Region:Asia

Author(s):Geetanshi

Product Code:KRAC8342

Pages:99

Published On:November 2025

By Waste Type:The waste management market can be segmented into various types of waste, including Municipal Solid Waste, Industrial Waste, Medical Waste, Hazardous Waste, Non-Hazardous Waste, E-Waste, Construction and Demolition Waste, and Organic Waste. Each of these subsegments plays a crucial role in the overall waste management landscape, with specific treatment and disposal methods tailored to their unique characteristics.

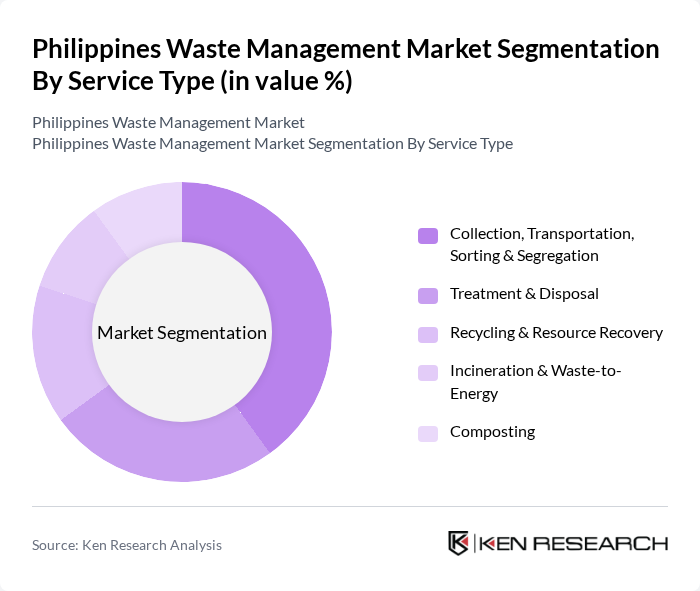

By Service Type:The waste management market is also categorized by service types, which include Collection, Transportation, Sorting & Segregation, Treatment & Disposal, Recycling & Resource Recovery, Incineration & Waste-to-Energy, and Composting. Each service type addresses different aspects of waste management, ensuring that waste is handled efficiently and sustainably.

The Philippines Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Philippines, SUEZ Philippines, Sembcorp Industries Philippines, Metro Pacific Investments Corporation (MPIC), San Miguel Corporation, Ayala Corporation, JG Summit Holdings, Inc., Aboitiz InfraCapital, Inc., Manila Water Company, Inc., First Philippine Holdings Corporation, Filinvest Development Corporation, DM Wenceslao and Associates, Inc., EcoWaste Coalition, Philippine Waste Management Association, Concepcion Industrial Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines waste management market is poised for significant transformation as urbanization accelerates and environmental awareness grows. In the future, the focus will shift towards innovative waste management solutions, including digital technologies and sustainable practices. The government’s commitment to enhancing waste management infrastructure and regulatory compliance will further drive market growth. As public-private partnerships become more prevalent, the sector is expected to attract increased investment, fostering a more efficient and environmentally friendly waste management ecosystem in the Philippines.

| Segment | Sub-Segments |

|---|---|

| By Waste Type | Municipal Solid Waste Industrial Waste Medical Waste Hazardous Waste Non-Hazardous Waste E-Waste Construction and Demolition Waste Organic Waste |

| By Service Type | Collection, Transportation, Sorting & Segregation Treatment & Disposal Recycling & Resource Recovery Incineration & Waste-to-Energy Composting |

| By Treatment Method | Landfilling Incineration Recycling Composting Autoclaving Chemical Treatment |

| By Source of Generation | Residential Commercial (Retail, Office, Hospitality) Industrial Hospitals & Healthcare Facilities Clinical Laboratories Government & Utilities |

| By Treatment Site | Onsite Treatment Offsite Treatment |

| By Region | Luzon Visayas Mindanao |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management Practices | 100 | City Waste Management Officers, Local Government Officials |

| Commercial Waste Disposal Strategies | 90 | Facility Managers, Business Owners |

| Recycling Initiatives and Participation | 80 | Recycling Program Coordinators, Environmental NGO Representatives |

| Public Awareness and Education Programs | 70 | Community Leaders, Educators |

| Hazardous Waste Management Compliance | 50 | Health and Safety Officers, Compliance Managers |

The Philippines Waste Management Market is valued at approximately USD 2.7 billion, driven by urbanization, population growth, and increased environmental awareness. This market is expected to grow as the demand for effective waste management solutions rises in urban areas.