Region:Middle East

Author(s):Dev

Product Code:KRAA8358

Pages:80

Published On:November 2025

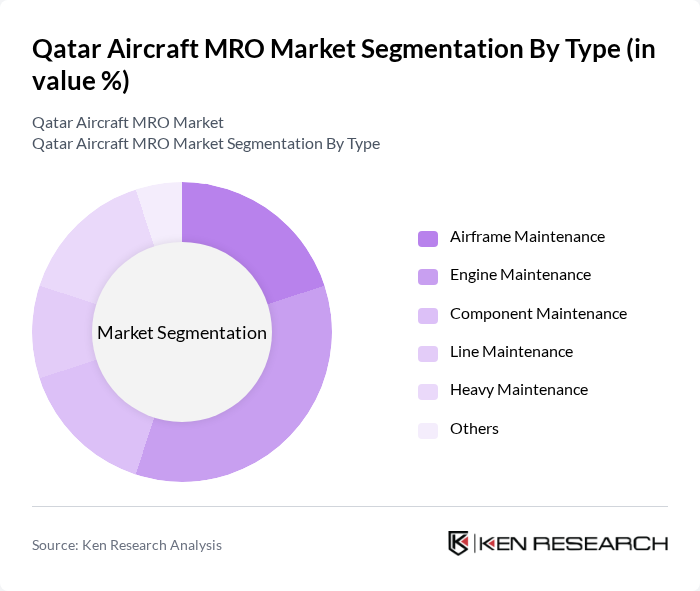

By Type:The market is segmented into various types of maintenance services, including Airframe Maintenance, Engine Maintenance, Component Maintenance, Line Maintenance, Heavy Maintenance, and Others. Among these, Engine Maintenance is currently the leading sub-segment due to the high costs associated with engine repairs and the critical nature of engine performance in aviation safety. The demand for specialized engine services is driven by the increasing number of aircraft in operation and the need for compliance with stringent safety regulations. Engine MRO typically accounts for the largest share of MRO spending in the Middle East, reflecting both commercial and government fleet requirements .

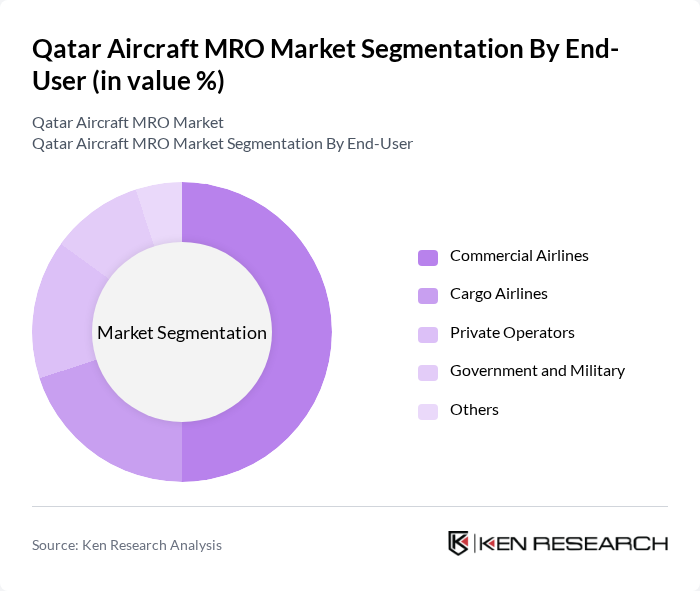

By End-User:The end-user segmentation includes Commercial Airlines, Cargo Airlines, Private Operators, Government and Military, and Others. The Commercial Airlines segment dominates the market, driven by the increasing number of passengers and cargo transported by air. This segment's growth is fueled by the expansion of airline fleets, especially Qatar Airways, and the need for regular maintenance to ensure safety and reliability in operations. The government and military segment also contributes significantly due to ongoing investments in defense aviation and helicopter fleets .

The Qatar Aircraft MRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Airways Engineering, Gulf Aviation Maintenance Company (GAMCO), Qatar Executive (Business Jet MRO), Airbus Services Qatar, Boeing Global Services Qatar, Lufthansa Technik Qatar, Rolls-Royce Qatar, Safran Aircraft Engines Qatar, Bombardier Service Center Qatar, Embraer Executive Care Qatar, Air France Industries KLM Engineering & Maintenance Qatar, HAECO Qatar, AAR Corp Qatar, Qatar Aviation Services (QAS), Qatar Aviation Maintenance (QAM) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar Aircraft MRO market appears promising, driven by increasing air traffic and fleet expansion. As airlines prioritize operational efficiency, the demand for advanced MRO services will rise, particularly those incorporating digital technologies. Additionally, Qatar's strategic location as a transit hub will attract international airlines seeking reliable MRO solutions. The focus on sustainability and regulatory compliance will further shape the market, encouraging investments in eco-friendly practices and technologies that enhance operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Airframe Maintenance Engine Maintenance Component Maintenance Line Maintenance Heavy Maintenance Others |

| By End-User | Commercial Airlines Cargo Airlines Private Operators Government and Military Others |

| By Aircraft Type | Narrow-Body Aircraft Wide-Body Aircraft Regional Aircraft Business Jets Others |

| By Service Type | Scheduled Maintenance Unscheduled Maintenance Modifications and Upgrades Others |

| By Technology Adoption | Traditional MRO Practices Digital MRO Solutions Predictive Maintenance Technologies Others |

| By Geographic Presence | Doha Al Rayyan Al Wakrah Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft MRO Services | 100 | MRO Managers, Airline Operations Directors |

| Helicopter Maintenance Services | 45 | Maintenance Supervisors, Safety Officers |

| Component Repair and Overhaul | 60 | Technical Directors, Quality Assurance Managers |

| Engine Maintenance Services | 55 | Engine Shop Managers, Procurement Specialists |

| Regulatory Compliance and Safety Audits | 40 | Compliance Officers, Safety Inspectors |

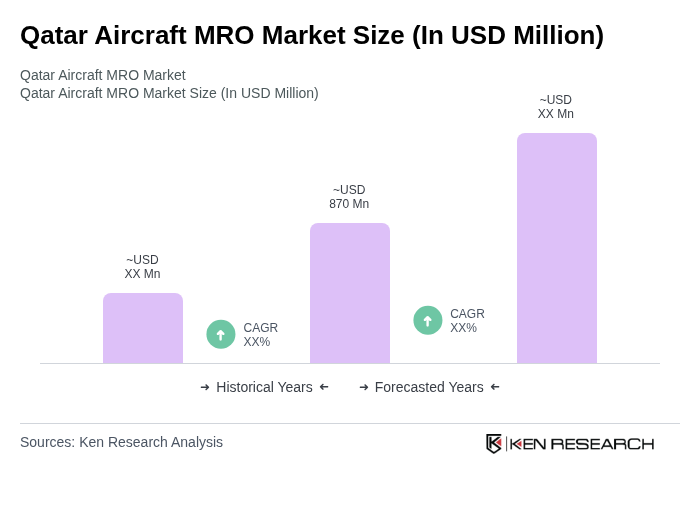

The Qatar Aircraft MRO Market is valued at approximately USD 870 million, reflecting a robust growth driven by increasing air traffic, expansion of aviation infrastructure, and rising demand for maintenance, repair, and overhaul services from commercial and private operators.