Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4442

Pages:96

Published On:October 2025

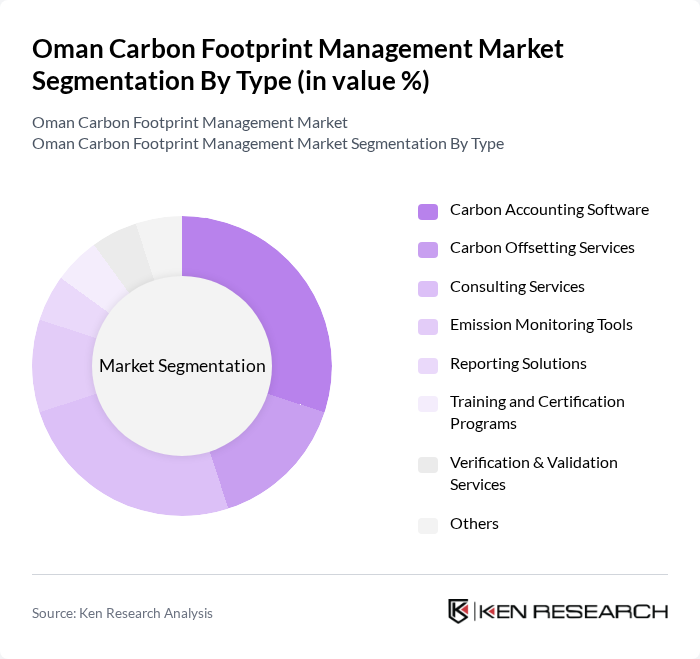

By Type:The market is segmented into various types of carbon management solutions, including Carbon Accounting Software, Carbon Offsetting Services, Consulting Services, Emission Monitoring Tools, Reporting Solutions, Training and Certification Programs, Verification & Validation Services, and Others. Among these, Carbon Accounting Software and Consulting Services are particularly prominent due to the increasing need for accurate carbon tracking and expert guidance in sustainability practices. The adoption of advanced software platforms, real-time emission monitoring, and AI-driven analytics is accelerating, especially among large enterprises and industrial clients.

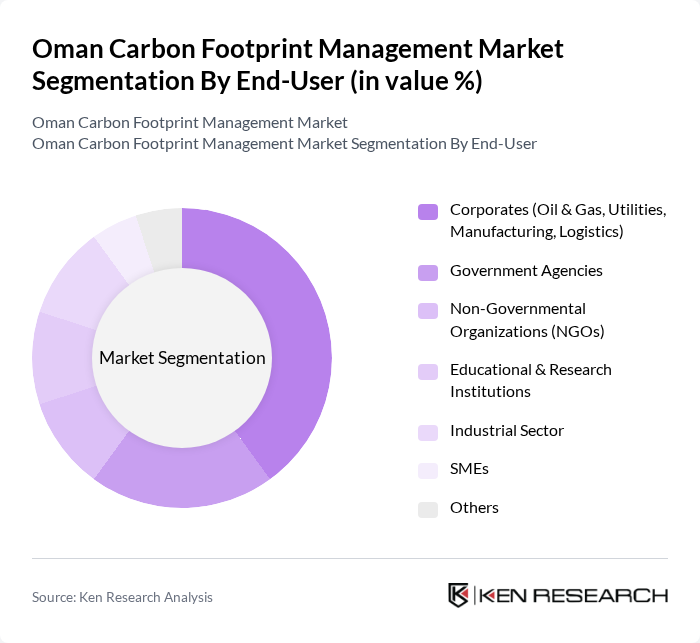

By End-User:The end-user segmentation includes Corporates (Oil & Gas, Utilities, Manufacturing, Logistics), Government Agencies, Non-Governmental Organizations (NGOs), Educational & Research Institutions, Industrial Sector, SMEs, and Others. Corporates, particularly in the Oil & Gas sector, are the leading users of carbon management solutions due to their significant carbon footprints and regulatory obligations. Utilities and manufacturing sectors also show strong adoption, driven by compliance requirements and sustainability targets.

The Oman Carbon Footprint Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Zubair Corporation (Zubair EDC), Petroleum Development Oman (PDO), Oman Environmental Services Holding Company (be’ah), Shell Oman, ENGIE Middle East, Veolia Oman, SGS SA, Bureau Veritas, DNV, Carbon Trust, South Pole, EcoAct, ClimatePartner, Greenstone, Verra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman carbon footprint management market appears promising, driven by increasing regulatory pressures and a shift towards sustainable practices. As businesses adapt to stringent emission targets, the demand for innovative carbon management solutions is expected to rise. Furthermore, the integration of digital technologies and AI in carbon analysis will enhance efficiency and accuracy, paving the way for more effective carbon management strategies. This evolving landscape presents significant opportunities for growth and collaboration across sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Accounting Software Carbon Offsetting Services Consulting Services Emission Monitoring Tools Reporting Solutions Training and Certification Programs Verification & Validation Services Others |

| By End-User | Corporates (Oil & Gas, Utilities, Manufacturing, Logistics) Government Agencies Non-Governmental Organizations (NGOs) Educational & Research Institutions Industrial Sector SMEs Others |

| By Application | Carbon Footprint Assessment Compliance Reporting Sustainability Reporting Risk Management Carbon Trading & Offsetting Others |

| By Investment Source | Private Investments Government Funding International Grants Public-Private Partnerships (PPP) Multilateral Development Banks Others |

| By Policy Support | Subsidies for Carbon Management Solutions Tax Incentives for Green Initiatives Regulatory Frameworks Supporting Carbon Reduction Carbon Pricing Mechanisms Others |

| By Market Maturity | Emerging Market Growth Market Mature Market |

| By Geographic Focus | Muscat (Urban Areas) Sohar (Industrial Zones) Duqm (Special Economic Zones) Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Sector Carbon Management | 100 | Environmental Managers, Sustainability Directors |

| Manufacturing Industry Emission Reduction | 80 | Operations Managers, Compliance Officers |

| Transportation Sector Carbon Footprint Strategies | 70 | Logistics Coordinators, Fleet Managers |

| Renewable Energy Initiatives | 50 | Project Managers, Energy Analysts |

| Corporate Sustainability Programs | 90 | Corporate Sustainability Managers, Policy Advisors |

The Oman Carbon Footprint Management Market is valued at approximately USD 500 million, driven by the increasing adoption of carbon management solutions among corporates and industrial sectors, alongside regulatory pressures and sustainability initiatives.