Region:Africa

Author(s):Geetanshi

Product Code:KRAA2045

Pages:89

Published On:August 2025

By Type:The market can be segmented into various types of fleet management solutions, including GPS Tracking Solutions, Fleet Telematics, Fleet Maintenance Software, Fuel Management Systems, Driver Management Solutions, Route Optimization Tools, Video Telematics & Dashcams, Asset Tracking Solutions, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and reducing costs for fleet operators .

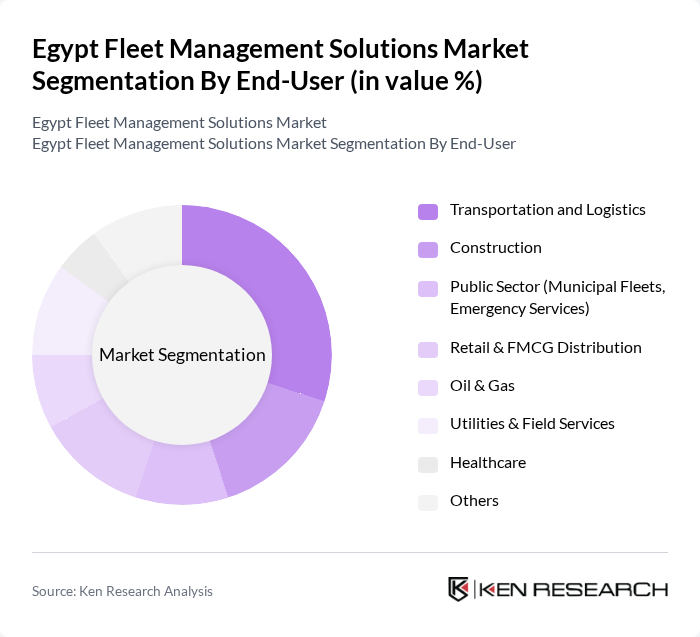

By End-User:The end-user segmentation includes various industries such as Transportation and Logistics, Construction, Public Sector (Municipal Fleets, Emergency Services), Retail & FMCG Distribution, Oil & Gas, Utilities & Field Services, Healthcare, and Others. Each sector has unique requirements and challenges that fleet management solutions address, leading to increased adoption across these industries .

The Egypt Fleet Management Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Masar Fleet, Fleet Complete, Brightskies Technologies, EgyptSat, FMS Tech (Fleet Management Systems & Technologies), Trakker Middle East, TomTom Telematics, Gurtam, Mix Telematics, Microlise, Samsara, Inseego, Verizon Connect,

The future of the Egyptian fleet management solutions market appears promising, driven by technological advancements and increasing demand for efficiency. As companies increasingly adopt cloud-based solutions and AI-driven analytics, operational efficiencies are expected to improve significantly. Additionally, the government's push for sustainable practices will likely accelerate the transition to electric vehicles, further enhancing fleet management capabilities. These trends indicate a robust growth trajectory for the market, with significant opportunities for innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking Solutions Fleet Telematics Fleet Maintenance Software Fuel Management Systems Driver Management Solutions Route Optimization Tools Video Telematics & Dashcams Asset Tracking Solutions Others |

| By End-User | Transportation and Logistics Construction Public Sector (Municipal Fleets, Emergency Services) Retail & FMCG Distribution Oil & Gas Utilities & Field Services Healthcare Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Deployment Mode | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By Geographic Coverage | Urban Areas Rural Areas National Coverage |

| By Service Type | Software as a Service (SaaS) Managed Services Consulting & Integration Services |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Freemium/Trial-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 120 | Fleet Managers, Operations Directors |

| Public Transport Fleet Solutions | 60 | Transport Authorities, Fleet Supervisors |

| Logistics and Supply Chain Fleet | 80 | Logistics Managers, Supply Chain Analysts |

| Technology Providers in Fleet Management | 40 | Product Managers, Software Developers |

| End-User Feedback on Fleet Solutions | 50 | Fleet Operators, Maintenance Managers |

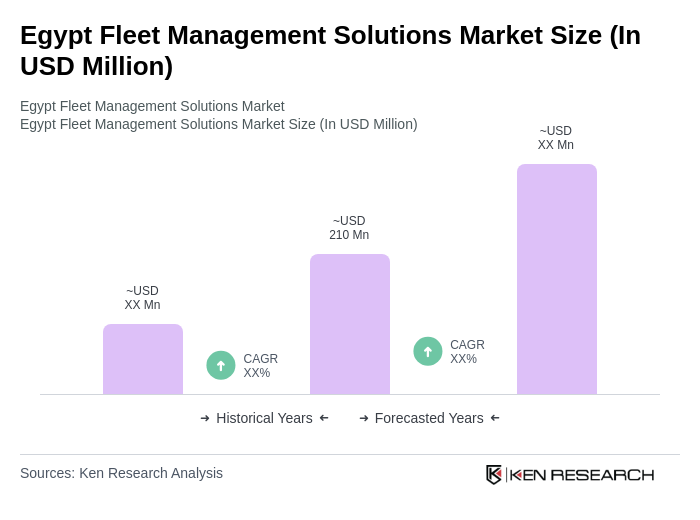

The Egypt Fleet Management Solutions Market is valued at approximately USD 210 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.