Region:Middle East

Author(s):Shubham

Product Code:KRAA8503

Pages:97

Published On:November 2025

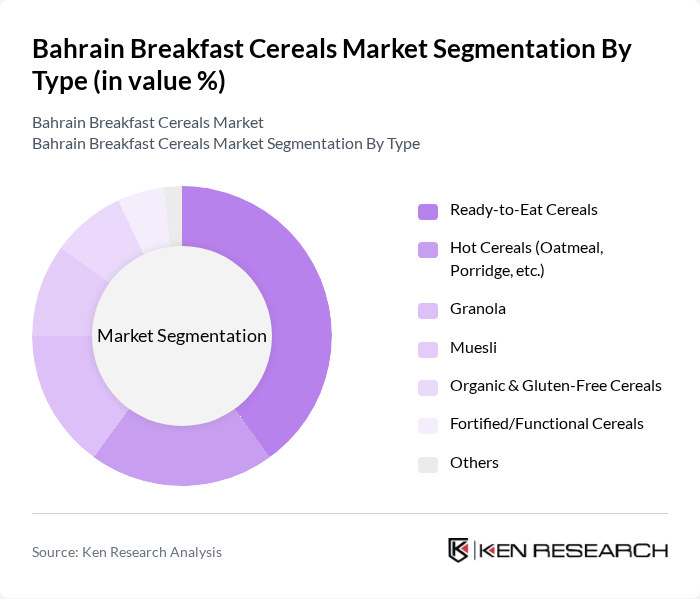

By Type:The market is segmented into various types of breakfast cereals, including Ready-to-Eat Cereals, Hot Cereals (Oatmeal, Porridge, etc.), Granola, Muesli, Organic & Gluten-Free Cereals, Fortified/Functional Cereals, and Others. Among these, Ready-to-Eat Cereals dominate the market due to their convenience and variety, appealing to busy consumers looking for quick meal solutions. The growing trend of health and wellness has also led to increased demand for Organic & Gluten-Free Cereals, reflecting changing consumer preferences towards healthier options. Fortified cereals, especially those with added vitamins and minerals, are gaining traction among health-conscious segments .

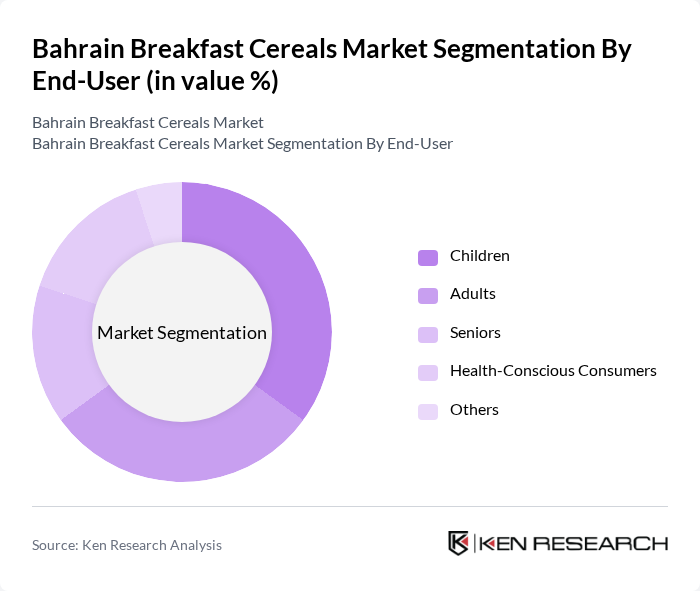

By End-User:The end-user segmentation includes Children, Adults, Seniors, Health-Conscious Consumers, and Others. The Children segment is particularly significant, driven by parents' increasing focus on providing nutritious breakfast options for their kids. Adults also represent a substantial portion of the market, as they seek convenient and healthy breakfast solutions to fit their busy lifestyles. Health-Conscious Consumers are increasingly opting for specialized products, such as organic and gluten-free options, reflecting a broader trend towards health and wellness. Seniors are showing rising interest in cereals with functional benefits, such as high fiber and low sugar content .

The Bahrain Breakfast Cereals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Bahrain, Kellogg's Bahrain, General Mills (Cheerios, Fitness), The Quaker Oats Company (PepsiCo), Weetabix Food Company, Al Jazira Supermarket (Private Label), Almarai, Al Rifai, Americana Group, Gulf Food Industries (California Garden), Bahlsen, Mondelez International, Al-Maida, United Biscuits (Pladis), Al-Mansoori Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain breakfast cereals market appears promising, driven by evolving consumer preferences and lifestyle changes. The increasing focus on health and wellness is expected to shape product innovation, with brands likely to introduce more nutritious options. Additionally, the growth of e-commerce platforms will facilitate wider distribution, allowing brands to reach a broader audience. As consumers continue to seek convenience and quality, the market is poised for dynamic growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ready-to-Eat Cereals Hot Cereals (Oatmeal, Porridge, etc.) Granola Muesli Organic & Gluten-Free Cereals Fortified/Functional Cereals Others |

| By End-User | Children Adults Seniors Health-Conscious Consumers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health Food Stores Specialty Stores Others |

| By Packaging Type | Boxed Cereals Pouches Bulk Packaging Single-Serve Packs Others |

| By Nutritional Content | High Fiber Low Sugar Protein-Enriched Fortified Cereals GMO-Free Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers New Entrants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 60 | Store Managers, Category Buyers |

| Consumer Preferences | 100 | Household Decision Makers, Health-Conscious Consumers |

| Distribution Channel Analysis | 50 | Logistics Coordinators, Supply Chain Managers |

| Brand Perception Studies | 70 | Marketing Managers, Brand Strategists |

| Market Trend Analysis | 40 | Industry Analysts, Food Scientists |

The Bahrain Breakfast Cereals Market is valued at approximately USD 630 million, reflecting a significant growth trend driven by increasing health consciousness and demand for convenient meal options among consumers.