Region:Middle East

Author(s):Rebecca

Product Code:KRAC3893

Pages:83

Published On:October 2025

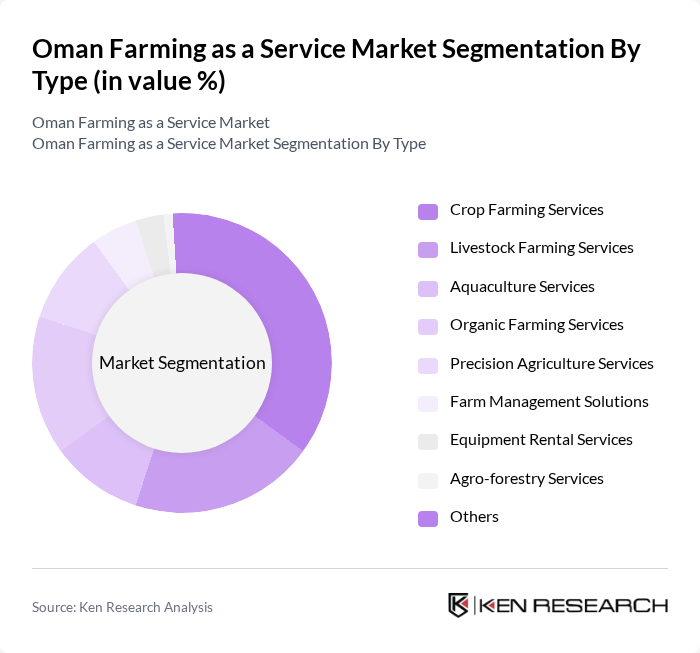

By Type:The market is segmented into various types of services that cater to different agricultural needs. The subsegments include Crop Farming Services, Livestock Farming Services, Aquaculture Services, Organic Farming Services, Precision Agriculture Services, Farm Management Solutions, Equipment Rental Services, Agro-forestry Services, and Others. Among these, Crop Farming Services are currently leading the market due to the high demand for food production, the adoption of smart irrigation and sensor-based monitoring, and the increasing focus on sustainable agricultural practices. The trend towards organic and precision farming is also gaining traction, driven by consumer preferences for healthier food options and efficient resource use, as well as government incentives for sustainable practices .

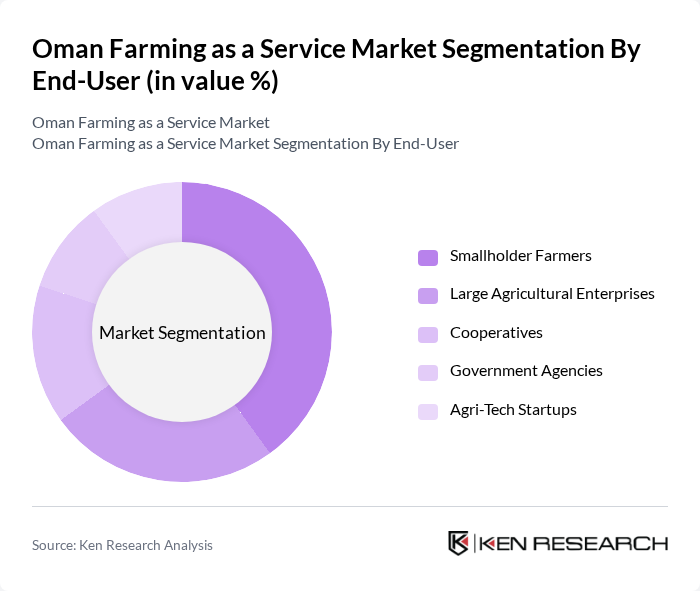

By End-User:The end-user segmentation includes Smallholder Farmers, Large Agricultural Enterprises, Cooperatives, Government Agencies, and Agri-Tech Startups. Smallholder Farmers are the dominant segment, representing a significant portion of the agricultural workforce in Oman. Their increasing reliance on farming services to enhance productivity and sustainability is driving growth in this segment. The rise of Agri-Tech Startups is fostering innovation and providing tailored solutions, including digital platforms, remote monitoring, and data-driven advisory services, to meet the specific needs of various end-users .

The Oman Farming as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Agriculture Development Company, Al-Fahd Farms, Oman Food Investment Holding Company (OFIC), Dhofar Cattle Feed Company, Al-Maha Agricultural Services, Oman Green Farms, Al-Batinah Agricultural Development, Muscat Livestock Company, Al-Sharqiya Agricultural Development, Oman Fisheries Company SAOG, Al-Dakhiliyah Agricultural Development, Al-Wusta Agricultural Services, Al-Jazira Poultry Company, Oman Organic Farming Association, Green Oasis Farms, Mazoon Dairy Company, Nakheel Oman Development Company, National Feed Company, Oman Flour Mills Company SAOG, Al Hosn Investment Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Farming as a Service market appears promising, driven by increasing investments in technology and sustainable practices. As the government continues to support agricultural innovation, the sector is likely to witness a surge in digital farming solutions and organic farming services. Additionally, the growing emphasis on food security and self-sufficiency will further propel the adoption of advanced farming techniques, positioning Oman as a competitive player in the regional agricultural landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Crop Farming Services Livestock Farming Services Aquaculture Services Organic Farming Services Precision Agriculture Services Farm Management Solutions Equipment Rental Services Agro-forestry Services Others |

| By End-User | Smallholder Farmers Large Agricultural Enterprises Cooperatives Government Agencies Agri-Tech Startups |

| By Application | Crop Production Livestock Management Aquaculture Management Soil Management Irrigation Management |

| By Distribution Mode | Direct Sales Online Platforms Retail Outlets Subscription Services |

| By Investment Source | Private Investments Government Grants International Aid |

| By Policy Support | Subsidies Tax Incentives Research Grants |

| By Technology Integration | IoT Solutions Data Analytics Automation Technologies Drones & Remote Sensing Artificial Intelligence |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers Using FaaS | 100 | Farm Owners, Agricultural Workers |

| Agricultural Technology Providers | 60 | Product Managers, Business Development Executives |

| Government Agricultural Officials | 50 | Policy Makers, Program Coordinators |

| Cooperative Farming Groups | 50 | Cooperative Leaders, Member Farmers |

| Research Institutions Focused on Agriculture | 40 | Researchers, Agronomists |

The Oman Farming as a Service market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by advanced technologies, food security demands, and government initiatives aimed at enhancing agricultural productivity.