Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4852

Pages:97

Published On:December 2025

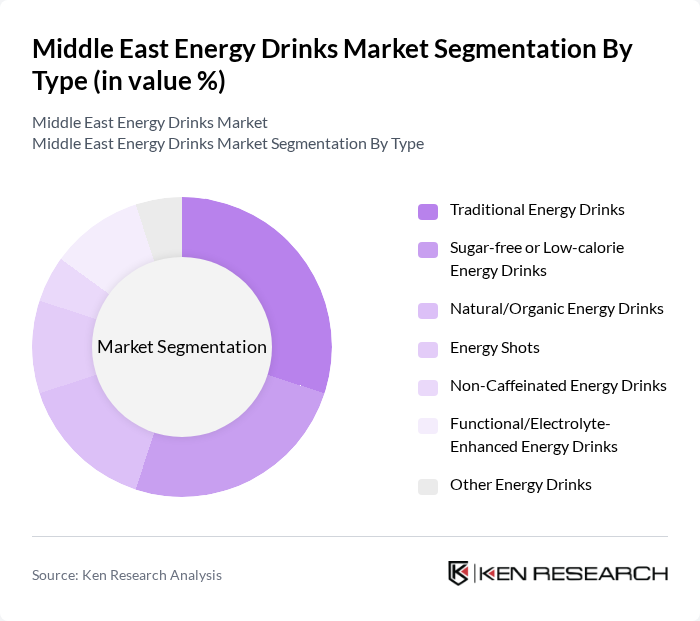

By Type:The energy drinks market can be segmented into various types, including Traditional Energy Drinks, Sugar-free or Low-calorie Energy Drinks, Natural/Organic Energy Drinks, Energy Shots, Non-Caffeinated Energy Drinks, Functional/Electrolyte-Enhanced Energy Drinks, and Other Energy Drinks. This segmentation reflects the regional shift from purely high-sugar, high-caffeine formulations toward a broader portfolio that includes low- and zero-sugar options, organic or naturally positioned products, and performance-oriented drinks with added electrolytes, vitamins, and botanicals, in line with rising health and wellness trends in the Middle East.

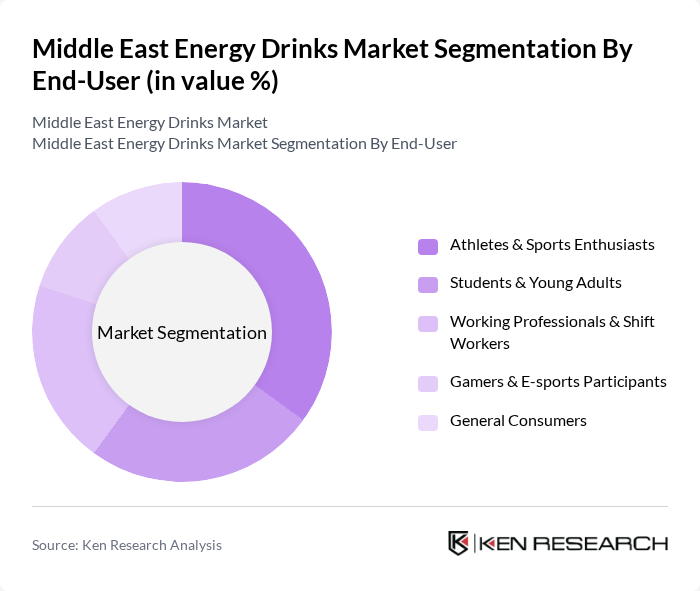

By End-User:The end-user segmentation includes Athletes & Sports Enthusiasts, Students & Young Adults, Working Professionals & Shift Workers, Gamers & E-sports Participants, and General Consumers. These segments mirror observed consumption patterns in the region, where sports- and fitness-focused users increasingly favor performance and electrolyte-enhanced drinks, students and young adults gravitate toward affordable, high-caffeine variants for focus and alertness, and working professionals and shift workers choose convenient single-serve cans and shots for long working hours and night shifts, with gamers and general consumers driving additional demand through lifestyle and social consumption occasions.

The Middle East Energy Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc. (Rockstar Energy, Mountain Dew Energy), The Coca-Cola Company (Burn, Power Play, Other Energy Brands), Saudi Food & Fine Chemicals Co. (Power Horse), Aujan Group Holding (Rani Float & Energy Extensions), National Beverage Company – NBC (Effective Energy Drink, Palestine), HELL ENERGY Magyarország Kft. (HELL Energy), Taqa Food Industries (TAQA Energy Drinks, UAE), Arwa Food Industries LLC (Arwa Energy, UAE), Richy Industries (Richy Pure Energy), Dali Group (Code Red Energy Drink, Saudi Arabia), Shani Beverage Industries Co. (Local Energy Drink Brands, KSA), Gulf Union Foods Co. (Energy & Functional Beverages, Saudi Arabia), Other Emerging Regional & Local Energy Drink Brands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East energy drinks market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-consciousness continues to rise, brands are likely to focus on developing functional beverages that cater to specific consumer needs. Additionally, the integration of technology in marketing strategies, particularly through social media, will enhance brand visibility and engagement, fostering a deeper connection with the youth demographic. Sustainability initiatives will also play a crucial role in shaping brand loyalty and consumer trust.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Energy Drinks Sugar-free or Low-calorie Energy Drinks Natural/Organic Energy Drinks Energy Shots Non-Caffeinated Energy Drinks Functional/Electrolyte-Enhanced Energy Drinks Other Energy Drinks |

| By End-User | Athletes & Sports Enthusiasts Students & Young Adults Working Professionals & Shift Workers Gamers & E-sports Participants General Consumers |

| By Distribution Channel | Supermarkets/Hypermarkets (Off-trade) Convenience Stores & Petrol Stations HoReCa & On-Trade Channels Online Retail & Quick Commerce Gyms, Health Clubs & Specialty Stores |

| By Packaging Type | Metal Cans PET Bottles Glass Bottles Multi-pack/Tetra Packs Other Packaging Formats |

| By Flavor | Citrus Berry Tropical & Exotic Cola & Classic Herbal & Botanical Other Flavors |

| By Region | Saudi Arabia United Arab Emirates Qatar Rest of GCC Levant (including Jordan, Lebanon) Rest of Middle East |

| By Price Range | Premium Mid-Range Value/Budget Private Label & Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Energy Drinks | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Insights | 90 | Retail Managers, Beverage Distributors |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

| Regulatory Impact Assessment | 50 | Compliance Officers, Industry Regulators |

| Brand Loyalty and Consumer Behavior | 100 | Brand Managers, Consumer Insights Analysts |

The Middle East Energy Drinks Market is valued at approximately USD 1.25 billion, reflecting a significant share within the broader Middle East & Africa energy drinks market, driven by increasing consumer demand and the expansion of organized retail channels.