Region:Middle East

Author(s):Dev

Product Code:KRAC2677

Pages:95

Published On:October 2025

By Process:The aluminum casting market is segmented into Die Casting, Permanent Mold Casting, Sand Casting, Investment Casting, and Others. Among these,Die Castingis the most dominant process, favored for its ability to produce complex shapes with high precision and minimal waste. This process is especially prevalent in automotive and electronics manufacturing, where high-volume production and stringent quality standards are critical. The efficiency and cost-effectiveness of Die Casting continue to make it the preferred choice for manufacturers seeking to optimize output and maintain competitive quality .

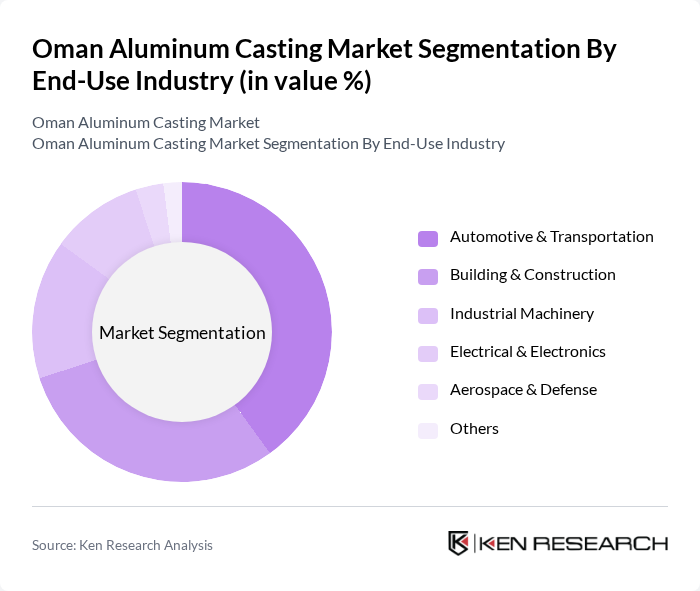

By End-Use Industry:The aluminum casting market is also segmented by end-use industries, including Automotive & Transportation, Building & Construction, Industrial Machinery, Electrical & Electronics, Aerospace & Defense, and Others. TheAutomotive & Transportationsector leads the market, driven by the rising demand for lightweight, fuel-efficient vehicles and the shift toward electric vehicles. Stringent emission standards and the need for advanced materials in vehicle manufacturing further accelerate aluminum adoption. Additionally, the post-pandemic recovery in construction has increased demand for aluminum in building applications, while industrial and electronics sectors continue to expand their usage of cast aluminum components .

The Oman Aluminum Casting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Aluminium Cast, Oman Aluminium Rolling Company (OARC), Sohar Aluminium, National Aluminium Products Company (NAPCO), Gulf Aluminium Rolling Mill Company (GARMCO), Emirates Global Aluminium (EGA), Al Jaber Iron & Steel Foundry, Blue Light Industry Foundry, Gulf Metal Foundry, Maadaniyah (National Metal Manufacturing and Casting Company), Qatar Aluminium Manufacturing Company, Specialized Industrial Casting Company (SICAST), Al Ain Factory for Metal Casting and Electroplating, Oman Mining Company, and Al-Mahhar Company contribute to innovation, geographic expansion, and service delivery in this space.

The Oman aluminum casting market is expected to experience transformative changes driven by technological advancements and sustainability initiatives. As manufacturers adopt eco-friendly casting methods, the demand for recycled aluminum is anticipated to rise, aligning with global sustainability goals. Additionally, the integration of automation and smart manufacturing technologies will enhance production efficiency, allowing companies to meet the growing demand for customized products. These trends indicate a robust future for the industry, characterized by innovation and adaptability to market needs.

| Segment | Sub-Segments |

|---|---|

| By Process | Die Casting Permanent Mold Casting Sand Casting Investment Casting Others |

| By End-Use Industry | Automotive & Transportation Building & Construction Industrial Machinery Electrical & Electronics Aerospace & Defense Others |

| By Application | Engine & Powertrain Components Structural Parts Transmission Parts Decorative & Architectural Items Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Material Grade | Primary Aluminum Alloys Recycled Aluminum Alloys Specialty Alloys Others |

| By Production Method | High-Pressure Die Casting Low-Pressure Die Casting Gravity Die Casting Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Aluminum Components | 100 | Product Managers, Procurement Specialists |

| Construction Industry Applications | 80 | Project Managers, Architects |

| Consumer Goods Manufacturing | 70 | Operations Managers, Supply Chain Coordinators |

| Aerospace Component Production | 40 | Quality Assurance Managers, Engineering Leads |

| Aluminum Recycling Initiatives | 50 | Sustainability Managers, Environmental Compliance Officers |

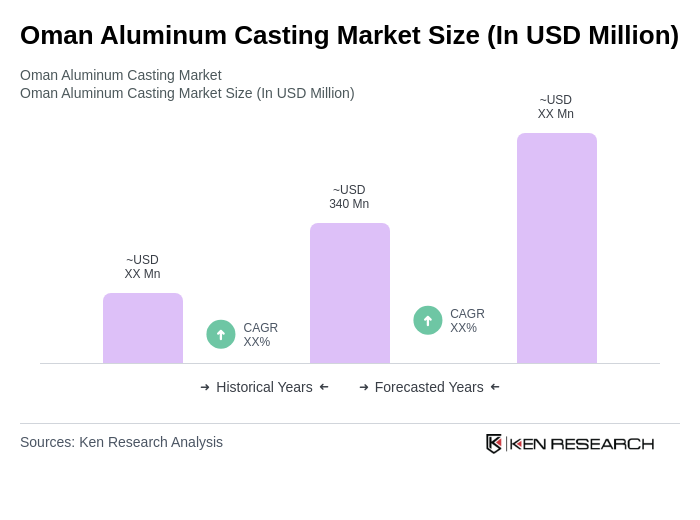

The Oman Aluminum Casting Market is valued at approximately USD 340 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for aluminum components across various industries, including automotive, construction, and electronics.