Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6046

Pages:92

Published On:December 2025

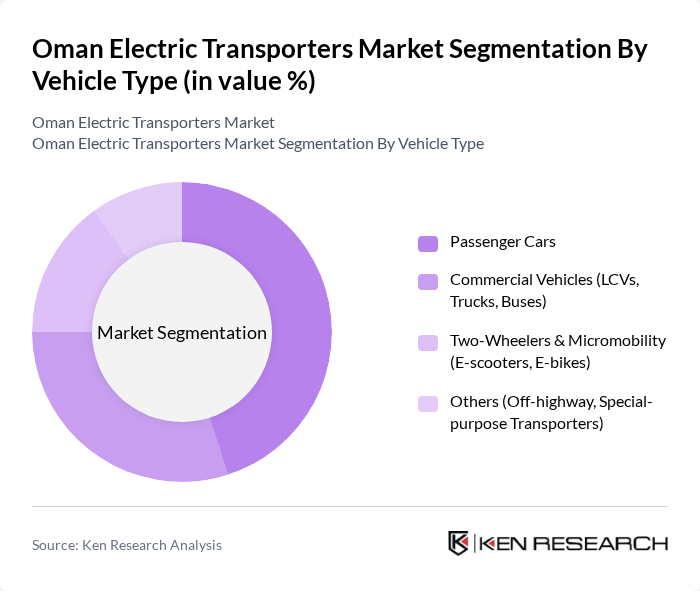

By Vehicle Type:The vehicle type segmentation includes various categories such as passenger cars, commercial vehicles, two-wheelers, and others. Among these, passenger cars are currently leading the market due to increasing consumer preference for personal electric vehicles, supported by a wider model range from global brands and an ecosystem primarily designed around passenger EVs. Commercial vehicles are also gaining traction as logistics operators, fleet owners, and public transport agencies seek to reduce operational costs and enhance sustainability through electric buses, vans, and taxis. The two-wheeler segment is witnessing gradual growth from a low base, with rising interest in e-scooters and e-bikes for short-distance commuting and micromobility, particularly in gated communities, campuses, and tourism areas.

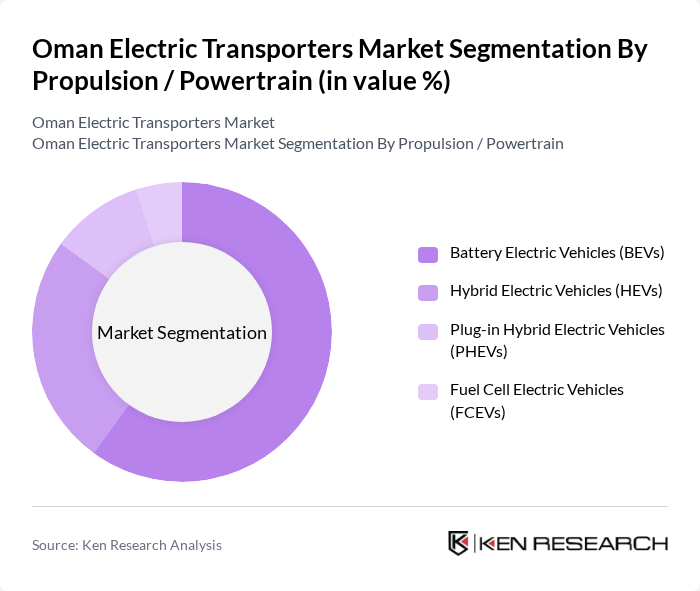

By Propulsion / Powertrain:The propulsion segment includes battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). Battery electric vehicles dominate the market due to their zero-emission capabilities, lower running costs, and advancements in battery technology and charging infrastructure, which have improved range and charging times. Hybrid electric vehicles are also popular, particularly among consumers looking for a transitional solution that combines internal combustion engines with electric drivetrains and offers flexibility where fast-charging infrastructure is still developing. The market for fuel cell electric vehicles is still emerging but holds potential for future growth in heavy-duty and long-haul applications as Oman advances its green hydrogen projects and related infrastructure.

The Oman Electric Transporters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mays Motors (Oman), Mwasalat (Oman National Transport Company), Oman Oil Marketing Company (OOMCO), Nama Group, Petroleum Development Oman (PDO), Oman Shell, Tesla, Inc., Nissan Motor Co., Ltd., Hyundai Motor Company, BMW AG, Porsche Middle East & Africa FZE, Renault Group, Ashok Leyland, Volvo Bus Corporation, CITA EV Charger contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman electric transporters market appears promising, driven by increasing government initiatives and consumer demand for sustainable solutions. As the government continues to invest in charging infrastructure and incentives, the market is likely to witness a surge in electric vehicle adoption in future. Furthermore, advancements in battery technology will enhance vehicle performance, making electric transporters more appealing. The integration of renewable energy sources will also play a crucial role in supporting this transition, fostering a cleaner transportation ecosystem in Oman.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Commercial Vehicles (LCVs, Trucks, Buses) Two-Wheelers & Micromobility (E?scooters, E?bikes) Others (Off-highway, Special-purpose Transporters) |

| By Propulsion / Powertrain | Battery Electric Vehicles (BEVs) Hybrid Electric Vehicles (HEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) |

| By End-User | Private Individual Owners Commercial Fleet Operators (Logistics, Delivery, Taxi) Government & Public-Sector Fleets Mobility Service Providers (Ride-hailing, Car-sharing) |

| By Application | Public Transport (City Buses, Staff Buses) Last-mile Delivery & Logistics Corporate & Institutional Fleets Residential & Personal Mobility |

| By Battery Type | Lithium-ion Batteries Lithium Titanate Oxide (LTO) Batteries Other Advanced Chemistries Legacy Lead-acid & Others |

| By Charging Type | AC Slow/Normal Charging DC Fast Charging Depot & Fleet Charging Destination & Public Charging |

| By Sales / Distribution Channel | OEM-authorized Dealerships Direct Importers & Independent Dealers Online & Digital Sales Platforms Corporate & Government Direct Procurement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 60 | Product Managers, Sales Directors |

| Charging Infrastructure Providers | 50 | Business Development Managers, Technical Leads |

| Government Policy Makers | 40 | Transport Policy Analysts, Environmental Officers |

| Fleet Operators | 70 | Fleet Managers, Operations Directors |

| Logistics Companies Utilizing Electric Vehicles | 60 | Logistics Managers, Sustainability Coordinators |

The Oman Electric Transporters Market is valued at approximately USD 0.2 billion, reflecting a significant growth trend driven by government initiatives, rising fuel prices, and increased consumer awareness regarding environmental sustainability.