Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7232

Pages:99

Published On:December 2025

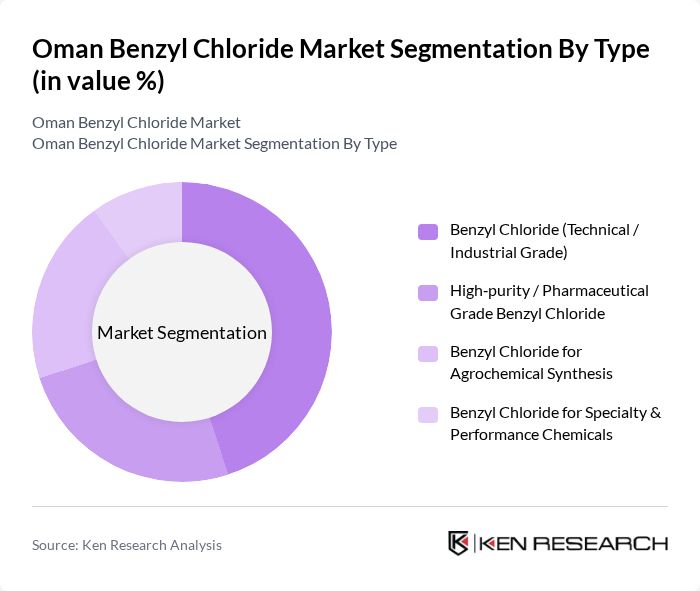

By Type:The benzyl chloride market in Oman is segmented into four main types: Technical / Industrial Grade, High-purity / Pharmaceutical Grade, Agrochemical Synthesis, and Specialty & Performance Chemicals. Among these, the Technical / Industrial Grade benzyl chloride is the most dominant segment due to its widespread use in various industrial applications, including the production of dyes, resins, and other chemical intermediates. The increasing industrial activities and demand for cost-effective solutions have further propelled the growth of this segment.

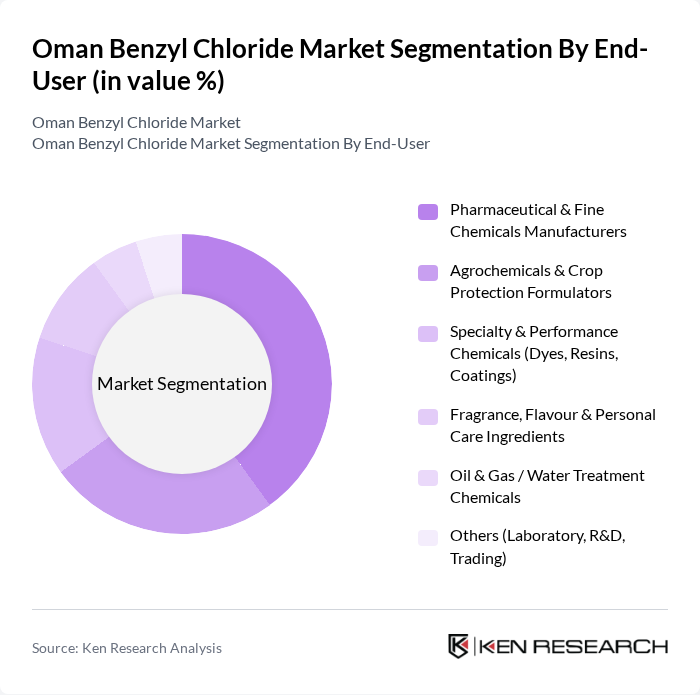

By End-User:The end-user segmentation of the benzyl chloride market includes Pharmaceutical & Fine Chemicals Manufacturers, Agrochemicals & Crop Protection Formulators, Specialty & Performance Chemicals (Dyes, Resins, Coatings), Fragrance, Flavour & Personal Care Ingredients, Oil & Gas / Water Treatment Chemicals, and Others. The Pharmaceutical & Fine Chemicals Manufacturers segment leads the market, driven by the increasing demand for active pharmaceutical ingredients and intermediates. The growth in healthcare and pharmaceutical sectors in Oman has significantly boosted this segment's prominence.

The Oman Benzyl Chloride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Chlorine S.A.O.G., Sohar International Urea & Chemical Industries LLC (SIUCI), Salalah Methanol Company LLC, Oman Methanol Company LLC, OQ (including OQ Refineries & Petrochemicals), Oman Chemical & Pharmaceutical Products Co. LLC, Muscat Chemical Co. LLC, Al Jazeera Chemical Products LLC, National Chemical Industries LLC, Oman Gulf Chemicals & Lubricants LLC, Al Ghubrah Chemicals Trading & Industrial Investments, Al Tasnim Chemicals LLC, Khimji Ramdas – Chemicals Division, Oman Oil Marketing Company SAOG (Industrial & Bulk Chemicals Segment), Key International Benzyl Chloride Suppliers Active in Oman (e.g., LANXESS AG, Valtris Specialty Chemicals, Taizhou Benxi Chemicals) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman benzyl chloride market is poised for growth, driven by increasing demand from the pharmaceutical and agrochemical sectors. As the government continues to support the expansion of chemical manufacturing, investments in new technologies and facilities will enhance production capabilities. Additionally, the shift towards sustainable practices will encourage the development of eco-friendly alternatives, positioning the market favorably for future opportunities. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Benzyl Chloride (Technical / Industrial Grade) High?purity / Pharmaceutical Grade Benzyl Chloride Benzyl Chloride for Agrochemical Synthesis Benzyl Chloride for Specialty & Performance Chemicals |

| By End-User | Pharmaceutical & Fine Chemicals Manufacturers Agrochemicals & Crop Protection Formulators Specialty & Performance Chemicals (Dyes, Resins, Coatings) Fragrance, Flavour & Personal Care Ingredients Oil & Gas / Water Treatment Chemicals Others (Laboratory, R&D, Trading) |

| By Application | Intermediates for Benzyl Alcohol, Benzyl Cyanide & Quaternary Ammonium Compounds Active Ingredients & Intermediates in Pharmaceuticals Intermediates in Agrochemicals (Herbicides, Fungicides, PGRs) Dyes, Pigments, Resins & Coating Resins Fragrances, Flavours & Personal Care Ingredients Others |

| By Distribution Channel | Direct Sales to Large Industrial Off?takers Regional Chemical Distributors / Traders International Trading Houses (Re?exports via UAE / GCC) Online & E?tender Based Procurement Others |

| By Geography | Muscat & Barka Industrial Area Sohar Industrial Port & Free Zone Salalah Free Zone & Dhofar Duqm SEZ & Other Governorates |

| By Packaging Type | ISO Tanks & Bulk Tanker Loads Drums & IBCs (Intermediate Bulk Containers) Small Packs (Jerrycans, Carboys) Others |

| By Product Form | Liquid Benzyl Chloride Formulated Blends / Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Product Managers, Regulatory Affairs Specialists |

| Agrochemical Sector | 80 | Procurement Managers, Research Scientists |

| Industrial Chemical Use | 70 | Operations Managers, Supply Chain Analysts |

| Research & Development Insights | 60 | R&D Directors, Technical Managers |

| Market Trends and Forecasting | 90 | Market Analysts, Business Development Managers |

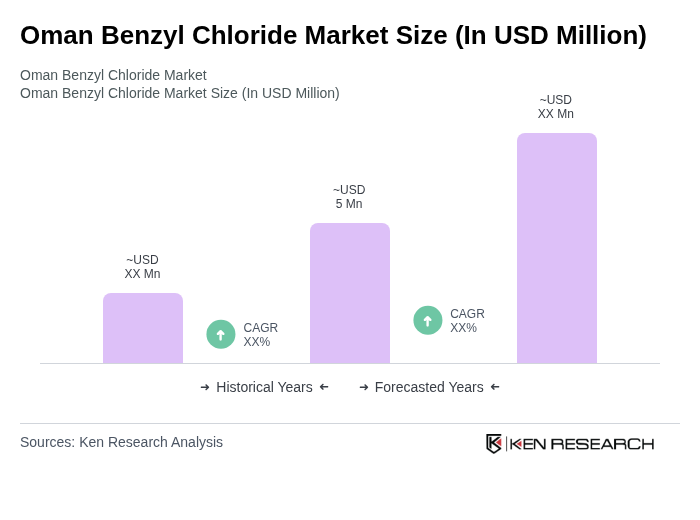

The Oman Benzyl Chloride market is valued at approximately USD 5 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various sectors, including pharmaceuticals and agrochemicals, alongside the growth of the chemical manufacturing sector in Oman.