Region:Middle East

Author(s):Dev

Product Code:KRAA9591

Pages:80

Published On:November 2025

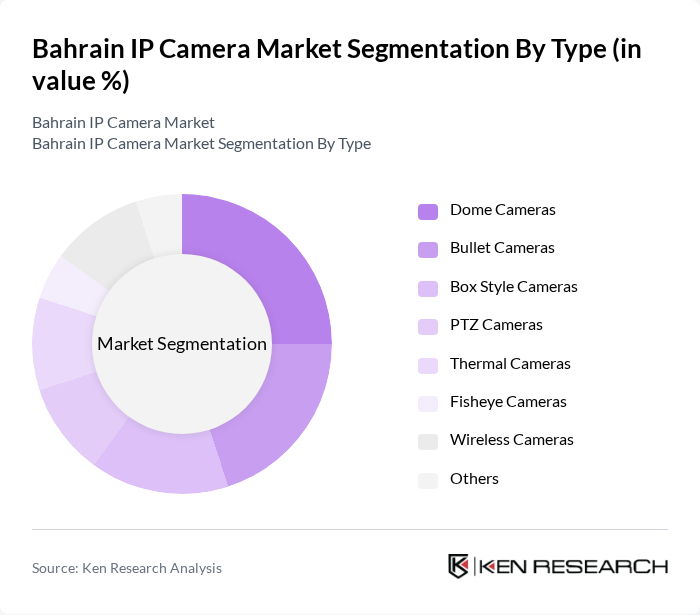

By Type:The market is segmented into various types of cameras, including Dome Cameras, Bullet Cameras, Box Style Cameras, PTZ Cameras, Thermal Cameras, Fisheye Cameras, Wireless Cameras, and Others. Each type serves different purposes and is preferred based on specific user requirements and installation environments. Dome cameras remain the most widely adopted due to their discreet design and suitability for both indoor and outdoor applications, while bullet and PTZ cameras are favored for perimeter and large-area monitoring .

The dominant sub-segment in the market isDome Cameras, which are favored for their discreet design and versatility in various environments. Their ability to provide 360-degree coverage makes them ideal for both indoor and outdoor applications, particularly in retail, hospitality, and commercial settings. The increasing focus on aesthetic appeal, vandal resistance, and integration with AI-based analytics has led to a growing preference for dome cameras among consumers and businesses alike .

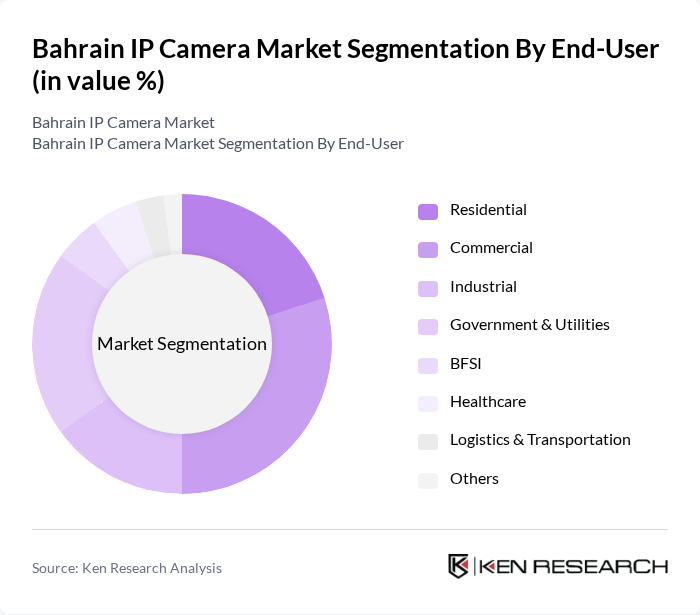

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, Government & Utilities, BFSI, Healthcare, Logistics & Transportation, and Others. Each segment has unique requirements and preferences for surveillance solutions. The commercial and government sectors are the primary adopters, driven by regulatory compliance and public safety mandates .

In the end-user segmentation, theCommercial sectorleads the market due to the high demand for security solutions in retail, offices, hospitality, and public spaces. The increasing need for enhanced security measures, loss prevention strategies, and compliance with government regulations drives the adoption of IP cameras. Additionally, government initiatives to improve public safety and the expansion of smart city projects further bolster the demand in this segment .

The Bahrain IP Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Hanwha Vision, FLIR Systems, Panasonic i-PRO, Sony, Avigilon (Motorola Solutions), Vivotek, MOBOTIX, Genetec, Honeywell, Johnson Controls (Tyco), ADT Commercial contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain IP camera market appears promising, driven by technological advancements and increasing security needs. As the government continues to invest in smart city initiatives, the integration of IP cameras with IoT technologies is expected to enhance surveillance capabilities significantly. Additionally, the growing trend of remote monitoring solutions will likely attract more consumers, fostering a competitive landscape that encourages innovation and improved service offerings in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dome Cameras Bullet Cameras Box Style Cameras PTZ Cameras Thermal Cameras Fisheye Cameras Wireless Cameras Others |

| By End-User | Residential Commercial Industrial Government & Utilities BFSI Healthcare Logistics & Transportation Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Technology | Analog Cameras IP Cameras HD Cameras K Cameras Infrared Cameras Others |

| By Application | Retail Security Traffic Monitoring Building Security Public Safety Industrial Surveillance Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Sector IP Camera Usage | 85 | Facility Managers, Security Directors |

| Residential Security Solutions | 65 | Homeowners, Property Managers |

| Government Surveillance Initiatives | 50 | Public Safety Officials, Urban Planners |

| Retail Security Systems | 60 | Store Managers, Loss Prevention Officers |

| Installation and Maintenance Services | 40 | Service Technicians, Installation Managers |

The Bahrain IP Camera Market is valued at approximately USD 48 million, driven by increasing security concerns, urbanization, and advancements in AI-powered surveillance technologies across various sectors, including residential, commercial, and government.