Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9064

Pages:100

Published On:November 2025

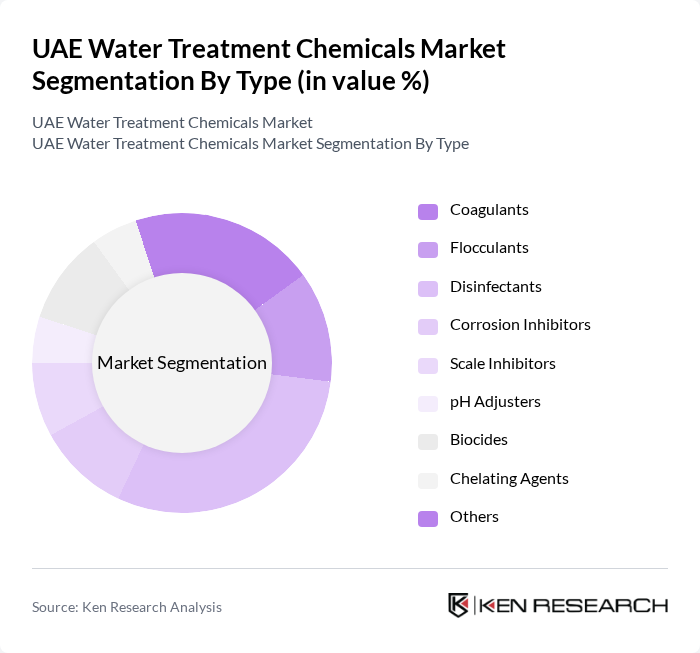

By Type:The market is segmented into various types of water treatment chemicals, each serving specific functions in the treatment process. The primary subsegments include Coagulants, Flocculants, Disinfectants, Corrosion Inhibitors, Scale Inhibitors, pH Adjusters, Biocides, Chelating Agents, and Others. Among these, Disinfectants and Biocides are currently the fastest-growing subsegments due to heightened focus on water safety, sanitation, and microbiological control, especially in municipal and industrial applications. Increasing awareness of health and environmental standards, along with post-pandemic sanitation priorities, has driven demand for high-performance disinfectants and biocidal solutions, making them crucial components in water treatment processes .

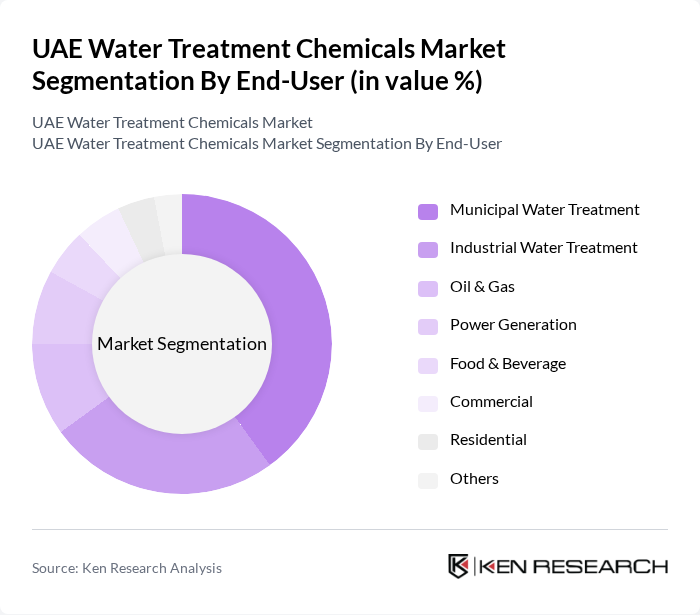

By End-User:The end-user segmentation includes Municipal Water Treatment, Industrial Water Treatment, Oil & Gas, Power Generation, Food & Beverage, Commercial, Residential, and Others. The Municipal Water Treatment segment is the largest due to the increasing population and urbanization in the UAE, necessitating efficient water treatment solutions to ensure safe drinking water. The government's focus on improving water infrastructure, expanding desalination capacity, and enforcing water quality standards has further solidified the position of this segment as a market leader .

The UAE Water Treatment Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Ecolab Inc., Kemira Oyj, SNF Group, Solvay S.A., Dow Chemical Company, AkzoNobel N.V., Veolia Environnement S.A., SUEZ S.A., Kurita Water Industries Ltd., Metito (Overseas) Limited, Nalco Water (an Ecolab Company), Al-Jazira Water Treatment Chemicals, EMVEES Waste Water Treatment LLC, Fouz Chemical Company contribute to innovation, geographic expansion, and service delivery in this space .

The UAE water treatment chemicals market is poised for significant growth, driven by increasing investments in sustainable technologies and infrastructure development. The government's commitment to enhancing water quality and expanding desalination projects will further stimulate market demand. Additionally, the integration of smart water management systems is expected to revolutionize the industry, promoting efficiency and sustainability. As environmental concerns rise, the shift towards eco-friendly chemicals will also shape future market dynamics, creating a more resilient and innovative landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Coagulants Flocculants Disinfectants Corrosion Inhibitors Scale Inhibitors pH Adjusters Biocides Chelating Agents Others |

| By End-User | Municipal Water Treatment Industrial Water Treatment Oil & Gas Power Generation Food & Beverage Commercial Residential Others |

| By Application | Drinking Water Treatment Wastewater Treatment Process Water Treatment Cooling Water Treatment Boiler Water Treatment Desalination Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Biochemical Products Others |

| By Regulatory Compliance | ISO Standards Local Environmental Regulations International Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 100 | Plant Managers, Environmental Engineers |

| Industrial Water Treatment Applications | 80 | Operations Managers, Chemical Engineers |

| Agricultural Water Management | 70 | Agronomists, Farm Managers |

| Research Institutions and Academia | 40 | Researchers, Professors in Environmental Science |

| Regulatory Bodies and Government Agencies | 50 | Policy Makers, Environmental Compliance Officers |

The UAE Water Treatment Chemicals Market is valued at approximately USD 250 million, driven by increasing industrial activities, urbanization, and the need for sustainable water management solutions.