Region:Middle East

Author(s):Rebecca

Product Code:KRAD4224

Pages:97

Published On:December 2025

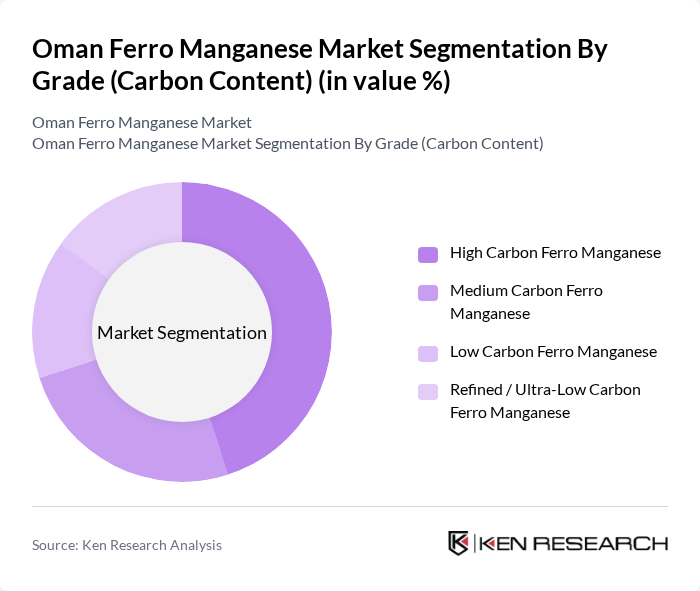

By Grade (Carbon Content):The market is segmented based on the carbon content of ferro manganese, which includes High Carbon Ferro Manganese, Medium Carbon Ferro Manganese, Low Carbon Ferro Manganese, and Refined / Ultra-Low Carbon Ferro Manganese. High Carbon Ferro Manganese is the leading subsegment due to its extensive use in carbon and construction steelmaking, where it serves as a key deoxidizer and alloying agent in long products and rebar. The demand for this grade is driven by growing crude steel and rebar production in Oman and the wider Middle East, which is essential for infrastructure, energy, and industrial development.

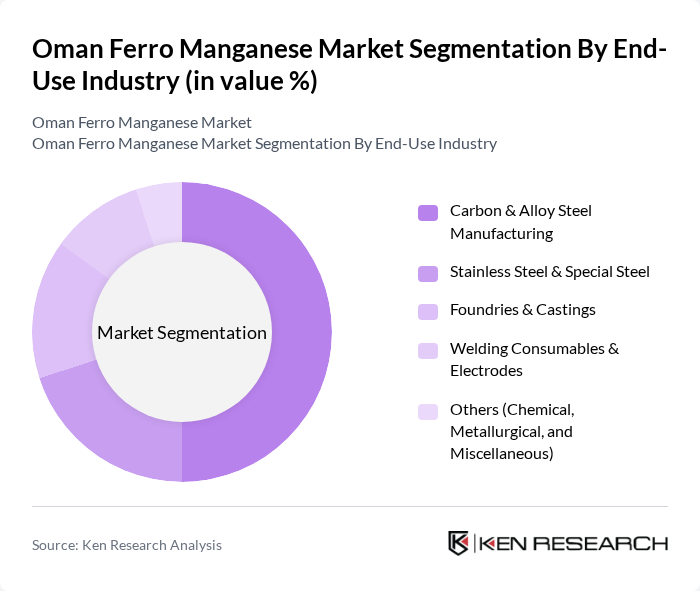

By End-Use Industry:The ferro manganese market is also segmented by end-use industries, which include Carbon & Alloy Steel Manufacturing, Stainless Steel & Special Steel, Foundries & Castings, Welding Consumables & Electrodes, and Others (Chemical, Metallurgical, and Miscellaneous). The Carbon & Alloy Steel Manufacturing segment holds the largest market share, driven by the increasing demand for construction steel, long products, and engineering steels in infrastructure, oil and gas, and industrial projects in Oman and the GCC. This trend is further supported by the expansion and modernization of steel and rolling facilities in Oman, which use ferro manganese as a critical input in melt shops and ladle metallurgy.

The Oman Ferro Manganese Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Mining Materials Co. LLC, Oman Ferro Alloys LLC (Sohar), Al Tamman Indsil Ferro Chrome LLC, Al Jazeera Steel Products Co. SAOG, Sohar Steel Group (formerly Majees Technical Services LLC), Muscat Overseas Group, Oman Mining Development Company LLC, Majan Mining Company LLC, Oman Chromite Company SAOG, Oman National Investments Development Company (TANMIA), Oman Cables Industry SAOG, Jindal Shadeed Iron & Steel LLC, Vale Oman Pelletizing Company LLC, Sohar Port and Freezone, Special Economic Zone Authority at Duqm (SEZAD) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman ferro manganese market is poised for growth, driven by increasing demand from the steel industry and government initiatives aimed at industrial expansion. As mining operations expand and technological advancements in production processes emerge, the market is likely to see enhanced efficiency and reduced costs. However, challenges such as fluctuating raw material prices and stringent environmental regulations will require strategic management. Overall, the market is expected to adapt and thrive in the evolving economic landscape of Oman.

| Segment | Sub-Segments |

|---|---|

| By Grade (Carbon Content) | High Carbon Ferro Manganese Medium Carbon Ferro Manganese Low Carbon Ferro Manganese Refined / Ultra-Low Carbon Ferro Manganese |

| By End-Use Industry | Carbon & Alloy Steel Manufacturing Stainless Steel & Special Steel Foundries & Castings Welding Consumables & Electrodes Others (Chemical, Metallurgical, and Miscellaneous) |

| By Functional Application | Alloying Element Additive Deoxidizer Desulfurizer Casting & Foundry Applications Others |

| By Sales Channel | Direct Sales to Steel Mills & Large End-Users Traders & Distributors Long-Term Offtake / Supply Agreements Spot & Short-Term Contracts |

| By Region in Oman | Muscat Sohar (incl. Sohar Port & Freezone) Salalah (incl. Salalah Free Zone) Duqm (incl. Special Economic Zone at Duqm) Other Governorates |

| By Production / Sourcing Mode | Domestic Smelting (Electric Arc / Submerged Arc Furnaces) Toll Smelting & Processing Arrangements Imports for Domestic Consumption Re-exports via Ports & Free Zones |

| By Quality / Specification | Standard Metallurgical Grade Low-Phosphorus / Low-Impurity Grade Customized Grades for Specialty Steel & Foundry |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ferro Manganese Producers | 60 | Production Managers, Operations Directors |

| Steel Manufacturers | 70 | Procurement Managers, Metallurgists |

| Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

| Logistics and Distribution Firms | 50 | Logistics Managers, Supply Chain Coordinators |

| Market Analysts and Consultants | 45 | Market Researchers, Economic Analysts |

The Oman Ferro Manganese Market is valued at approximately USD 45 million, driven by increasing demand for ferro alloys in steel production, particularly in the construction and automotive sectors, supported by ongoing industrialization and investments in Oman.