Region:Middle East

Author(s):Dev

Product Code:KRAC4088

Pages:99

Published On:October 2025

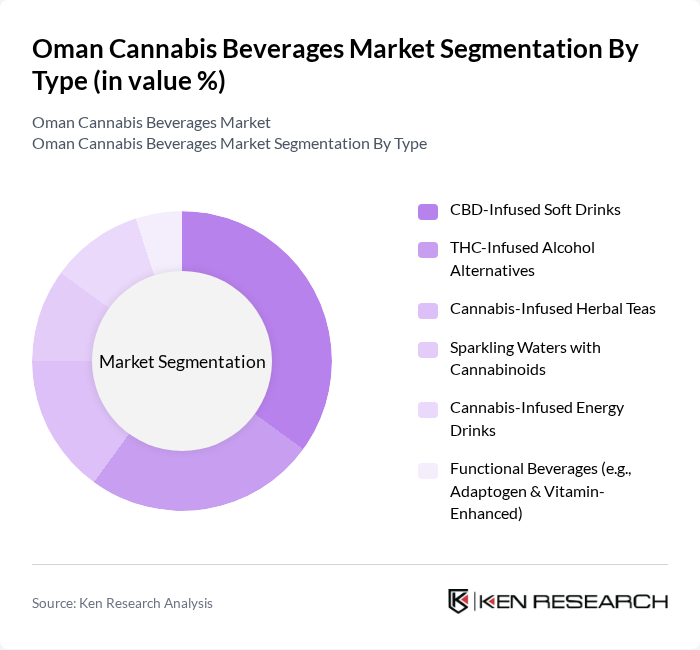

By Type:The market is segmented into CBD-infused soft drinks, THC-infused alcohol alternatives, cannabis-infused herbal teas, sparkling waters with cannabinoids, cannabis-infused energy drinks, and functional beverages such as adaptogen and vitamin-enhanced drinks. CBD-infused soft drinks are gaining significant traction due to their perceived health benefits, non-psychoactive properties, and broad appeal among wellness-oriented consumers.

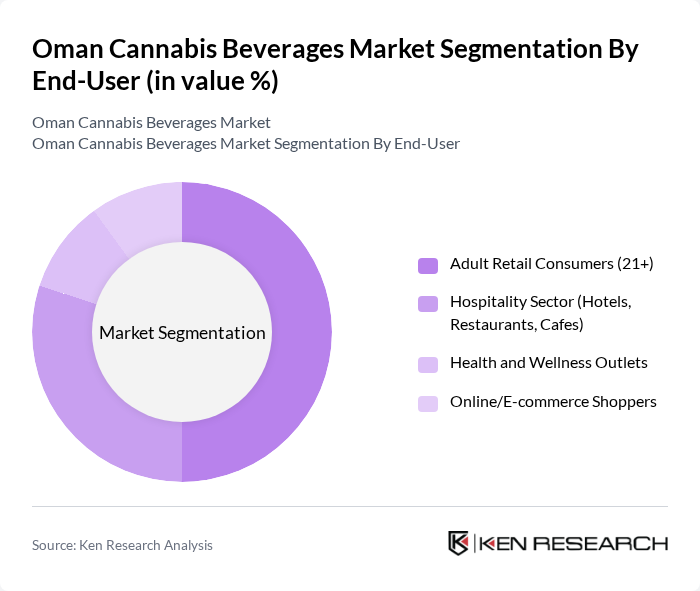

By End-User:The end-user segmentation includes adult retail consumers (21+), the hospitality sector (hotels, restaurants, cafes), health and wellness outlets, and online/e-commerce shoppers. The adult retail consumer segment is the most significant, driven by a growing trend toward health-conscious choices and the increasing acceptance of cannabis products among younger adults. Online retail channels are also experiencing rapid growth due to convenience and privacy preferences.

The Oman Cannabis Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canopy Growth Corporation, Aurora Cannabis Inc., Tilray Brands, Inc., Hexo Corp., Truss Beverage Co., Brewbudz, Green Thumb Industries, Curaleaf Holdings, Inc., Organigram Holdings Inc., Flowr Corporation, MedMen Enterprises Inc., CannaCraft, Kiva Confections, Lagunitas Brewing Company, The Alkaline Water Company Inc., Keef Brands, Dixie Brands Inc., VCC Brand, Phivida Holdings Inc., Oleo Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cannabis beverages market in Oman appears promising, driven by evolving consumer preferences and increasing health awareness. As regulatory frameworks become clearer, more producers are likely to enter the market, enhancing product diversity. Additionally, the rise of e-commerce platforms will facilitate broader access to cannabis beverages, catering to a tech-savvy consumer base. With ongoing education efforts to combat stigma, the market is poised for significant growth in future, reflecting broader trends in health and wellness.

| Segment | Sub-Segments |

|---|---|

| By Type | CBD-Infused Soft Drinks THC-Infused Alcohol Alternatives Cannabis-Infused Herbal Teas Sparkling Waters with Cannabinoids Cannabis-Infused Energy Drinks Functional Beverages (e.g., Adaptogen & Vitamin-Enhanced) |

| By End-User | Adult Retail Consumers (21+) Hospitality Sector (Hotels, Restaurants, Cafes) Health and Wellness Outlets Online/E-commerce Shoppers |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Beverage Stores Licensed Dispensaries E-commerce Platforms |

| By Packaging Type | Cans Bottles Tetra Packs Sachets and Pouches |

| By Flavor Profile | Citrus Berry Herbal Tropical & Exotic Others |

| By Price Range | Premium Mid-Range Budget |

| By Consumer Demographics | Age Group (21-29, 30-44, 45+) Gender Lifestyle Preferences (Wellness, Social, Recreational) Nationality (Omani, Expatriate) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Cannabis Beverages | 150 | General Consumers, Beverage Enthusiasts |

| Retailer Insights on Cannabis Beverage Sales | 100 | Store Managers, Beverage Buyers |

| Industry Expert Opinions on Market Trends | 50 | Market Analysts, Industry Consultants |

| Regulatory Perspectives on Cannabis Beverages | 40 | Legal Advisors, Government Officials |

| Distribution Channel Effectiveness | 80 | Logistics Managers, Supply Chain Coordinators |

The Oman Cannabis Beverages Market is valued at approximately USD 20 million, reflecting a growing consumer interest in health and wellness products, particularly low-calorie and functional beverages infused with cannabinoids.