Region:Asia

Author(s):Dev

Product Code:KRAA9554

Pages:80

Published On:November 2025

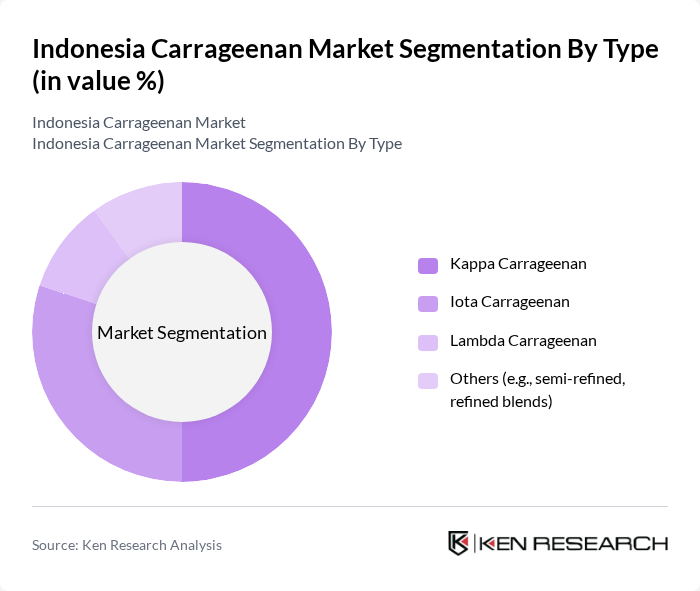

By Type:The market is segmented into Kappa Carrageenan, Iota Carrageenan, Lambda Carrageenan, and Others (e.g., semi-refined, refined blends). Kappa Carrageenan remains the most widely used type due to its strong gelling properties, making it a preferred choice in the food industry, particularly in dairy and meat products. Iota Carrageenan is gaining traction for applications requiring softer, more elastic gels, while Lambda Carrageenan is utilized in products where thickening without gel formation is essential.

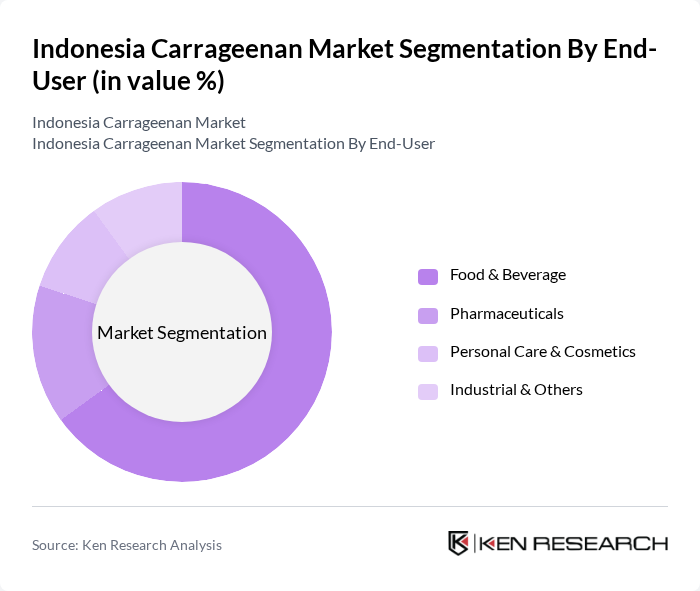

By End-User:The primary end-users of carrageenan include the Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, and Industrial & Others sectors. The Food & Beverage sector dominates the market, driven by the increasing use of carrageenan as a thickening and stabilizing agent in various food products, especially dairy alternatives and processed foods. The pharmaceutical industry is a significant contributor, utilizing carrageenan in drug formulations, controlled-release systems, and as a gelling agent. The personal care and cosmetics sector leverages carrageenan for its film-forming and viscosity-enhancing properties in products such as creams, lotions, and toothpaste.

The Indonesia Carrageenan Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Agarindo Bogatama, PT. Sari Bumi Sukses, PT. Galic Artabahari, PT. Gumindo Perkasa Industri, PT. Karagen Indonesia, PT. Hydrocolloid Indonesia, PT. Surya Indoalgas, PT. Java Biocolloid, PT. Algalindo Perdana, PT. Cargill Indonesia, PT. Indo Seaweed, PT. Lautan Natural Krimerindo, PT. Rote Karaginan Nusantara, PT. Biotech Surindo, and PT. Seaweed Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the carrageenan market in Indonesia appears promising, driven by increasing consumer demand for natural and organic products. As the food and cosmetics industries continue to expand, the adoption of carrageenan is likely to rise, particularly in plant-based formulations. Additionally, technological advancements in extraction processes are expected to enhance production efficiency. However, manufacturers must navigate challenges such as raw material price fluctuations and regulatory compliance to capitalize on these growth opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Kappa Carrageenan Iota Carrageenan Lambda Carrageenan Others (e.g., semi-refined, refined blends) |

| By End-User | Food & Beverage Pharmaceuticals Personal Care & Cosmetics Industrial & Others |

| By Application | Thickening Agent Stabilizer Gelling Agent Emulsifier Others |

| By Distribution Channel | Direct Sales (B2B) Online Retail Distributors/Wholesalers Others |

| By Region | Java Sumatra Sulawesi Bali & Nusa Tenggara Others |

| By Packaging Type | Bulk Packaging (Sacks, Drums) Retail Packaging (Pouches, Small Packs) Others |

| By Source of Raw Material | Wild Harvested (Natural Seaweed) Farmed (Cultivated Seaweed, e.g., Eucheuma cottonii) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Sector Usage | 80 | Regulatory Affairs Managers, R&D Scientists |

| Cosmetics and Personal Care | 70 | Formulation Chemists, Brand Managers |

| Seaweed Farming Practices | 50 | Farm Owners, Agricultural Extension Officers |

| Export Market Dynamics | 60 | Export Managers, Trade Analysts |

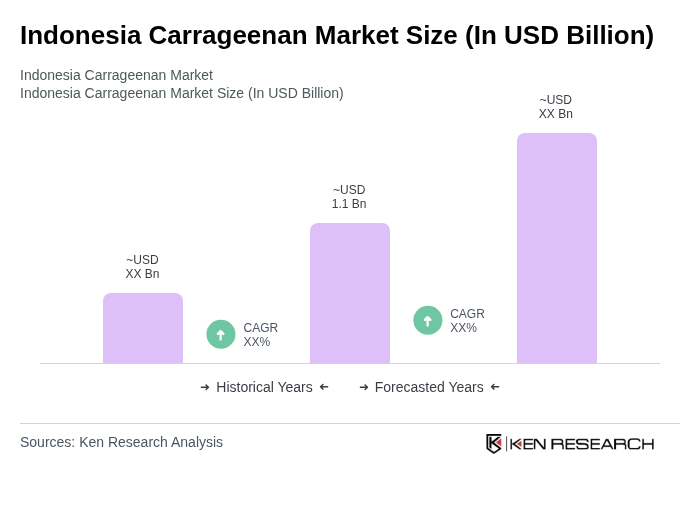

The Indonesia Carrageenan Market is valued at approximately USD 1.1 billion, driven by increasing demand for carrageenan as a natural thickener and stabilizer in various industries, particularly food and beverages, pharmaceuticals, and personal care products.