Oman Cleanroom Technology Market Overview

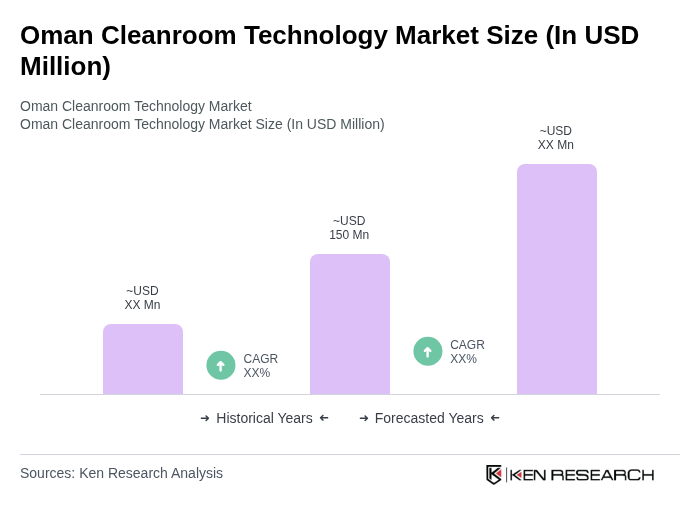

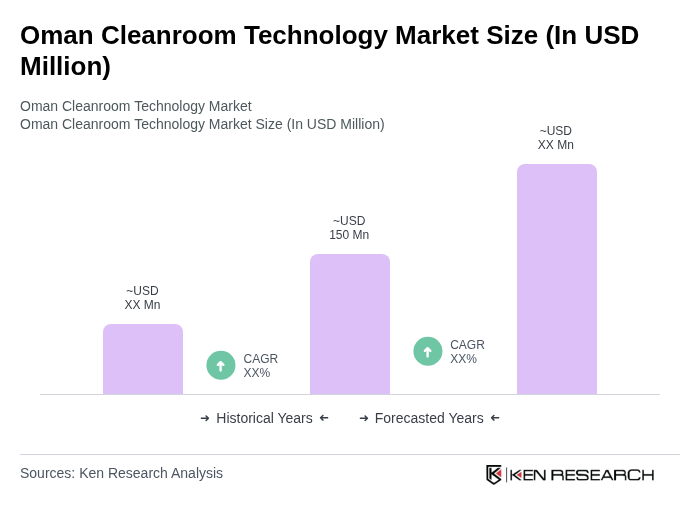

- The Oman Cleanroom Technology Market is valued at USD 150 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for contamination control in pharmaceuticals, biotechnology, and electronics, as well as the adoption of advanced cleanroom solutions such as modular and energy-efficient systems. The integration of IoT technologies for real-time monitoring and the focus on regulatory compliance are further accelerating market expansion in Oman.

- Muscat remains the dominant city in the Oman Cleanroom Technology Market due to its strategic location and concentration of key industries, including pharmaceuticals and electronics. The city acts as a hub for international trade and investment, attracting companies that require cleanroom facilities to comply with stringent regulatory standards and support high-value manufacturing activities.

- In 2023, the Omani government mandated that all pharmaceutical manufacturing facilities comply with ISO 14644 standards for cleanrooms, as stipulated by the Ministry of Health under the "Oman Pharmaceutical Manufacturing Cleanroom Compliance Directive, 2023." This regulation requires pharmaceutical producers to implement certified cleanroom environments, maintain regular documentation, and undergo periodic audits to ensure product quality and safety in line with international standards.

Oman Cleanroom Technology Market Segmentation

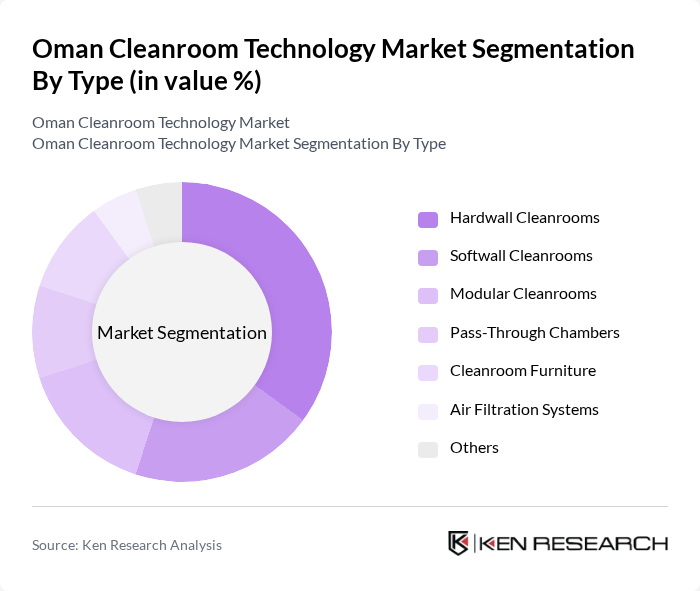

By Type:The cleanroom technology market in Oman is segmented into Hardwall Cleanrooms, Softwall Cleanrooms, Modular Cleanrooms, Pass-Through Chambers, Cleanroom Furniture, Air Filtration Systems, and Others. Modular Cleanrooms are gaining significant traction due to their flexibility, ease of installation, and ability to support rapid scaling for various industries. Hardwall Cleanrooms remain preferred for environments requiring stringent contamination control, particularly in pharmaceuticals and electronics.

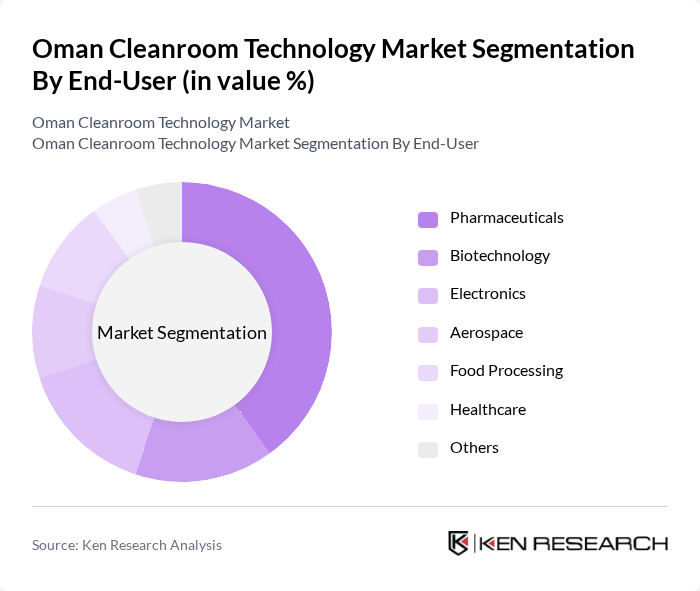

By End-User:The end-user segmentation includes Pharmaceuticals, Biotechnology, Electronics, Aerospace, Food Processing, Healthcare, and Others. Pharmaceuticals continue to be the leading end-user segment, driven by strict regulatory requirements and the need for high-quality, contamination-free production environments. Biotechnology and electronics sectors are also significant contributors, reflecting the expanding applications of cleanroom technology in Oman.

Oman Cleanroom Technology Market Competitive Landscape

The Oman Cleanroom Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cleanroom Technology Solutions LLC, Al-Futtaim Engineering, M+W Group (Exyte), Ecolab Inc., Thermo Fisher Scientific, Clean Air Products, Azbil Corporation, AAF International, Camfil Group, DuPont, Contamination Control Solutions, Enviroair, Labconco Corporation, Cleanroom Supplies Ltd., Clestra Hauserman, Terra Universal, Connect Cleanroom, Lindner Group, CTS Middle East, Abu Dhabi Clean Rooms LLC contribute to innovation, geographic expansion, and service delivery in this space.

Oman Cleanroom Technology Market Industry Analysis

Growth Drivers

- Increasing Demand from Pharmaceuticals:The pharmaceutical sector in Oman is projected to reach a value of OMR 1.2 billion in future, driven by a growing population and rising healthcare needs. This surge in demand necessitates advanced cleanroom technologies to ensure product safety and compliance with stringent quality standards. The increasing number of pharmaceutical companies, estimated at 50 in future, further fuels the need for cleanroom facilities, enhancing the overall market for cleanroom technology in the region.

- Rising Healthcare Standards:Oman’s healthcare expenditure is expected to rise to OMR 1.5 billion in future, reflecting a commitment to improving healthcare services. This increase is accompanied by stricter regulations and standards for healthcare facilities, necessitating the implementation of cleanroom technologies. The Ministry of Health's initiatives to enhance healthcare infrastructure will drive investments in cleanroom solutions, ensuring compliance with international standards and improving patient outcomes across the nation.

- Expansion of Semiconductor Manufacturing:The semiconductor industry in Oman is anticipated to grow significantly, with investments projected to reach OMR 300 million in future. This expansion is driven by the global demand for electronic components, necessitating advanced cleanroom environments for manufacturing. The establishment of new semiconductor plants will create a substantial demand for cleanroom technology, as these facilities require stringent contamination control to ensure product quality and reliability in the competitive electronics market.

Market Challenges

- High Initial Investment Costs:The establishment of cleanroom facilities involves substantial initial investments, often exceeding OMR 500,000 for small to medium-sized operations. This financial barrier can deter new entrants and limit the expansion of existing companies. Additionally, the ongoing costs associated with maintaining cleanroom standards can further strain budgets, particularly for smaller firms that may struggle to allocate sufficient resources for compliance and operational efficiency.

- Stringent Regulatory Requirements:Compliance with international cleanroom standards, such as ISO 14644, poses significant challenges for companies in Oman. The regulatory landscape is complex, requiring continuous monitoring and documentation, which can be resource-intensive. Companies must invest in training and technology to meet these standards, with non-compliance potentially leading to costly penalties and reputational damage, thereby hindering market growth and innovation.

Oman Cleanroom Technology Market Future Outlook

The Oman cleanroom technology market is poised for significant growth, driven by advancements in technology and increasing regulatory demands. The integration of IoT in cleanroom management is expected to enhance operational efficiency, while the shift towards energy-efficient solutions will align with global sustainability trends. As the biotechnology sector expands, the demand for customized cleanroom solutions will rise, presenting opportunities for innovation and investment in the region's cleanroom infrastructure, ultimately fostering a more competitive market landscape.

Market Opportunities

- Growth in Biotechnology Sector:The biotechnology sector in Oman is projected to grow to OMR 200 million in future, creating a substantial demand for specialized cleanroom environments. This growth presents opportunities for cleanroom technology providers to develop tailored solutions that meet the unique requirements of biotechnology applications, enhancing product safety and efficacy in this rapidly evolving field.

- Adoption of Modular Cleanroom Solutions:The trend towards modular cleanroom solutions is gaining traction, with an estimated market value of OMR 50 million in future. These flexible systems allow for rapid deployment and scalability, making them attractive to companies looking to minimize costs and adapt to changing production needs. This opportunity aligns with the growing demand for efficient and customizable cleanroom environments in various industries.