Region:North America

Author(s):Rebecca

Product Code:KRAB0178

Pages:82

Published On:August 2025

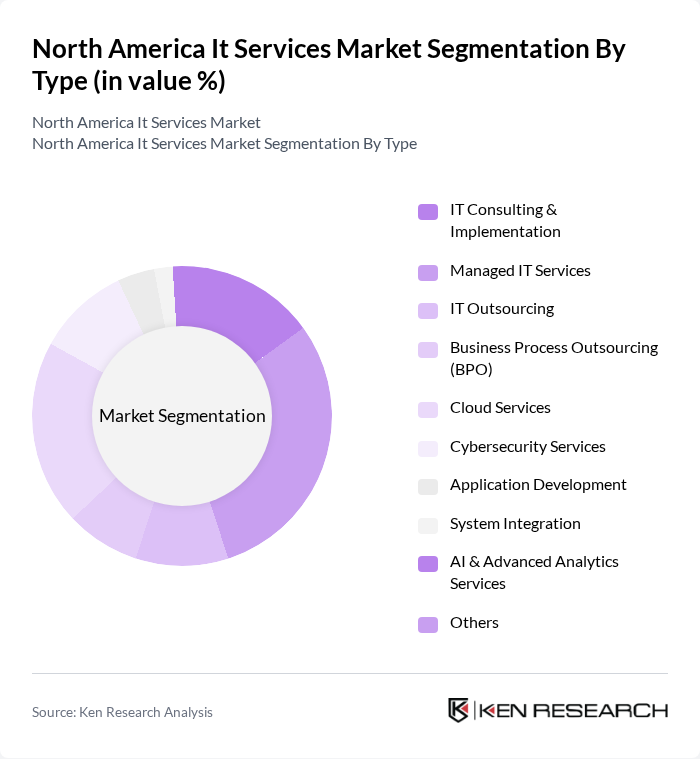

By Type:The IT Services Market in North America is segmented into IT Consulting & Implementation, Managed IT Services, IT Outsourcing, Business Process Outsourcing (BPO), Cloud Services, Cybersecurity Services, Application Development, System Integration, AI & Advanced Analytics Services, and Others. Among these, Managed IT Services is currently the leading sub-segment, driven by the increasing need for businesses to outsource their IT operations to enhance efficiency, reduce costs, and access specialized expertise. The rise of cloud services and cybersecurity solutions is also notable, reflecting the region's focus on digital transformation and data protection.

By End-User:The end-user segmentation of the IT Services Market includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, and Non-Profit Organizations. Large Enterprises dominate this segment due to their extensive IT needs, larger budgets, and advanced adoption of digital transformation initiatives, which enable investment in comprehensive IT solutions for operational and strategic support.

The North America IT Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Accenture plc, Deloitte Consulting LLP, Cognizant Technology Solutions, Infosys Limited, Tata Consultancy Services Limited, Capgemini SE, HCL Technologies Limited, Wipro Limited, DXC Technology Company, NTT DATA Corporation, CGI Inc., Atos SE, Rackspace Technology, Inc., ServiceNow, Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc. (AWS), Salesforce, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American IT services market is poised for transformative growth, driven by advancements in artificial intelligence and machine learning technologies. As organizations increasingly adopt these innovations, the demand for specialized IT services will rise. Additionally, the focus on enhancing customer experience through personalized services will shape the competitive landscape. Companies that leverage data analytics and automation are likely to gain a significant advantage, positioning themselves as leaders in this evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Consulting & Implementation Managed IT Services IT Outsourcing Business Process Outsourcing (BPO) Cloud Services Cybersecurity Services Application Development System Integration AI & Advanced Analytics Services Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Healthcare Retail & E-commerce Manufacturing Education Telecommunications Government & Public Sector Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud |

| By Pricing Model | Subscription-Based Pay-As-You-Go Fixed Pricing |

| By Geographic Distribution | United States Canada Mexico North East US West Coast US Midwest US Southern US |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Services Adoption | 100 | CIOs, IT Directors |

| Cybersecurity Solutions | 80 | Security Managers, Compliance Officers |

| IT Consulting Services | 60 | Business Analysts, Project Managers |

| Managed IT Services | 90 | Operations Managers, IT Service Managers |

| Digital Transformation Initiatives | 50 | Digital Strategy Leads, Innovation Officers |

The North America IT Services Market is valued at approximately USD 552 billion, driven by digital transformation, cloud migration, and cybersecurity adoption. This market is expected to grow as organizations invest in IT services to enhance operational efficiency and customer experiences.