Region:North America

Author(s):Shubham

Product Code:KRAC0786

Pages:93

Published On:August 2025

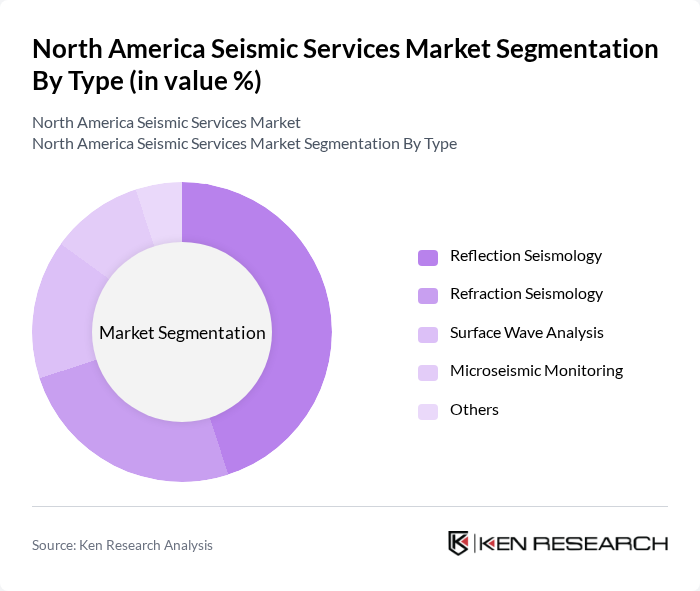

By Type:The segmentation by type includes various methods used in seismic services, which are essential for different applications in the industry. The subsegments are Reflection Seismology, Refraction Seismology, Surface Wave Analysis, Microseismic Monitoring, and Others. Among these, Reflection Seismology is the most widely used technique due to its effectiveness in oil and gas exploration, providing detailed subsurface images that are crucial for resource extraction and offshore wind foundation design .

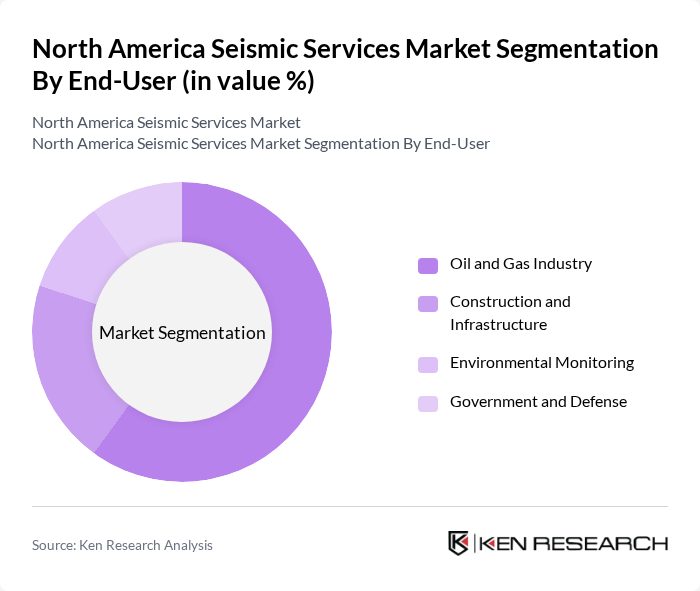

By End-User:The end-user segmentation includes various industries that utilize seismic services, such as the Oil and Gas Industry, Construction and Infrastructure, Environmental Monitoring, and Government and Defense. The Oil and Gas Industry is the leading end-user, driven by the need for exploration and production of hydrocarbons, which requires extensive seismic data to identify potential drilling sites and assess reservoir characteristics. Offshore wind energy and infrastructure projects are also increasing demand for seismic surveys to ensure safe and efficient construction .

The North America Seismic Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, CGG SA, Baker Hughes Company, Fugro N.V., ION Geophysical Corporation, PGS ASA, TGS ASA, Seitel, Inc., Geokinetics Inc., WesternGeco, Dawson Geophysical Company, SAExploration Holdings, Inc., Geospace Technologies Corporation, Fairfield Geotechnologies contribute to innovation, geographic expansion, and service delivery in this space.

The North America seismic services market is poised for significant evolution, driven by technological advancements and increasing demand for sustainable practices. As companies integrate artificial intelligence and machine learning into seismic data analysis, operational efficiencies will improve. Additionally, the focus on disaster preparedness and infrastructure resilience will likely lead to increased funding and collaboration with government agencies, fostering a more robust market environment. The emphasis on data security will also shape future developments in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Reflection Seismology Refraction Seismology Surface Wave Analysis Microseismic Monitoring Others |

| By End-User | Oil and Gas Industry Construction and Infrastructure Environmental Monitoring Government and Defense |

| By Application | Exploration Production Risk Assessment Research and Development |

| By Service Type | Data Acquisition Data Processing Interpretation Services Consulting Services |

| By Region | United States Canada Mexico Others |

| By Technology | D Seismic Technology D Seismic Technology D Seismic Technology |

| By Deployment Mode | Onshore Offshore |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Services | 100 | Geophysicists, Project Managers |

| Construction Seismic Assessments | 60 | Structural Engineers, Safety Compliance Officers |

| Environmental Seismic Monitoring | 50 | Environmental Scientists, Regulatory Analysts |

| Seismic Data Analysis Services | 70 | Data Analysts, Research Scientists |

| Seismic Risk Assessment for Infrastructure | 40 | Urban Planners, Risk Management Consultants |

The North America Seismic Services Market is valued at approximately USD 3.85 billion, driven by increased energy exploration, advancements in seismic imaging technologies, and infrastructure development needs in urban and coastal areas.