Region:Middle East

Author(s):Dev

Product Code:KRAD5114

Pages:96

Published On:December 2025

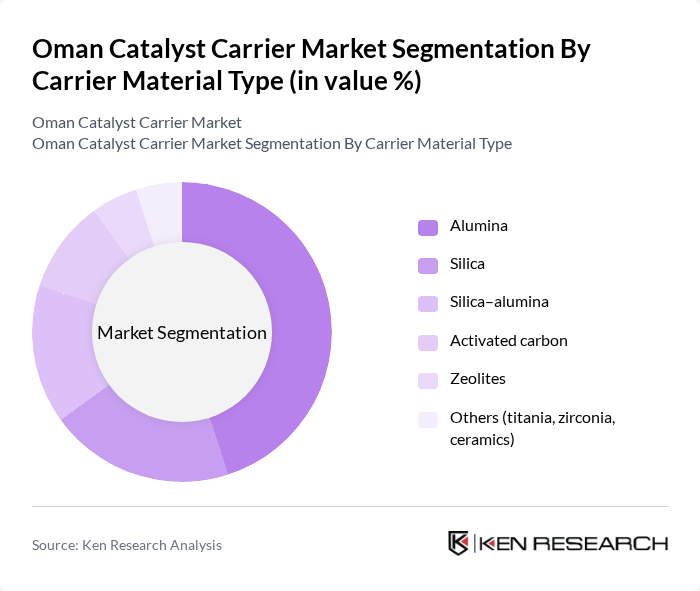

By Carrier Material Type:The carrier material type segmentation includes various materials used in catalyst carriers, each with unique properties and applications. The primary subsegments are Alumina, Silica, Silica–alumina, Activated carbon, Zeolites, and Others (titania, zirconia, ceramics). Among these, Alumina is the leading subsegment due to its high surface area, mechanical strength, and thermal and hydrothermal stability, making it ideal for hydroprocessing, reforming, and other refinery and petrochemical catalytic processes. The demand for Alumina is driven by its extensive use in oil refining and petrochemical applications in the Middle East, where stringent fuel specifications and high operating severities require robust carriers to maintain catalyst activity and selectivity over long cycles.

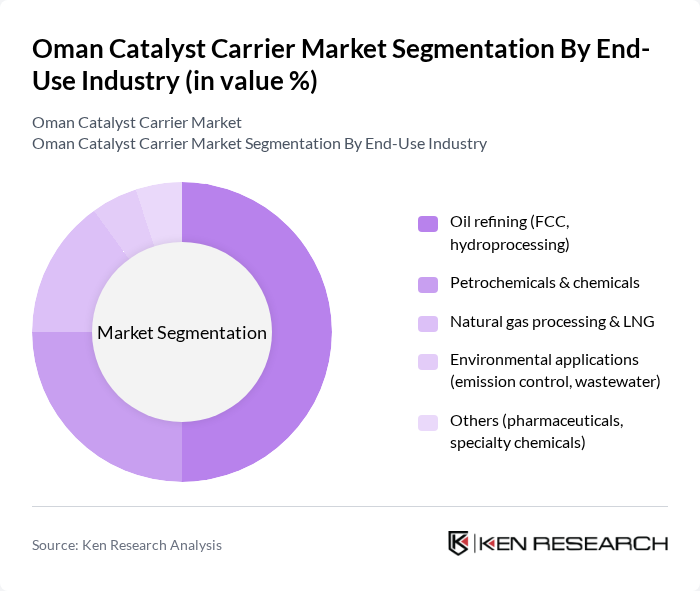

By End-Use Industry:The end-use industry segmentation encompasses various sectors utilizing catalyst carriers, including Oil refining (FCC, hydroprocessing), Petrochemicals & chemicals, Natural gas processing & LNG, Environmental applications (emission control, wastewater), and Others (pharmaceuticals, specialty chemicals). The Oil refining sector is the dominant segment, driven by the need for efficient catalytic processes to maximize yield, improve conversion of heavy fractions, and minimize emissions in line with tighter fuel-quality and air?emission requirements in the Middle East. The increasing complexity of crude oil processed in the region, the shift towards value?added petrochemicals, and the expansion of gas-processing and LNG projects further bolster the growth of this segment and sustain demand for high?performance catalyst carriers in Oman.

The Oman Catalyst Carrier Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Johnson Matthey Plc, Haldor Topsoe A/S (Topsoe), W. R. Grace & Co., Almatis GmbH, Evonik Industries AG, Cabot Corporation, Magma Ceramics & Catalysts, Axens, Honeywell UOP, Sasol Limited, Saint-Gobain, CoorsTek Inc., Noritake Co., Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Oman catalyst carrier market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the demand for eco-friendly catalysts rises, companies are likely to invest in innovative solutions that reduce environmental impact. Furthermore, the expansion of oil refining and petrochemical sectors will create new opportunities for catalyst carriers, fostering collaboration with global players and enhancing local manufacturing capabilities to meet emerging market needs.

| Segment | Sub-Segments |

|---|---|

| By Carrier Material Type | Alumina Silica Silica–alumina Activated carbon Zeolites Others (titania, zirconia, ceramics) |

| By End-Use Industry | Oil refining (FCC, hydroprocessing) Petrochemicals & chemicals Natural gas processing & LNG Environmental applications (emission control, wastewater) Others (pharmaceuticals, specialty chemicals) |

| By Application | Fluid catalytic cracking (FCC) Hydrocracking & hydrotreating Reforming & isomerization Desulfurization & gas treatment Others (dehydrogenation, oxidation) |

| By Physical Form | Spheres / beads Extrudates / pellets Monoliths / honeycomb structures Powder & others |

| By Region (Within Oman) | Muscat & Barka (refining, LNG & utilities corridor) Sohar Industrial Port & Freezone Duqm Special Economic Zone Salalah & Dhofar industrial cluster Other regions (Interior oil & gas fields) |

| By Source | Imported catalyst carriers Locally produced / regionally toll-manufactured carriers |

| By Sales Channel | Direct supply to refineries & petrochemical plants Supply via international catalyst licensors / EPCs Regional distributors & trading houses Others (OEM / equipment-integrated supply) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Catalyst Carrier Production | 100 | Production Managers, Quality Control Supervisors |

| Petrochemical Applications | 80 | Process Engineers, R&D Directors |

| Automotive Industry Usage | 70 | Supply Chain Managers, Product Development Engineers |

| Environmental Compliance | 60 | Regulatory Affairs Specialists, Sustainability Managers |

| Market Trends and Innovations | 90 | Market Analysts, Business Development Executives |

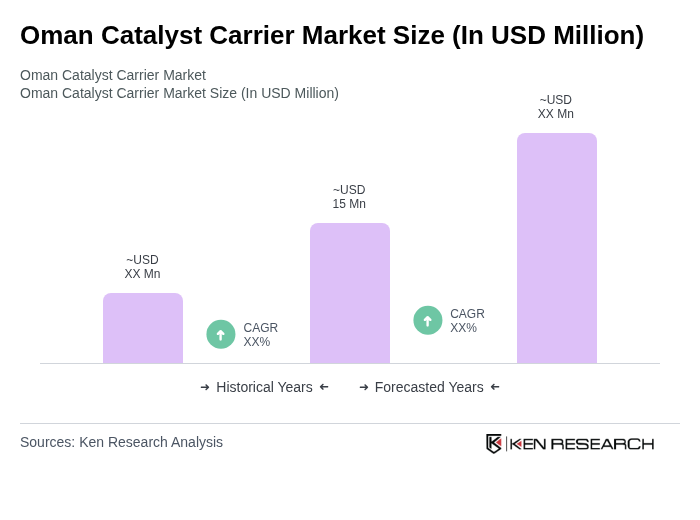

The Oman Catalyst Carrier Market is valued at approximately USD 15 million, reflecting a five-year historical analysis and the country's share within the broader Middle East industrial catalyst and catalyst carrier industry.