Region:Middle East

Author(s):Rebecca

Product Code:KRAD6179

Pages:86

Published On:December 2025

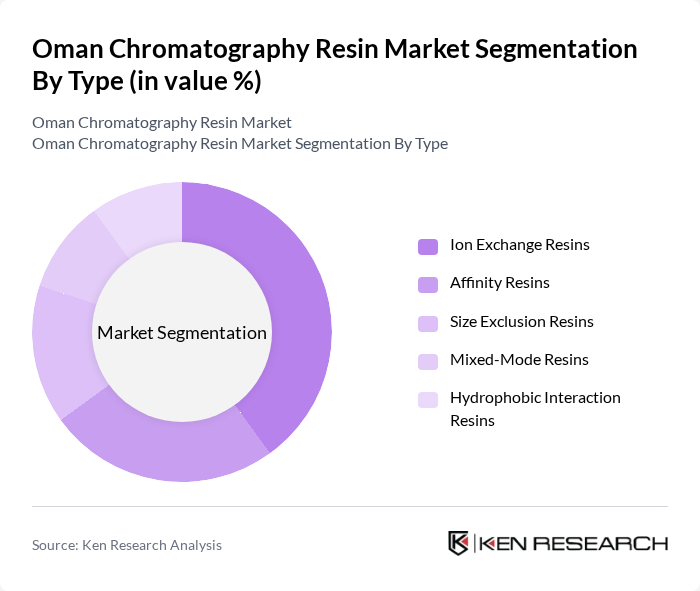

By Type:The chromatography resin market can be segmented into various types, including Ion Exchange Resins, Affinity Resins, Size Exclusion Resins, Mixed-Mode Resins, and Hydrophobic Interaction Resins. Among these, Ion Exchange Resins are the most widely used due to their versatility and effectiveness in separating charged molecules. The increasing demand for biopharmaceuticals has led to a surge in the use of these resins for protein purification, making them a dominant force in the market.

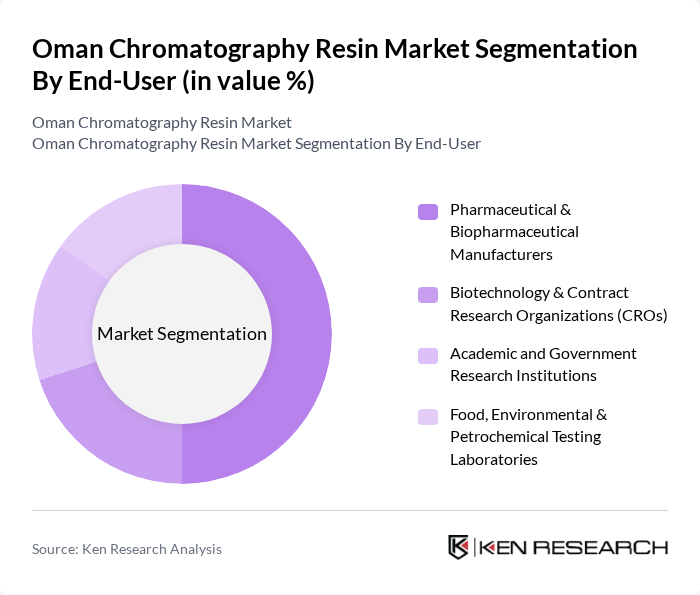

By End-User:The end-user segmentation includes Pharmaceutical & Biopharmaceutical Manufacturers, Biotechnology & Contract Research Organizations (CROs), Academic and Government Research Institutions, and Food, Environmental & Petrochemical Testing Laboratories. Pharmaceutical & Biopharmaceutical Manufacturers dominate this segment due to their extensive use of chromatography resins for drug development and production processes. The increasing focus on biologics and monoclonal antibodies has further solidified their position in the market.

The Oman Chromatography Resin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cytiva (formerly GE Healthcare Life Sciences), Merck KGaA (Merck Life Science / MilliporeSigma), Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Tosoh Corporation (Tosoh Bioscience), Sartorius AG (Sartorius Stedim Biotech), Pall Corporation (part of Danaher Corporation), Repligen Corporation, Waters Corporation, Shimadzu Corporation, Phenomenex, Inc. (a Danaher company), Bio-Works Technologies AB, Purolite Corporation (an Ecolab company), KNAUER Wissenschaftliche Geräte GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The Oman chromatography resin market is poised for significant growth, driven by advancements in biopharmaceuticals and increasing investments in research and development. As the demand for personalized medicine rises, the need for efficient separation techniques will become more critical. Furthermore, the integration of automation and artificial intelligence in analytical processes is expected to enhance productivity, making chromatography more accessible and efficient for various applications in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Ion Exchange Resins Affinity Resins Size Exclusion Resins Mixed-Mode Resins Hydrophobic Interaction Resins |

| By End-User | Pharmaceutical & Biopharmaceutical Manufacturers Biotechnology & Contract Research Organizations (CROs) Academic and Government Research Institutions Food, Environmental & Petrochemical Testing Laboratories |

| By Application | Protein & Monoclonal Antibody Purification Nucleic Acid (DNA/RNA) Separation & Purification Small Molecule & Impurity Profiling Process Development, Scale-Up & Quality Control |

| By Formulation | Pre-packed Columns & Cartridges Bulk Resins for Process-Scale Chromatography Single-Use / Disposable Chromatography Formats |

| By Region | Muscat Salalah Sohar Duqm & Other Regions |

| By Distribution Channel | Direct Sales by Manufacturers Local & Regional Distributors Online & E-Procurement Portals System Integrators & Value-Added Resellers |

| By Customer Type | Large Multinational Corporations Local & Regional SMEs Government & Public Sector Laboratories Hospital, Clinical & Diagnostic Laboratories |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 45 | R&D Managers, Quality Control Analysts |

| Food and Beverage Testing | 40 | Laboratory Technicians, Compliance Officers |

| Environmental Analysis | 40 | Environmental Scientists, Regulatory Affairs Specialists |

| Academic Research Institutions | 40 | Research Professors, Graduate Students |

| Industrial Applications | 45 | Process Engineers, Production Managers |

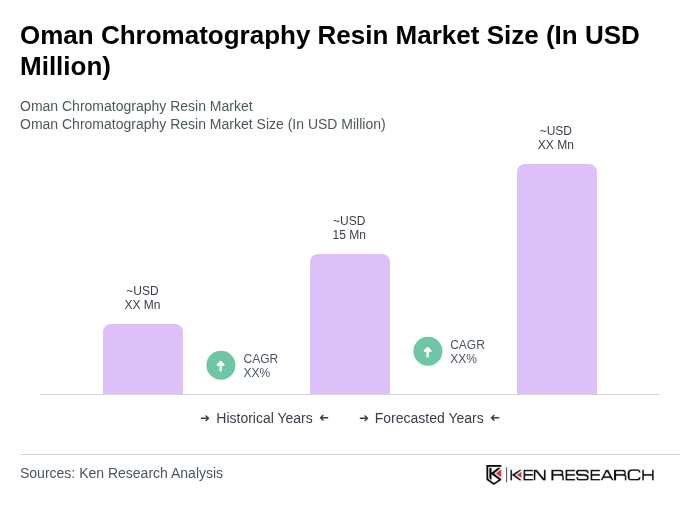

The Oman Chromatography Resin Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for biopharmaceuticals and advanced purification techniques across various industries.