Region:Middle East

Author(s):Rebecca

Product Code:KRAD8147

Pages:98

Published On:December 2025

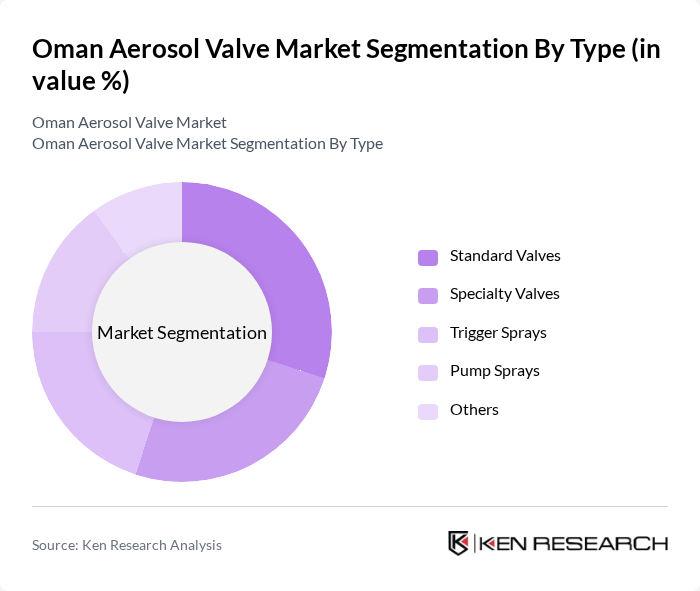

By Type:The aerosol valve market can be segmented into various types, including Continuous Valves, Metered Valves, Specialty Aerosol Valves, Trigger Spray Valves, Foam Valves, and Others. Continuous valves dominate the market due to their widespread use in personal care and household products, accounting for approximately 58% of the market share. The simplicity and reliability of these valves make them a preferred choice for manufacturers, contributing to their significant market presence.

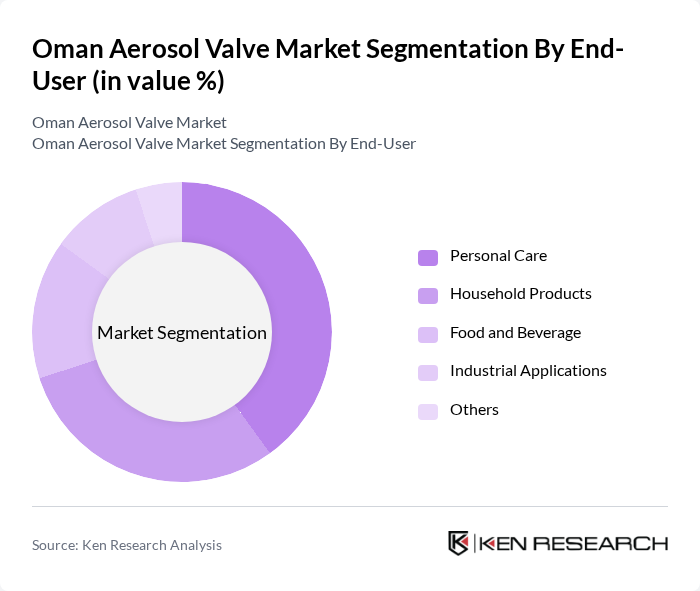

By End-User:The end-user segmentation includes Personal Care, Household Products, Industrial Applications, Food and Beverage, and Others. The Personal Care segment leads the market, driven by the increasing demand for aerosol-based products such as deodorants, hair sprays, and skincare items. This trend is fueled by changing consumer preferences towards convenience and effective application methods.

The Oman Aerosol Valve Market is characterized by a dynamic mix of regional and international players. Leading participants such as Precision Valve Corporation, AptarGroup, Inc., Lindal Group, Coster Group, and Exal Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Oman aerosol valve market is poised for significant growth, driven by increasing consumer demand for sustainable and innovative packaging solutions. As the personal care and cosmetics industry expands, manufacturers are likely to invest in advanced valve technologies that enhance product safety and user experience. Additionally, the ongoing trend towards e-commerce will facilitate wider distribution channels, allowing for greater market penetration. Companies that adapt to these trends will likely capture a larger share of the market, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Aerosol Valves Specialty Aerosol Valves Trigger Spray Valves Foam Valves Others |

| By End-User | Personal Care Household Products Industrial Applications Food and Beverage Others |

| By Material | Plastic Metal Composite Materials Others |

| By Application | Aerosol Paints Insecticides Air Fresheners Medical Applications Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Regulatory Compliance | ISO Standards Local Regulations International Safety Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Product Managers, Marketing Directors |

| Pharmaceutical Applications | 80 | Regulatory Affairs Specialists, Quality Control Managers |

| Food & Beverage Sector | 70 | Production Supervisors, Supply Chain Managers |

| Automotive Industry | 60 | Engineering Managers, Procurement Officers |

| Industrial Applications | 90 | Operations Managers, Safety Compliance Officers |

The Oman Aerosol Valve Market is valued at approximately USD 10 million, based on a five-year historical analysis. This valuation reflects the increasing demand for aerosol products across various sectors, including personal care and industrial applications.