America Breakfast Cereals Market is valued at approximately USD 24.7 billion, reflecting a significant growth trend driven by consumer demand for convenient and nutritious breakfast options, as well as a shift towards health-conscious eating habits.