Region:Middle East

Author(s):Dev

Product Code:KRAC3468

Pages:92

Published On:October 2025

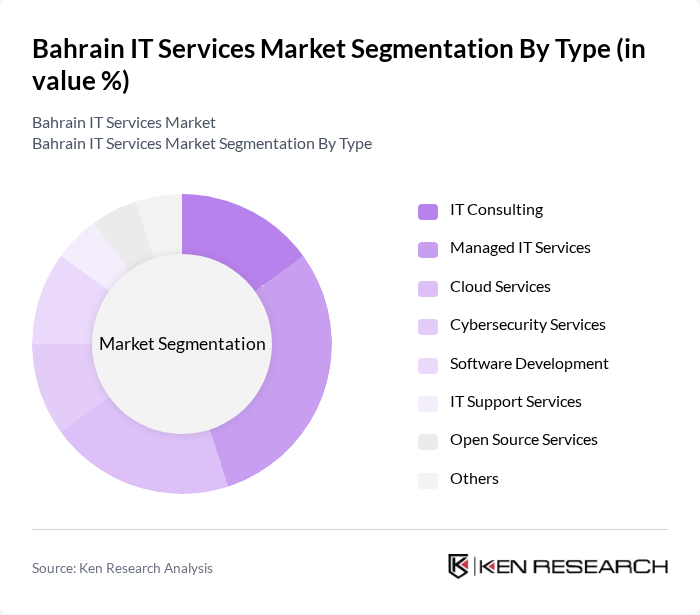

By Type:The IT services market in Bahrain is segmented into IT Consulting, Managed IT Services, Cloud Services, Cybersecurity Services, Software Development, IT Support Services, Open Source Services, and Others. Managed IT Services is currently the leading segment, driven by the increasing need for businesses to outsource IT operations for greater efficiency and cost reduction. The complexity of IT environments and the demand for continuous support and maintenance have accelerated growth in this segment. Cloud Services and Cybersecurity Services are also experiencing rapid expansion, reflecting the market’s focus on secure, scalable, and resilient digital infrastructure.

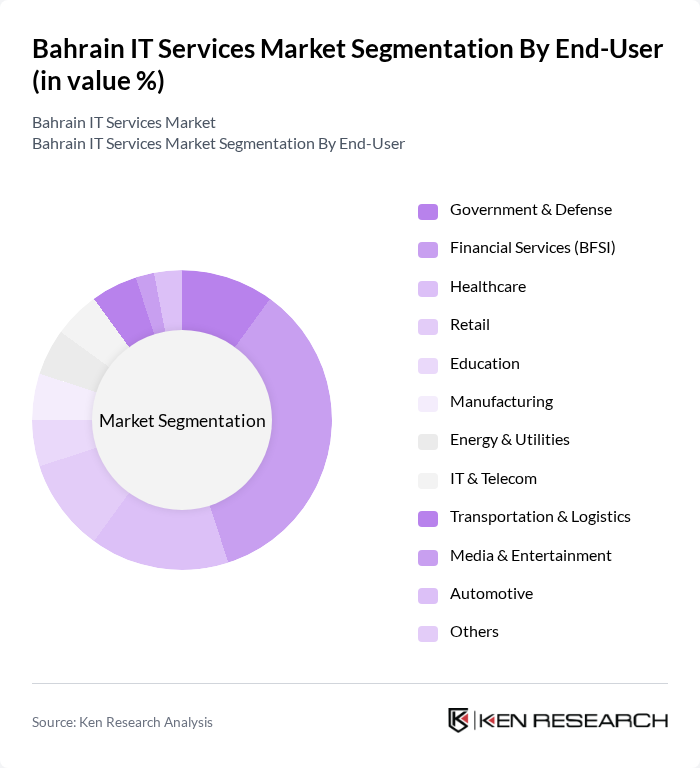

By End-User:The end-user segmentation of the IT services market in Bahrain includes Government & Defense, Financial Services (BFSI), Healthcare, Retail, Education, Manufacturing, Energy & Utilities, IT & Telecom, Transportation & Logistics, Media & Entertainment, Automotive, and Others. The Financial Services sector is the dominant end-user, as banks and financial institutions increasingly rely on IT services for enhanced security, improved customer service, and regulatory compliance. Rapid digitalization and adoption of cloud and cybersecurity solutions in BFSI, government, and telecom sectors are driving significant demand for IT solutions.

The Bahrain IT Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Business Machines (GBM), Bahrain Telecommunications Company (Batelco), Zain Bahrain, STC Bahrain (Saudi Telecom Company Bahrain), Almoayyed Computers, Kalaam Telecom, Inovar, ITQAN Global for IT Services, MenaITech, Bahrain eGovernment Authority, Bahrain National Holding, Almoayyed International Group, KPMG Bahrain, Deloitte Bahrain, PwC Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain IT services market is poised for significant evolution, driven by ongoing digital transformation and government initiatives. As organizations increasingly adopt cloud solutions and managed IT services, the demand for cybersecurity and data analytics will rise. Furthermore, the emphasis on sustainable IT practices will shape service offerings, encouraging providers to innovate. The market is expected to adapt to these trends, fostering a more resilient and competitive landscape that aligns with global technological advancements and local economic goals.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Consulting Managed IT Services Cloud Services Cybersecurity Services Software Development IT Support Services Open Source Services Others |

| By End-User | Government & Defense Financial Services (BFSI) Healthcare Retail Education Manufacturing Energy & Utilities IT & Telecom Transportation & Logistics Media & Entertainment Automotive Others |

| By Application | Enterprise Resource Planning (ERP) Customer Relationship Management (CRM) Business Intelligence & Analytics Network Management Data Storage & Backup Solutions Disaster Recovery & Business Continuity Artificial Intelligence & Machine Learning Internet of Things (IoT) Web Hosting & Development Virtual Desktop Infrastructure (VDI) Video Conferencing & Collaboration Tools Content Delivery Networks (CDNs) Online Gaming & Streaming Scientific Research & Simulations Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| By Deployment Mode | On-Premises Cloud-Based (Public, Private, Hybrid) Hybrid/Multi-Cloud |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based Pay-As-You-Go Fixed Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Computing Services | 60 | IT Managers, Cloud Architects |

| Cybersecurity Solutions | 50 | Chief Information Security Officers, IT Security Analysts |

| IT Consulting Services | 40 | Business Analysts, IT Consultants |

| Software Development Services | 55 | Project Managers, Software Engineers |

| Managed IT Services | 45 | Operations Managers, Service Delivery Managers |

The Bahrain IT Services Market is valued at approximately USD 160 million, reflecting significant growth driven by digital transformation initiatives across various sectors, including finance, healthcare, and government.