Region:Middle East

Author(s):Shubham

Product Code:KRAB7275

Pages:80

Published On:October 2025

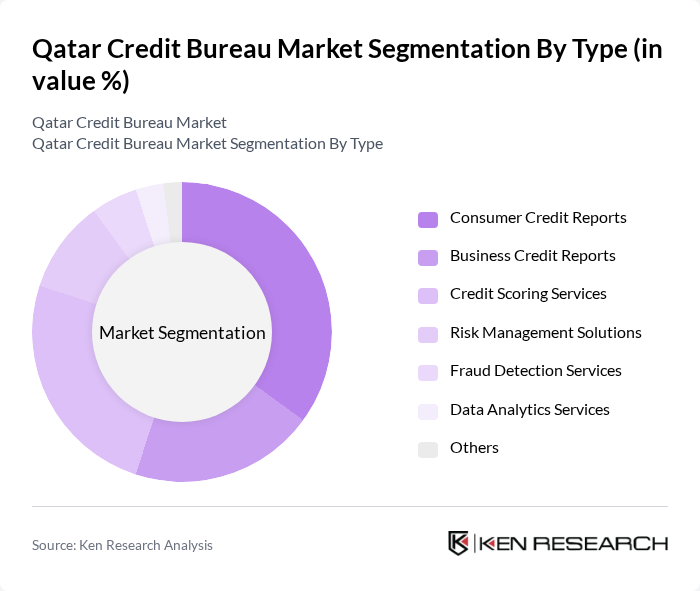

By Type:The market is segmented into various types of services that cater to different needs within the credit reporting landscape. The subsegments include Consumer Credit Reports, Business Credit Reports, Credit Scoring Services, Risk Management Solutions, Fraud Detection Services, Data Analytics Services, and Others. Among these, Consumer Credit Reports and Credit Scoring Services are particularly significant due to the increasing reliance on credit scores for loan approvals and consumer credit assessments.

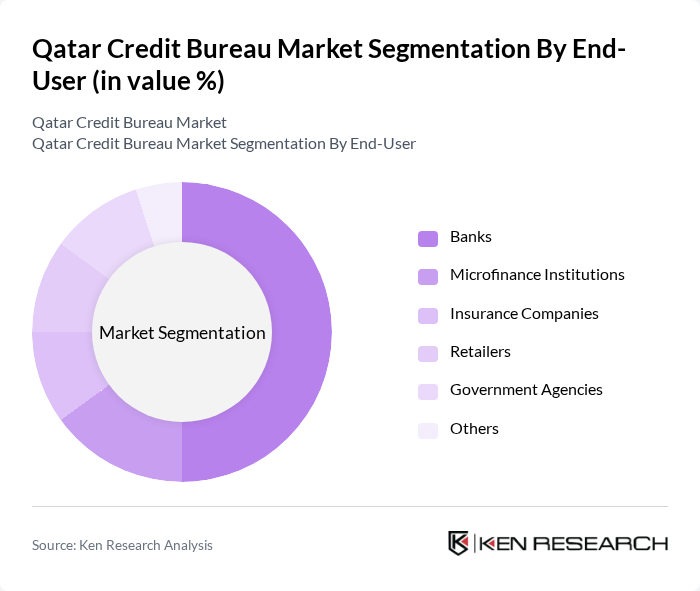

By End-User:The end-user segmentation includes various sectors that utilize credit bureau services, such as Banks, Microfinance Institutions, Insurance Companies, Retailers, Government Agencies, and Others. Banks are the dominant end-users, as they rely heavily on credit reports and scoring services to make informed lending decisions and manage their risk exposure effectively.

The Qatar Credit Bureau Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Credit Bureau, Al Etihad Credit Bureau, Experian Qatar, Dun & Bradstreet Qatar, TransUnion Qatar, Creditinfo Qatar, FICO, Equifax Qatar, CRIF Qatar, CIBIL Qatar, Fintech Solutions Qatar, DataX Qatar, CreditSafe Qatar, RiskMetrics Qatar, InfoCredit Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Credit Bureau market appears promising, driven by technological advancements and increasing consumer demand for credit information. As financial institutions increasingly adopt digital solutions, the integration of artificial intelligence and real-time data analytics will enhance credit assessment processes. Furthermore, the government's commitment to financial inclusion will likely expand the consumer base, creating a more robust market for credit bureaus. These trends suggest a dynamic evolution in the industry, fostering innovation and improved services.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Credit Reports Business Credit Reports Credit Scoring Services Risk Management Solutions Fraud Detection Services Data Analytics Services Others |

| By End-User | Banks Microfinance Institutions Insurance Companies Retailers Government Agencies Others |

| By Application | Loan Underwriting Risk Assessment Identity Verification Credit Monitoring Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Others |

| By Customer Type | Individual Consumers Small and Medium Enterprises Large Corporations Others |

| By Service Model | Subscription-Based Services Pay-Per-Use Services Freemium Models Others |

| By Geographic Coverage | National Coverage Regional Coverage International Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Usage | 150 | Individual Borrowers, Credit Card Holders |

| SME Credit Access | 100 | Business Owners, Financial Managers |

| Mortgage Market Insights | 80 | Home Buyers, Real Estate Agents |

| Banking Sector Perspectives | 60 | Bank Executives, Risk Assessment Officers |

| Regulatory Impact Assessment | 50 | Policy Makers, Financial Regulators |

The Qatar Credit Bureau Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for credit information services essential for financial institutions to assess creditworthiness and manage risk effectively.