Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7326

Pages:89

Published On:October 2025

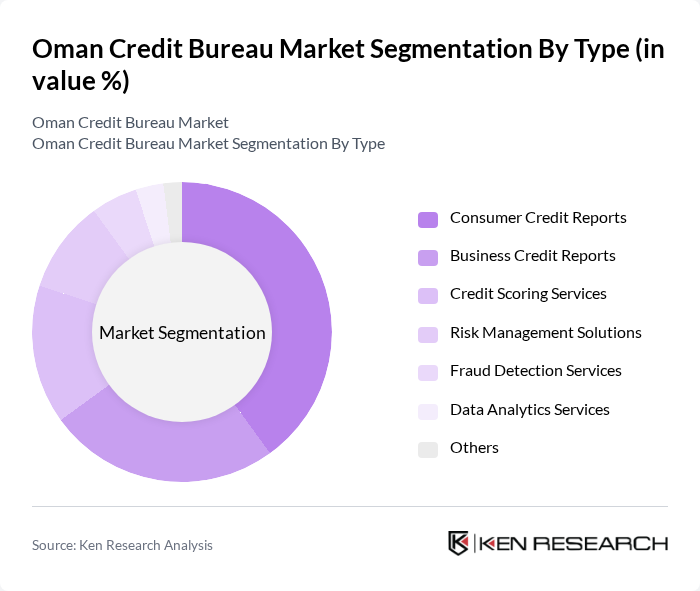

By Type:This segmentation includes various services offered by credit bureaus, which are essential for assessing creditworthiness and managing financial risks. The subsegments include Consumer Credit Reports, Business Credit Reports, Credit Scoring Services, Risk Management Solutions, Fraud Detection Services, Data Analytics Services, and Others. Among these, Consumer Credit Reports are currently dominating the market due to the increasing number of individuals seeking loans and credit facilities, driving the demand for detailed credit histories.

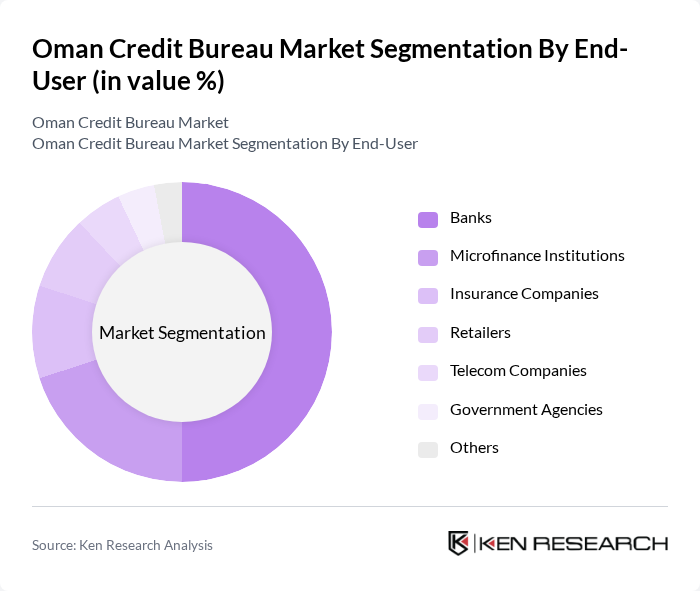

By End-User:This segmentation focuses on the various entities that utilize credit bureau services, including Banks, Microfinance Institutions, Insurance Companies, Retailers, Telecom Companies, Government Agencies, and Others. Banks are the leading end-users, as they rely heavily on credit reports to make informed lending decisions and manage their risk exposure effectively. The increasing number of banking transactions and loans has significantly contributed to the demand for credit bureau services among financial institutions.

The Oman Credit Bureau Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Credit and Financial Information Company, Al Etihad Credit Bureau, Gulf Credit Bureau, Experian Oman, Dun & Bradstreet Oman, Creditinfo Oman, FICO, TransUnion Oman, Equifax Oman, CIBIL Oman, CRIF Oman, Fintech Solutions Oman, DataX Oman, CreditSafe Oman, Risk Management Solutions Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman credit bureau market is poised for significant transformation, driven by technological advancements and increasing consumer awareness. As digital financial services expand, the integration of artificial intelligence in credit assessments will enhance accuracy and efficiency. Furthermore, partnerships between credit bureaus and financial institutions are expected to foster innovation in credit scoring models, ultimately improving access to credit for a broader segment of the population. This evolution will create a more inclusive financial ecosystem in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Credit Reports Business Credit Reports Credit Scoring Services Risk Management Solutions Fraud Detection Services Data Analytics Services Others |

| By End-User | Banks Microfinance Institutions Insurance Companies Retailers Telecom Companies Government Agencies Others |

| By Application | Loan Underwriting Risk Assessment Credit Monitoring Identity Verification Debt Collection Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Third-Party Resellers Others |

| By Customer Type | Individual Consumers Small and Medium Enterprises Large Corporations Government Entities Others |

| By Service Model | Subscription-Based Services Pay-Per-Use Services Freemium Models Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Access | 150 | Individual Borrowers, Financial Advisors |

| SME Credit Utilization | 100 | Business Owners, Financial Managers |

| Banking Sector Insights | 80 | Bank Executives, Risk Management Officers |

| Microfinance Impact Assessment | 70 | Microfinance Institution Managers, Community Leaders |

| Regulatory Compliance Perspectives | 60 | Compliance Officers, Legal Advisors |

The Oman Credit Bureau Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for credit information services essential for assessing the creditworthiness of individuals and businesses.