Oman Coding Bootcamp Market Overview

- The Oman Coding Bootcamp Market is valued at USD 50 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for skilled tech professionals, as the country aims to diversify its economy away from oil dependency. The rise in digital transformation initiatives across various sectors has further fueled the need for coding education and training programs.

- Muscat is the dominant city in the Oman Coding Bootcamp Market due to its status as the capital and economic hub of the country. The presence of numerous educational institutions and tech companies in Muscat creates a conducive environment for coding bootcamps. Additionally, the government's focus on enhancing digital skills among the youth has led to a surge in bootcamp enrollments in this region.

- In 2023, the Omani government introduced a new regulation aimed at promoting digital literacy among its citizens. This initiative mandates that all educational institutions incorporate coding and digital skills training into their curricula, thereby increasing the demand for coding bootcamps. The regulation is part of a broader strategy to prepare the workforce for a technology-driven economy.

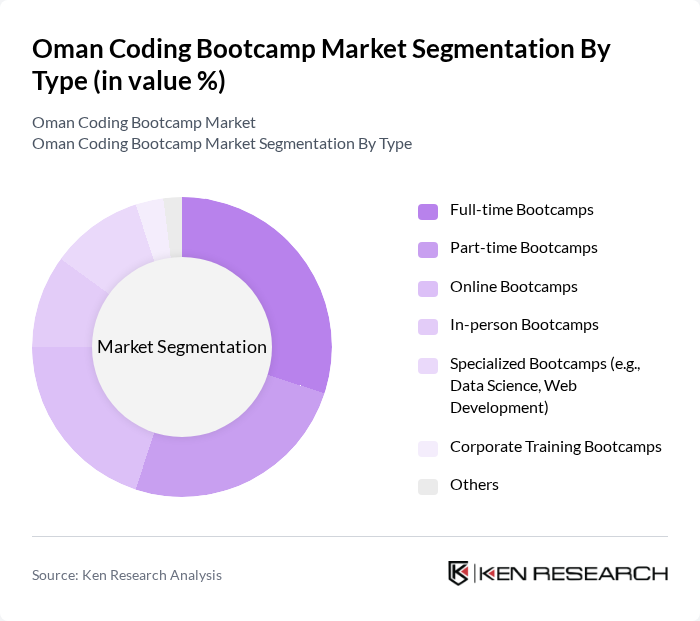

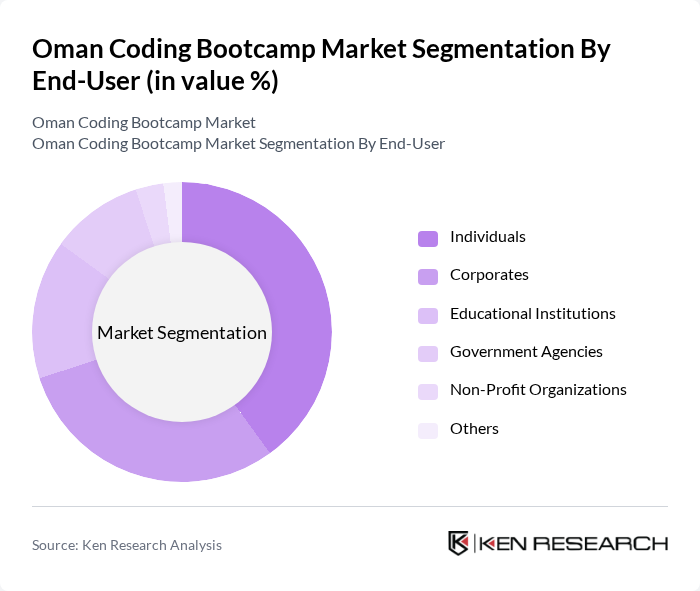

Oman Coding Bootcamp Market Segmentation

By Type:The market is segmented into various types of bootcamps, including Full-time Bootcamps, Part-time Bootcamps, Online Bootcamps, In-person Bootcamps, Specialized Bootcamps (e.g., Data Science, Web Development), Corporate Training Bootcamps, and Others. Each type caters to different learning preferences and schedules, allowing a diverse range of participants to engage in coding education.

By End-User:The end-user segmentation includes Individuals, Corporates, Educational Institutions, Government Agencies, Non-Profit Organizations, and Others. This segmentation highlights the diverse clientele that coding bootcamps serve, from individuals seeking career changes to organizations aiming to upskill their workforce.

Oman Coding Bootcamp Market Competitive Landscape

The Oman Coding Bootcamp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Code Academy, Le Wagon, General Assembly, Ironhack, Thinkful, Flatiron School, Springboard, CareerFoundry, Coding Dojo, Nucamp, BrainStation, Bloc, Tech Elevator, App Academy, Microverse contribute to innovation, geographic expansion, and service delivery in this space.

Oman Coding Bootcamp Market Industry Analysis

Growth Drivers

- Increasing Demand for Tech Skills:The demand for tech skills in Oman is surging, with the World Bank reporting a projected increase of 20,000 tech jobs in the near future. This growth is driven by the digital transformation across various sectors, including finance and healthcare. As companies seek to enhance their digital capabilities, coding bootcamps are positioned to fill the skills gap, providing targeted training that aligns with industry needs. This trend is further supported by a 15% annual increase in tech job postings in the region.

- Government Initiatives Promoting Digital Education:The Omani government has allocated approximately $50 million for digital education initiatives in the near future, aiming to enhance the country's tech workforce. This funding supports coding bootcamps and other educational programs, fostering a culture of innovation and entrepreneurship. Additionally, the government's Vision 2040 strategy emphasizes the importance of digital skills, creating a favorable environment for bootcamps to thrive and attract more students seeking tech careers.

- Rise of Remote Work Opportunities:The shift towards remote work has accelerated in Oman, with a reported 30% increase in remote job listings since 2023. This trend has heightened the need for tech skills, as companies adapt to flexible work arrangements. Coding bootcamps are capitalizing on this demand by offering specialized training in programming and software development, enabling graduates to access a broader range of job opportunities, both locally and internationally, thus driving enrollment.

Market Challenges

- Limited Awareness of Coding Bootcamps:Despite the growing demand for tech skills, awareness of coding bootcamps remains low in Oman. A recent survey indicated that only 25% of potential students are familiar with bootcamp offerings. This lack of awareness hinders enrollment and growth, as many individuals still prefer traditional educational pathways. Effective marketing strategies and outreach programs are essential to educate the public about the benefits and opportunities provided by coding bootcamps.

- High Dropout Rates Among Students:Coding bootcamps in Oman face significant challenges with dropout rates, which can reach as high as 40%. Factors contributing to this issue include financial constraints, lack of support, and unrealistic expectations regarding job placement. Addressing these challenges through enhanced student support services and realistic career guidance is crucial for improving retention rates and ensuring that graduates successfully transition into the workforce.

Oman Coding Bootcamp Market Future Outlook

The Oman coding bootcamp market is poised for significant growth, driven by increasing demand for tech skills and supportive government initiatives. As remote work continues to rise, bootcamps will adapt their offerings to meet the evolving needs of the workforce. Additionally, partnerships with local businesses will enhance job placement success rates, further attracting students. The focus on hybrid learning models and soft skills training will also play a crucial role in shaping the future landscape of coding education in Oman.

Market Opportunities

- Expansion of Online Bootcamp Offerings:The shift towards online education presents a significant opportunity for coding bootcamps in Oman. With an estimated 60% of students preferring online learning formats, bootcamps can expand their reach and accessibility. This transition can lead to increased enrollment and a diverse student base, allowing institutions to cater to various demographics and geographical locations.

- Partnerships with Tech Companies for Curriculum Development:Collaborating with tech companies to develop relevant curricula can enhance the quality of coding bootcamps. Such partnerships can ensure that training aligns with industry standards and emerging technologies, making graduates more employable. This approach not only benefits students but also helps companies secure a skilled workforce tailored to their specific needs.