Region:Middle East

Author(s):Rebecca

Product Code:KRAD1549

Pages:95

Published On:November 2025

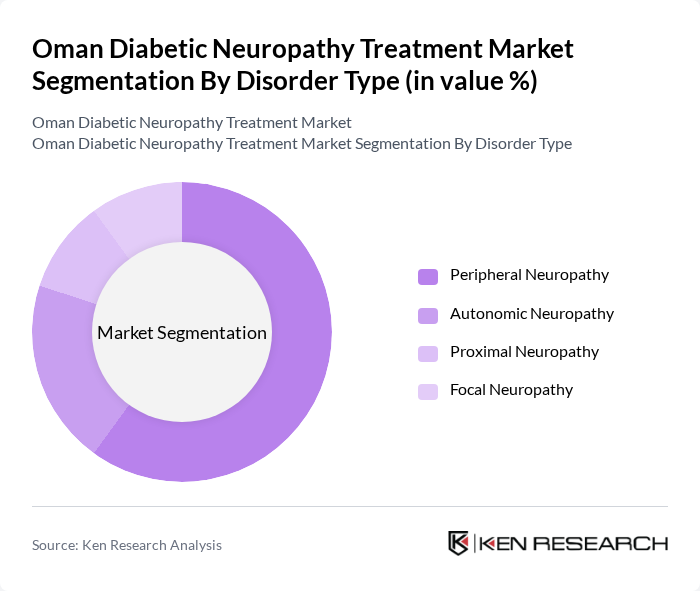

By Disorder Type:The market is segmented into various disorder types, including Peripheral Neuropathy, Autonomic Neuropathy, Proximal Neuropathy, and Focal Neuropathy. Among these, Peripheral Neuropathy is the most prevalent, accounting for a significant portion of the market due to its common occurrence in diabetic patients. The increasing number of diabetes cases in Oman has led to a higher demand for treatments targeting this specific disorder. Autonomic Neuropathy follows, as it affects the autonomic nervous system, leading to various complications that require specialized treatment. The focus on early diagnosis and management of these conditions is driving the growth of this segment.

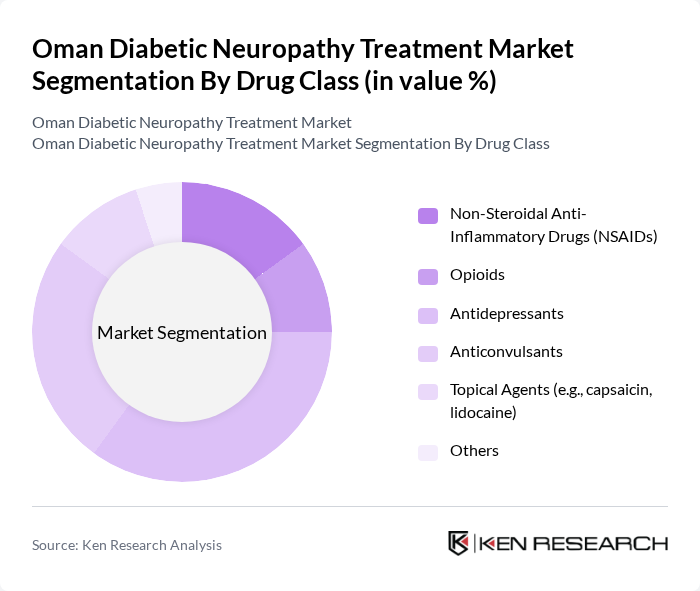

By Drug Class:The treatment market is categorized into several drug classes, including Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Opioids, Antidepressants, Anticonvulsants, Topical Agents (e.g., capsaicin, lidocaine), and Others. Antidepressants and Anticonvulsants are leading the market due to their effectiveness in managing neuropathic pain associated with diabetic neuropathy. The growing acceptance of these drug classes among healthcare providers and patients is contributing to their dominance. Additionally, the increasing focus on pain management strategies in diabetic care is further propelling the demand for these medications. Recent clinical guidelines in Oman emphasize the use of duloxetine, pregabalin, and gabapentin as first-line therapies for diabetic neuropathy.

The Oman Diabetic Neuropathy Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Medical Supplies Co. LLC, Al Nahda Medical Supplies, Muscat Pharmacy & Stores LLC, Gulf Pharmaceutical Industries (Julphar), AstraZeneca Oman, Novartis Pharmaceuticals Oman, Sanofi Oman, Pfizer Oman, Merck Sharp & Dohme (MSD) Oman, Boehringer Ingelheim Oman, Eli Lilly Oman, Bayer Oman, GlaxoSmithKline Oman, Hikma Pharmaceuticals Oman, Takeda Pharmaceuticals Oman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman diabetic neuropathy treatment market appears promising, driven by ongoing advancements in medical technology and increased healthcare investments. The government is expected to enhance healthcare infrastructure, facilitating better access to specialized care. Additionally, the integration of telemedicine and personalized treatment approaches will likely improve patient engagement and adherence to treatment plans, ultimately leading to better health outcomes for diabetic neuropathy patients in Oman.

| Segment | Sub-Segments |

|---|---|

| By Disorder Type | Peripheral Neuropathy Autonomic Neuropathy Proximal Neuropathy Focal Neuropathy |

| By Drug Class | Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Opioids Antidepressants Anticonvulsants Topical Agents (e.g., capsaicin, lidocaine) Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By End-User | Hospitals Clinics Homecare Settings Others |

| By Patient Demographics | Age Groups Gender Socioeconomic Status Others |

| By Treatment Duration | Short-term Treatments Long-term Treatments Others |

| By Geographic Distribution | Urban Areas Rural Areas Others |

| By Healthcare Provider Type | Public Healthcare Providers Private Healthcare Providers Others |

| By Insurance Coverage | Public Insurance Private Insurance Out-of-Pocket Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists | 40 | Healthcare Providers, Diabetes Specialists |

| Neurologists | 40 | Healthcare Providers, Neurology Experts |

| Pharmacists | 40 | Pharmacy Managers, Community Pharmacists |

| Diabetic Patients | 100 | Patients with Diabetic Neuropathy, Caregivers |

| Healthcare Administrators | 40 | Hospital Administrators, Policy Makers |

The Oman Diabetic Neuropathy Treatment Market is valued at approximately USD 15 million, reflecting a significant increase driven by the rising prevalence of diabetes and heightened awareness of diabetic complications among healthcare providers and patients.