Region:Middle East

Author(s):Shubham

Product Code:KRAD5409

Pages:83

Published On:December 2025

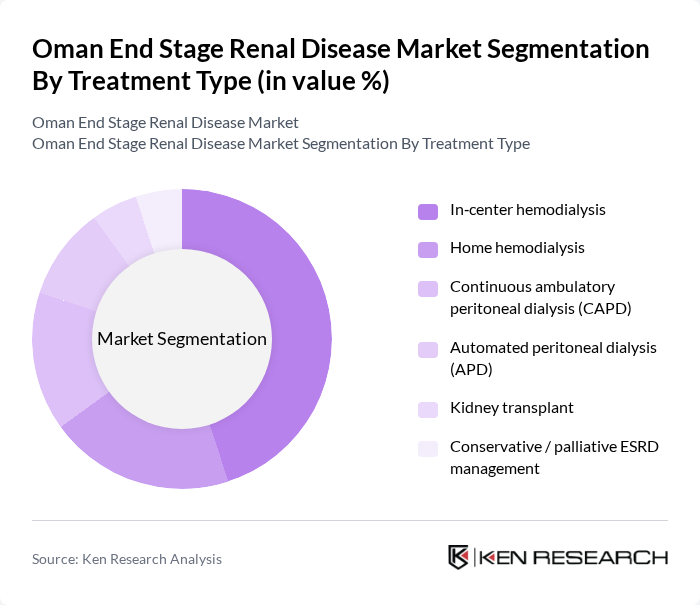

By Treatment Type:The treatment type segmentation includes various methods used to manage End Stage Renal Disease. The subsegments are In-center hemodialysis, Home hemodialysis, Continuous ambulatory peritoneal dialysis (CAPD), Automated peritoneal dialysis (APD), Kidney transplant, and Conservative/palliative ESRD management. Among these, In-center hemodialysis is the most widely adopted treatment method due to its established protocols and availability in healthcare facilities. Patients often prefer this method for its comprehensive monitoring and support from healthcare professionals.

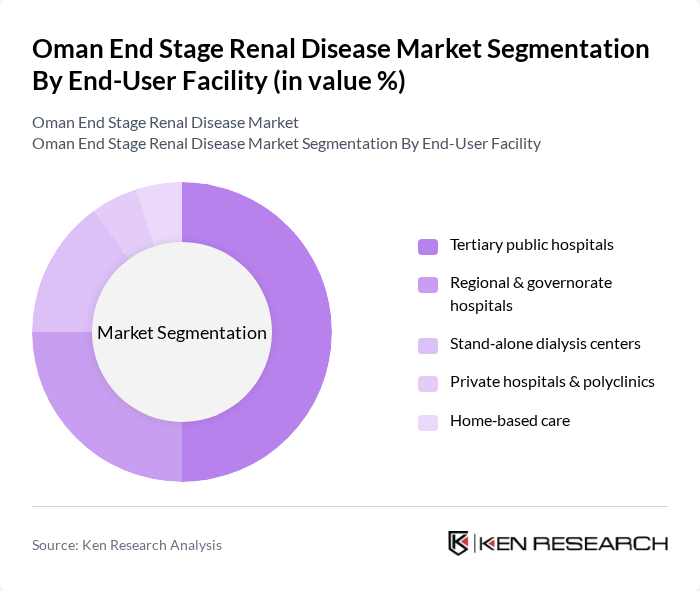

By End-User Facility:This segmentation focuses on the types of facilities providing treatment for End Stage Renal Disease. The subsegments include Tertiary public hospitals, Regional & governorate hospitals, Stand-alone dialysis centers, Private hospitals & polyclinics, and Home-based care. Tertiary public hospitals dominate this segment due to their advanced facilities and specialized staff, which are essential for managing complex cases of ESRD. The increasing number of patients seeking treatment in these hospitals further solidifies their leading position in the market.

The Oman End Stage Renal Disease market is characterized by a dynamic mix of regional and international players. Leading participants such as Royal Hospital, Muscat, Sultan Qaboos University Hospital, Khoula Hospital, Al Nahda Hospital, Al Raffah Hospital, Starcare Hospital Muscat, Burjeel Hospital, Muscat, Aster Royal Hospital, Ghubra, NMC Specialty Hospital, Al Ghoubra, Badr Al Samaa Group of Hospitals, Sohar Hospital, Ibri Regional Hospital, Rustaq Hospital, Sur Hospital, Salalah Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman end-stage renal disease market appears promising, driven by ongoing advancements in healthcare infrastructure and technology. In future, the government is expected to invest significantly in expanding renal care facilities, aiming to increase the number of dialysis centers by 25%. Additionally, the integration of telemedicine is anticipated to enhance patient monitoring and follow-up care, improving overall treatment adherence and outcomes for ESRD patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | In?center hemodialysis Home hemodialysis Continuous ambulatory peritoneal dialysis (CAPD) Automated peritoneal dialysis (APD) Kidney transplant Conservative / palliative ESRD management |

| By End-User Facility | Tertiary public hospitals Regional & governorate hospitals Stand?alone dialysis centers Private hospitals & polyclinics Home?based care |

| By Patient Demographics | Age group (Pediatric, Adult, Geriatric) Gender (Male, Female) Nationality (Omani nationals, Expatriates) |

| By Clinical Profile | Diabetic nephropathy–related ESRD Hypertensive nephrosclerosis–related ESRD Glomerulonephritis & autoimmune causes Polycystic kidney disease & genetic causes Other/unknown etiology |

| By Stage of Care Pathway | Newly initiated dialysis patients (< 12 months) Maintenance dialysis patients (>= 12 months) Patients on transplant waiting list Post?transplant follow?up patients |

| By Geographic Distribution | Muscat governorate Dhofar governorate Al Batinah (North & South) Dakhiliyah & Dhahirah Other governorates |

| By Payer & Insurance Coverage | Ministry of Health–funded patients Royal Oman Police & Armed Forces schemes Private insurance Self?pay / out?of?pocket |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dialysis Treatment Facilities | 60 | Healthcare Administrators, Dialysis Center Managers |

| Nephrology Clinics | 50 | Nephrologists, Nurse Practitioners |

| Patient Experience Surveys | 120 | ESRD Patients, Caregivers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Policy Analysts |

| Pharmaceutical and Device Suppliers | 70 | Sales Representatives, Product Managers |

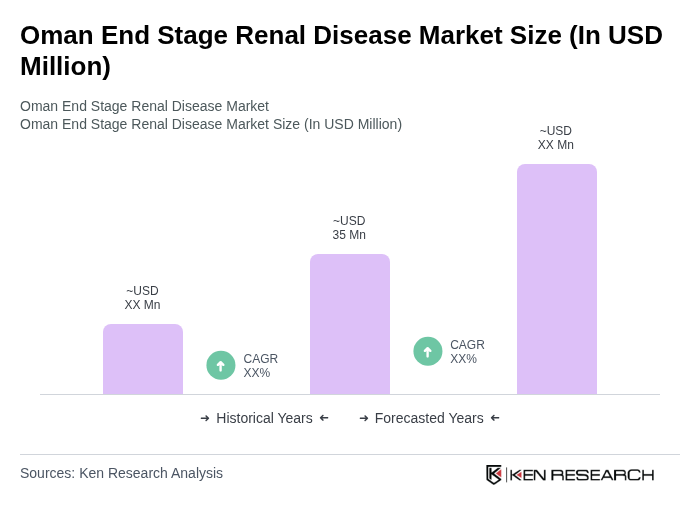

The Oman End Stage Renal Disease market is valued at approximately USD 35 million, driven by the increasing prevalence of diabetes and hypertension, along with advancements in dialysis technology and treatment options.