Region:Middle East

Author(s):Rebecca

Product Code:KRAD4329

Pages:99

Published On:December 2025

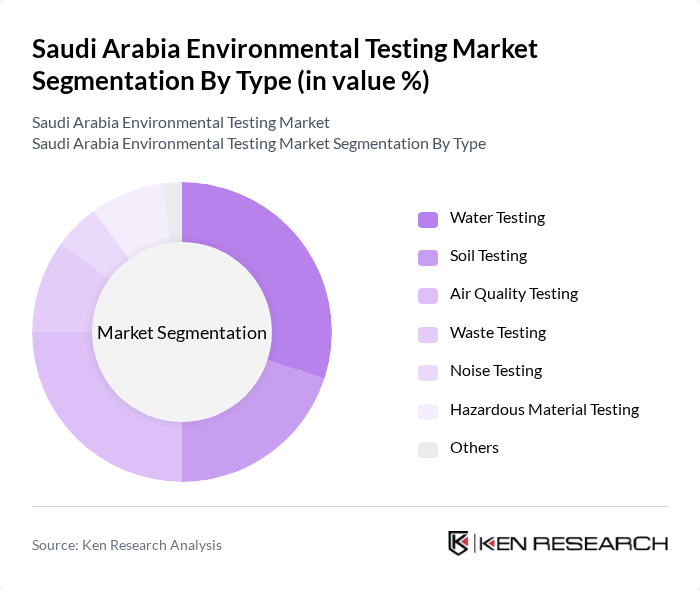

By Type:The market is segmented into various types of environmental testing services, including water testing, soil testing, air quality testing, waste testing, noise testing, hazardous material testing, and others. Each of these segments plays a crucial role in ensuring compliance with environmental regulations and safeguarding public health.

The water testing segment is currently dominating the market due to the increasing concerns over water quality and safety. With the rising population and industrial activities, the demand for water testing has surged, driven by regulatory requirements and public health initiatives. Additionally, the growing awareness of waterborne diseases has led to a heightened focus on ensuring safe drinking water, further propelling the growth of this segment. The air quality testing segment also shows significant growth, driven by urbanization and industrial emissions.

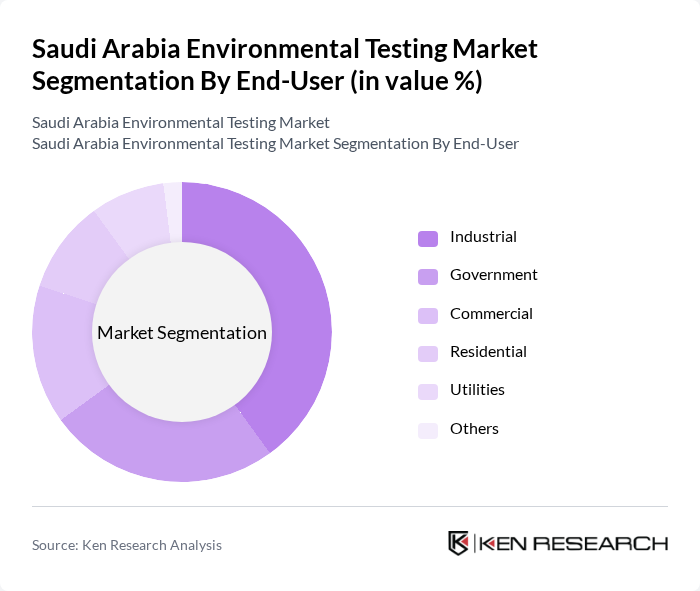

By End-User:The market is segmented by end-users, including industrial, government, commercial, residential, utilities, and others. Each segment has unique requirements and regulatory obligations that drive the demand for environmental testing services.

The industrial segment is the largest end-user in the market, driven by stringent regulations and the need for compliance with environmental standards. Industries such as oil and gas, manufacturing, and construction require regular environmental testing to mitigate risks and ensure safety. The government sector also plays a significant role, as regulatory bodies mandate testing to monitor environmental quality and enforce compliance.

The Saudi Arabia Environmental Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS Saudi Arabia, Bureau Veritas, Intertek, ALS Environmental, Eurofins Scientific, TUV Rheinland, Applus+, KBR, Inc., AECOM, Ramboll, ERM, DNV GL, Golder Associates, SLR Consulting, Wood Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia environmental testing market appears promising, driven by ongoing regulatory developments and increased public engagement in environmental issues. As the government continues to enforce stricter environmental laws, the demand for testing services is expected to rise significantly. Additionally, advancements in technology, particularly in digital solutions and AI integration, will enhance testing accuracy and efficiency, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water Testing Soil Testing Air Quality Testing Waste Testing Noise Testing Hazardous Material Testing Others |

| By End-User | Industrial Government Commercial Residential Utilities Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Environmental Compliance Research and Development Risk Assessment Remediation Projects Others |

| By Technology | Traditional Testing Methods Advanced Analytical Techniques Remote Sensing Technologies Others |

| By Investment Source | Private Sector Investment Government Funding International Aid Public-Private Partnerships |

| By Policy Support | Environmental Subsidies Tax Incentives Grants for Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Quality Testing Services | 110 | Environmental Scientists, Laboratory Managers |

| Water Quality Analysis | 95 | Water Resource Managers, Compliance Officers |

| Soil Testing and Remediation | 85 | Agricultural Consultants, Environmental Engineers |

| Hazardous Waste Testing | 75 | Waste Management Specialists, Regulatory Affairs Managers |

| Environmental Compliance Audits | 100 | Compliance Auditors, Environmental Policy Analysts |

The Saudi Arabia Environmental Testing Market is valued at approximately USD 183 million, reflecting significant growth driven by industrial activities, stringent environmental regulations, and increased public awareness regarding environmental sustainability.