Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7965

Pages:86

Published On:December 2025

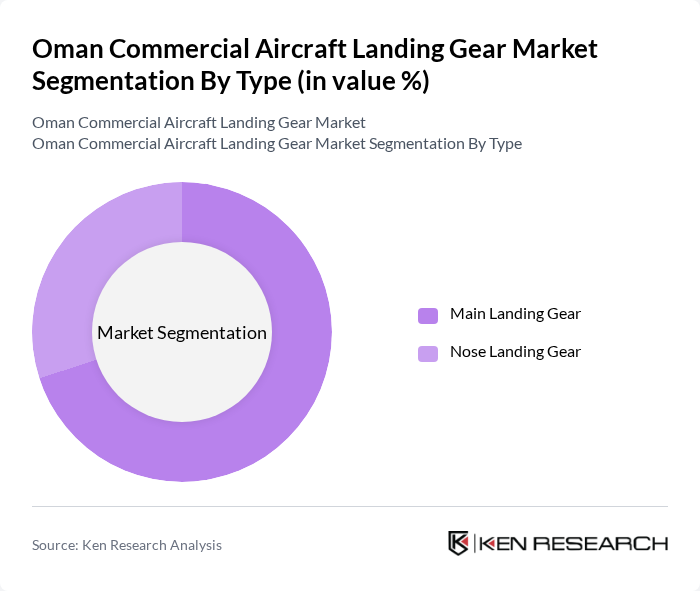

By Type:

The market is segmented into two main types: Main Landing Gear and Nose Landing Gear. The Main Landing Gear is the dominant segment, primarily due to its critical role in supporting the aircraft's weight during landing and takeoff. This segment is favored by commercial airlines and cargo operators, as it ensures stability and safety during operations. The Nose Landing Gear, while essential, has a smaller market share as it primarily supports the front of the aircraft and is less complex than the main gear.

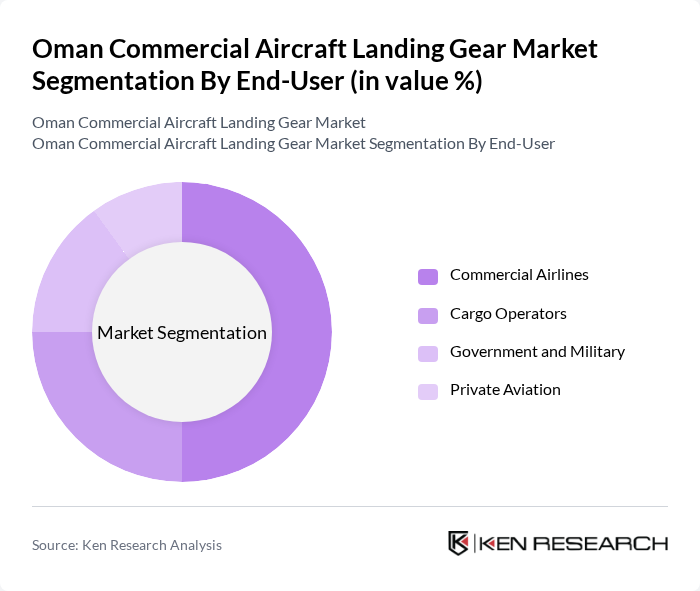

By End-User:

This segment includes Commercial Airlines, Cargo Operators, Government and Military, and Private Aviation. The Commercial Airlines segment leads the market, driven by the increasing number of passengers and the expansion of airline networks. Cargo Operators also contribute significantly, as the demand for air freight continues to rise. Government and Military usage is stable, while Private Aviation is growing, reflecting a trend towards personalized air travel.

The Oman Commercial Aircraft Landing Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safran Landing Systems, Collins Aerospace (RTX Corporation), Honeywell Aerospace, Liebherr-Aerospace, Messier-Bugatti-Dowty (Safran Group), AAR Corp, Triumph Group, GKN Aerospace, Airbus S.A.S., Boeing Commercial Airplanes contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Commercial Aircraft Landing Gear Market is poised for growth, driven by increasing air traffic and significant investments in airport infrastructure. As the aviation sector expands, the demand for innovative landing gear solutions will rise, particularly those that enhance safety and efficiency. Furthermore, the integration of smart technologies and predictive maintenance will likely shape the future landscape, ensuring that Oman remains competitive in the regional aviation market while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Main Landing Gear Nose Landing Gear |

| By End-User | Commercial Airlines Cargo Operators Government and Military Private Aviation |

| By Aircraft Type | Narrow-Body Aircraft Wide-Body Aircraft Regional Jets |

| By Material | Aluminum Alloys Composite Materials Steel Alloys Titanium Alloys |

| By Service Type | Maintenance, Repair, and Overhaul (MRO) Upgrades and Modifications Spare Parts Supply |

| By Region | Muscat Salalah Sohar |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines Operating in Oman | 45 | Fleet Managers, Operations Directors |

| Aerospace Component Manufacturers | 38 | Product Development Engineers, Supply Chain Managers |

| Maintenance, Repair, and Overhaul (MRO) Providers | 32 | Maintenance Managers, Quality Assurance Officers |

| Aviation Regulatory Bodies | 22 | Regulatory Compliance Officers, Safety Inspectors |

| Industry Experts and Consultants | 18 | Aviation Analysts, Market Researchers |

The Oman Commercial Aircraft Landing Gear Market is valued at approximately USD 155 million, reflecting a significant growth driven by increased air travel demand, expansion of the aviation sector, and modernization of aircraft fleets in the region.