Region:Global

Author(s):Shubham

Product Code:KRAA3118

Pages:80

Published On:August 2025

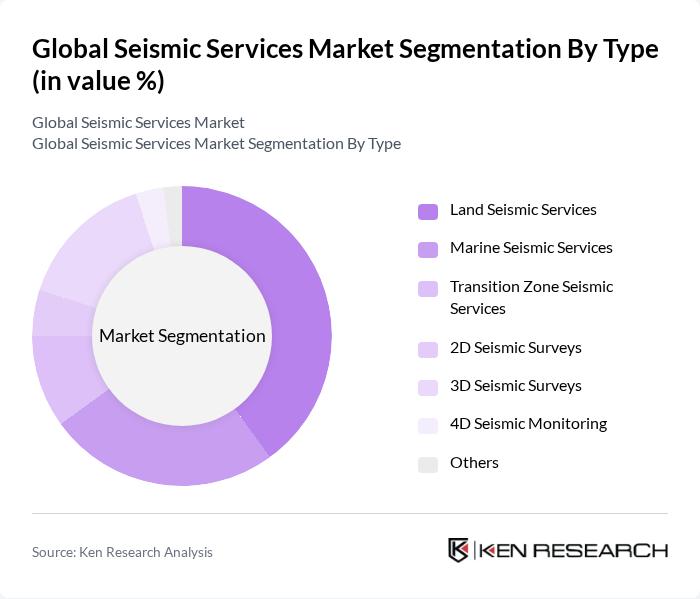

By Type:The seismic services market is segmented into Land Seismic Services, Marine Seismic Services, Transition Zone Seismic Services, 2D Seismic Surveys, 3D Seismic Surveys, 4D Seismic Monitoring, and Others. Land Seismic Services and 3D Seismic Surveys are particularly dominant due to their widespread use in oil and gas exploration and their ability to provide high-resolution subsurface images. Marine seismic services are increasingly important as offshore exploration expands, while 4D seismic monitoring is gaining traction for reservoir management and production optimization.

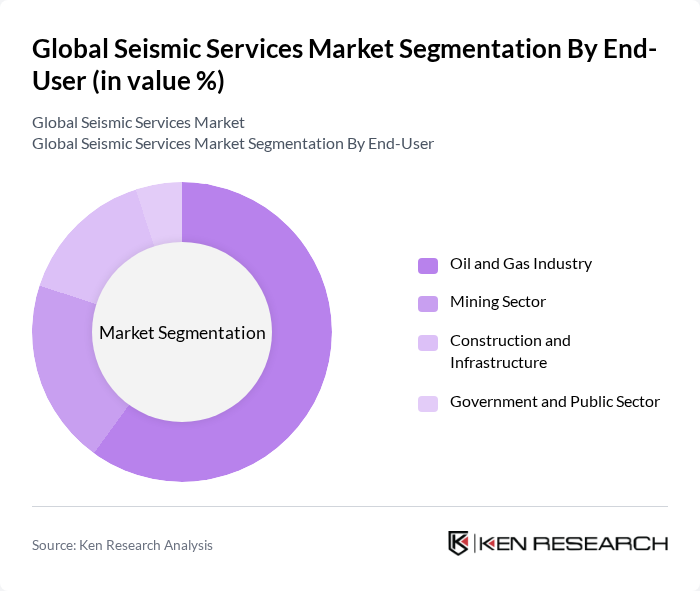

By End-User:The end-user segmentation includes the Oil and Gas Industry, Mining Sector, Construction and Infrastructure, and Government and Public Sector. The Oil and Gas Industry is the leading segment, driven by the continuous need for exploration and production activities, which require advanced seismic services for resource identification and extraction. Mining and construction sectors utilize seismic surveys for geotechnical assessment and risk mitigation, while government agencies employ seismic data for earthquake risk management and infrastructure planning.

The Global Seismic Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, CGG S.A., Baker Hughes Company, PGS ASA, TGS-NOPEC Geophysical Company ASA, ION Geophysical Corporation, Fugro N.V., DMT Group, Geosyntec Consultants, Inc., Geophysical Survey Systems, Inc., TerraSond Limited, Seismic Source, Inc., RPS Group plc, and Fairfield Geotechnologies contribute to innovation, geographic expansion, and service delivery in this space.

The seismic services market is poised for transformative growth, driven by technological advancements and increasing global awareness of disaster preparedness. As countries invest in infrastructure and energy exploration, the demand for innovative seismic solutions will rise. The integration of AI and machine learning will enhance data analysis capabilities, while sustainable practices will become a priority. Companies that adapt to these trends will likely capture significant market share, positioning themselves as leaders in the evolving seismic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Land Seismic Services Marine Seismic Services Transition Zone Seismic Services D Seismic Surveys D Seismic Surveys D Seismic Monitoring Others |

| By End-User | Oil and Gas Industry Mining Sector Construction and Infrastructure Government and Public Sector |

| By Application | Exploration Production Environmental Monitoring Disaster Management |

| By Service Model | Data Acquisition Services Data Processing and Interpretation Services Consulting Services |

| By Geographic Coverage | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Technology | Conventional Seismic Technology (2D, 3D) Advanced Seismic Technology (4D, AI/ML-enabled) Digital Seismic Solutions |

| By Investment Source | Private Investments Public Funding International Aid Joint Ventures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Services | 100 | Geophysicists, Exploration Managers |

| Mining Sector Seismic Surveys | 60 | Mining Engineers, Project Supervisors |

| Civil Engineering Applications | 50 | Civil Engineers, Construction Managers |

| Seismic Data Processing Services | 40 | Data Analysts, Software Developers |

| Environmental Seismic Monitoring | 40 | Environmental Scientists, Regulatory Compliance Officers |

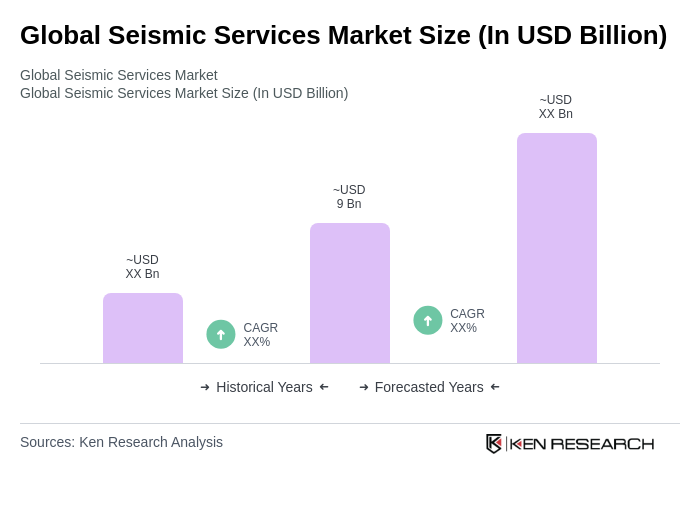

The Global Seismic Services Market is valued at approximately USD 9 billion, driven by the increasing demand for energy resources, particularly in oil and gas exploration, and advancements in seismic imaging technology.