Region:North America

Author(s):Geetanshi

Product Code:KRAA1258

Pages:97

Published On:August 2025

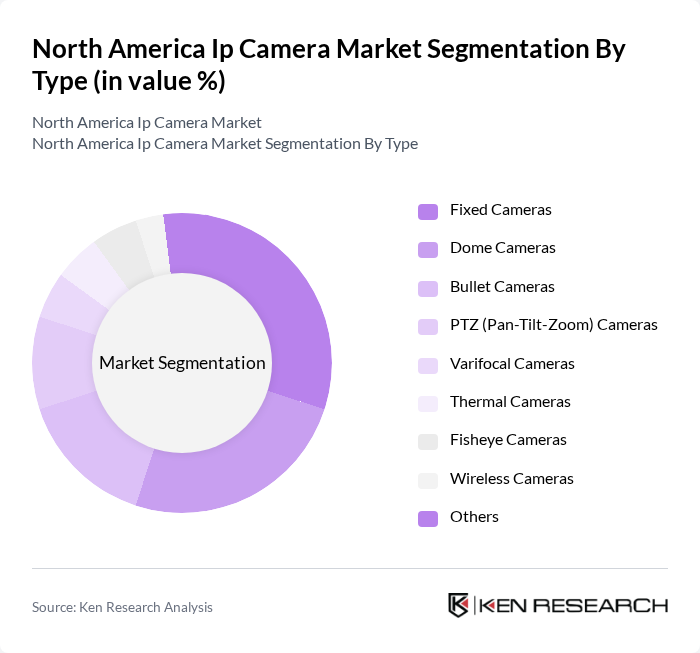

By Type:The market is segmented into Fixed Cameras, Dome Cameras, Bullet Cameras, PTZ (Pan-Tilt-Zoom) Cameras, Varifocal Cameras, Thermal Cameras, Fisheye Cameras, Wireless Cameras, and Others. Fixed Cameras and Dome Cameras remain the most popular due to their versatility, affordability, and ease of installation, making them suitable for both residential and commercial applications. PTZ and thermal cameras are increasingly adopted in industrial and government settings for advanced surveillance needs .

By End-User Industry:The IP camera market is segmented by end-user industries, including Residential, Commercial (BFSI, Education, Healthcare, Real Estate, Retail), Industrial, and Government and Law Enforcement. The commercial sector is the largest consumer of IP cameras, driven by the need for enhanced security in businesses and public spaces. Residential adoption is expanding rapidly due to smart home trends and increased awareness of home security. Industrial and government segments are investing in advanced surveillance solutions for critical infrastructure and public safety .

The North America IP Camera market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision USA Inc., Axis Communications Inc., Dahua Technology USA Inc., Bosch Security Systems Inc., FLIR Systems Inc., Hanwha Techwin America Inc., Panasonic System Solutions Company of North America, Sony Electronics Inc., Avigilon Corporation (Motorola Solutions), Honeywell Security Group, Genetec Inc., Tyco Integrated Security (Johnson Controls), ADT Inc., FLIR Commercial Systems Inc., Pelco Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American IP camera market is poised for significant growth, driven by technological advancements and increasing security needs. As smart home integration becomes more prevalent, the demand for IP cameras is expected to rise. Additionally, the focus on cybersecurity will lead to innovations in secure camera systems. Companies are likely to invest in R&D to enhance features and address privacy concerns, ensuring compliance with evolving regulations while meeting consumer expectations for advanced security solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Cameras Dome Cameras Bullet Cameras PTZ (Pan-Tilt-Zoom) Cameras Varifocal Cameras Thermal Cameras Fisheye Cameras Wireless Cameras Others |

| By End-User Industry | Residential Commercial (BFSI, Education, Healthcare, Real Estate, Retail) Industrial Government and Law Enforcement |

| By Application | Surveillance Traffic Monitoring Retail Security Home Automation |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Country | United States Canada Mexico |

| By Price Range | Low-End Cameras Mid-Range Cameras High-End Cameras |

| By Technology | Wired IP Cameras Wireless IP Cameras Cloud-Based Cameras |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Security Installations | 100 | Security Managers, Facility Directors |

| Residential IP Camera Users | 60 | Homeowners, Property Managers |

| Healthcare Surveillance Systems | 50 | IT Managers, Compliance Officers |

| Transportation Security Solutions | 40 | Logistics Coordinators, Safety Officers |

| Retail Loss Prevention Strategies | 50 | Loss Prevention Managers, Store Operations Heads |

The North America IP Camera market is valued at approximately USD 16.1 billion, reflecting significant growth driven by the increasing demand for advanced surveillance and security solutions across various sectors, including residential, commercial, and government.