Region:Global

Author(s):Shubham

Product Code:KRAD1999

Pages:83

Published On:December 2025

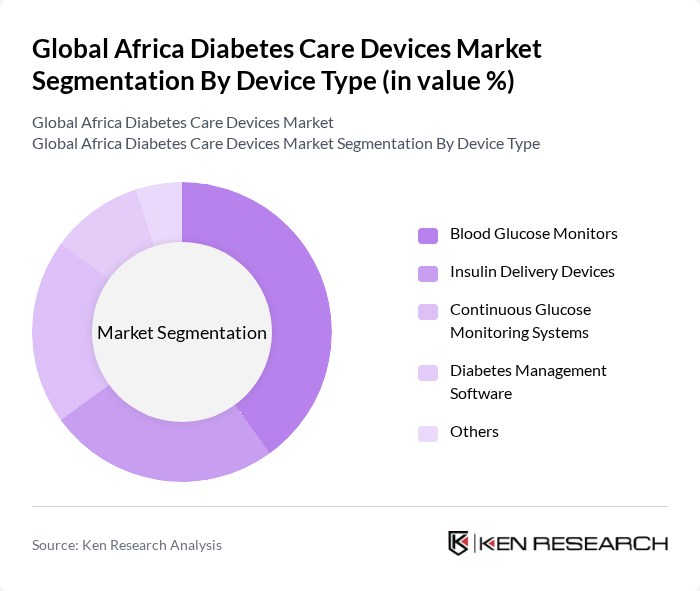

By Device Type:The market is segmented into various device types, including Blood Glucose Monitors, Insulin Delivery Devices, Continuous Glucose Monitoring Systems, Diabetes Management Software, and Others. Among these, Blood Glucose Monitors are currently the leading sub-segment due to their widespread use in both clinical and home settings. The increasing prevalence of diabetes and the need for regular monitoring are driving demand for these devices. Continuous Glucose Monitoring Systems are also gaining traction, particularly among patients seeking more advanced management solutions.(source)(source)

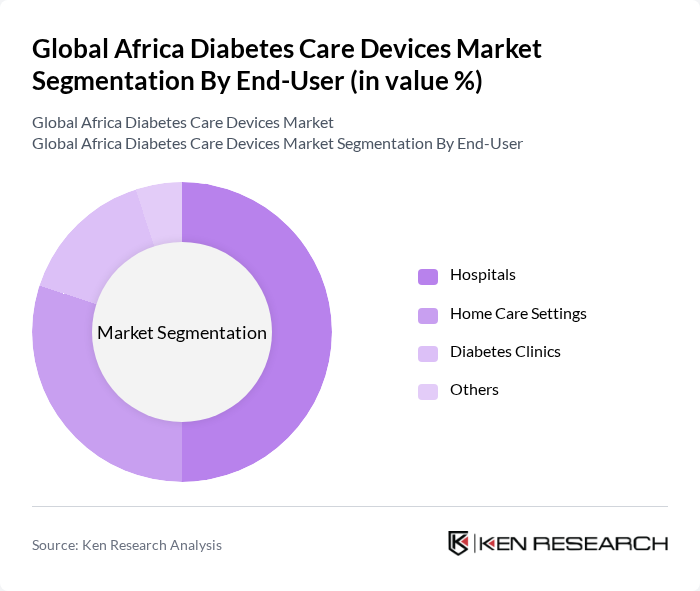

By End-User:The end-user segmentation includes Hospitals, Home Care Settings, Diabetes Clinics, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of diabetes patients requiring inpatient care and monitoring. Home care settings are also witnessing significant growth as more patients prefer managing their conditions at home with the help of advanced monitoring devices. Diabetes clinics are essential for specialized care, contributing to the overall market growth.(source)(source)

The Global Africa Diabetes Care Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Abbott Laboratories, Roche Diabetes Care, Johnson & Johnson, Novo Nordisk, Sanofi, Becton, Dickinson and Company, Ascensia Diabetes Care, Dexcom, Insulet Corporation, Ypsomed, Eli Lilly and Company, Acon Laboratories, LifeScan, and Arkray contribute to innovation, geographic expansion, and service delivery in this space.(source)

The future of the diabetes care devices market in Africa appears promising, driven by the increasing adoption of continuous glucose monitoring (CGM) systems and smart insulin delivery devices. Digital health transformation is expected to accelerate, particularly in urban areas, as telemedicine and mobile health solutions gain traction. Local manufacturing initiatives will likely enhance supply chain resilience, while strategic partnerships between multinationals and local firms will improve device availability and integration into healthcare systems.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Blood Glucose Monitors Insulin Delivery Devices Continuous Glucose Monitoring Systems Diabetes Management Software Others |

| By End-User | Hospitals Home Care Settings Diabetes Clinics Others |

| By Distribution Channel | Online Retail Pharmacies Hospitals and Clinics Direct Sales Others |

| By Region | North Africa Sub-Saharan Africa East Africa West Africa Others |

| By Age Group | Pediatric Adult Geriatric Others |

| By Income Level | Low-Income Middle-Income High-Income Others |

| By Product Features | Smart Devices Non-Smart Devices Wearable Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 150 | Endocrinologists, Diabetes Educators |

| Diabetes Patients | 120 | Type 1 and Type 2 Diabetes Patients |

| Device Manufacturers | 60 | Product Managers, R&D Heads |

| Healthcare Policy Makers | 50 | Government Officials, Health Administrators |

| Pharmacy and Distribution Channels | 40 | Pharmacy Managers, Supply Chain Coordinators |

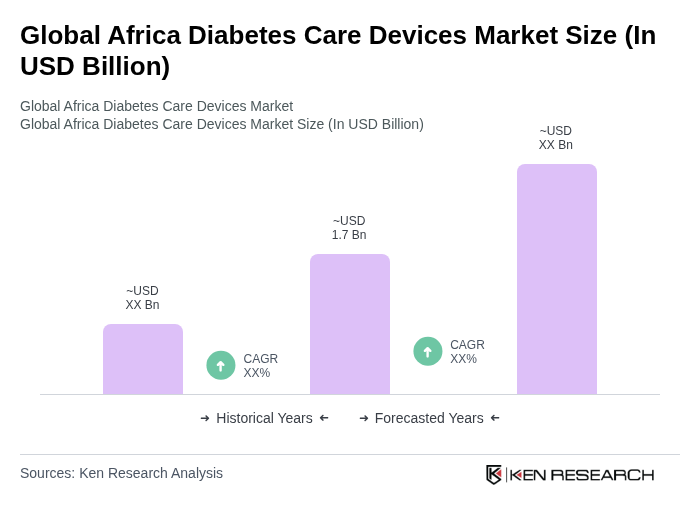

The Global Africa Diabetes Care Devices Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by increased access to continuous glucose monitoring systems and rising diabetes prevalence linked to urbanization and sedentary lifestyles.