Region:North America

Author(s):Geetanshi

Product Code:KRAC0051

Pages:84

Published On:August 2025

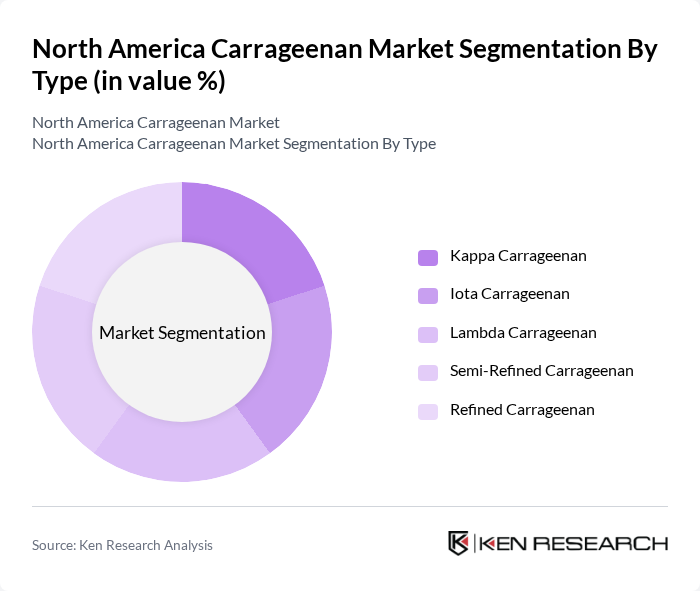

By Type:The market is segmented into Kappa, Iota, Lambda, Semi-Refined, and Refined carrageenan. Kappa carrageenan is the most widely used type due to its strong gelling properties, making it the preferred choice in dairy, meat, and plant-based food applications. Iota carrageenan is also gaining traction, particularly in dairy and dessert products for its elastic gel formation. Lambda carrageenan is valued for its thickening capabilities, especially in dairy beverages and sauces .

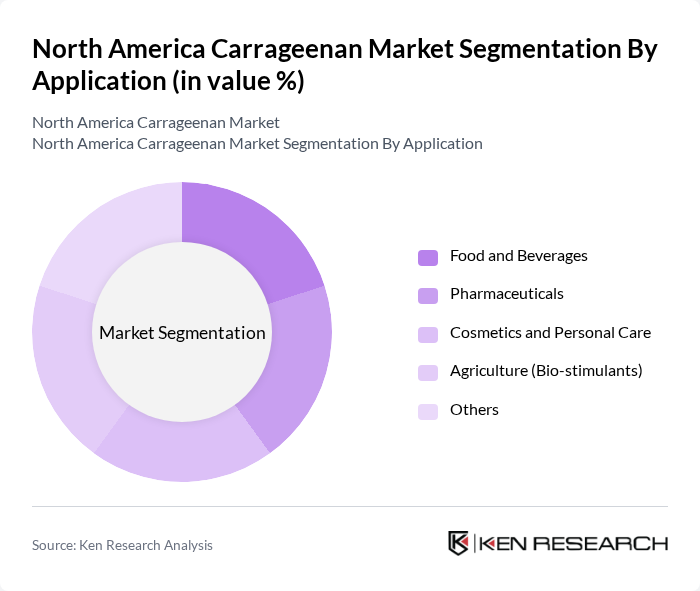

By Application:Carrageenan is used in a variety of applications, including food and beverages, pharmaceuticals, cosmetics and personal care, agriculture (bio-stimulants), and others. The food and beverage sector is the largest application area, driven by the demand for natural, vegan, and clean-label products. Pharmaceuticals use carrageenan as a stabilizer and thickener in formulations, while cosmetics and personal care industries utilize it for its texture-enhancing properties. In agriculture, carrageenan is increasingly used as a bio-stimulant to promote plant growth .

The North America Carrageenan Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., Kerry Group plc, Cargill, Incorporated, Ingredion Incorporated, FMC Corporation, CP Kelco U.S., Inc., Ashland Global Holdings Inc., Ingredients Solutions, Inc., W Hydrocolloids, Inc., Gelymar S.A., Algaia S.A., Marcel Trading Corporation, Shemberg Group, Ceamsa (Compañía Española de Algas Marinas S.A.), TBK Manufacturing Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The North American carrageenan market is poised for significant growth, driven by evolving consumer preferences towards natural and clean-label products. Innovations in extraction processes and applications are expected to enhance product offerings, while the expansion into emerging markets will provide new revenue streams. Additionally, the increasing incorporation of carrageenan in plant-based products aligns with the growing trend of veganism, further solidifying its market position in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Kappa Carrageenan Iota Carrageenan Lambda Carrageenan Semi-Refined Carrageenan Refined Carrageenan |

| By Application | Food and Beverages Pharmaceuticals Cosmetics and Personal Care Agriculture (Bio-stimulants) Others |

| By End-User | Food Manufacturers Cosmetic Companies Pharmaceutical Firms Agriculture Producers Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Others |

| By Region | United States Canada Mexico Others |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Companies | 60 | Regulatory Affairs Managers, R&D Directors |

| Cosmetics and Personal Care Brands | 50 | Formulation Chemists, Brand Managers |

| Food Additive Distributors | 40 | Sales Managers, Supply Chain Coordinators |

| Research Institutions and Universities | 40 | Food Science Researchers, Academic Professors |

The North America Carrageenan Market is valued at approximately USD 430 million, reflecting a growing demand for natural food additives and clean-label ingredients, particularly in the food and beverage sector.