Region:North America

Author(s):Geetanshi

Product Code:KRAD4126

Pages:87

Published On:December 2025

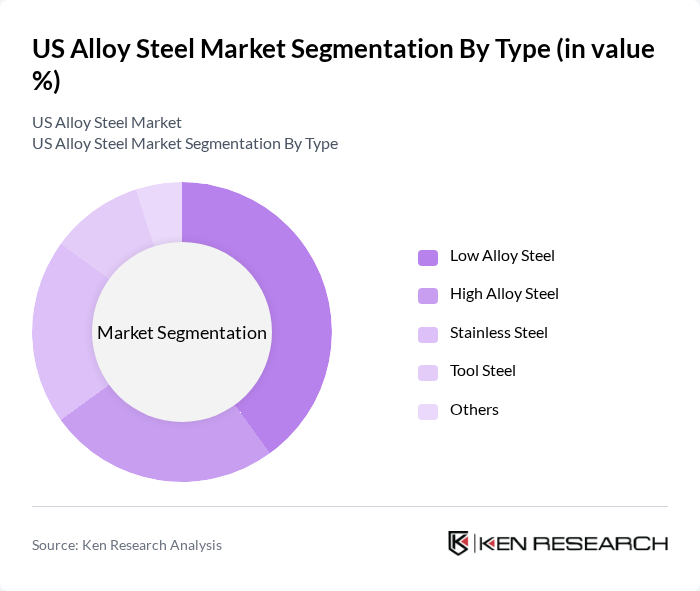

By Type:The alloy steel market is segmented into various types, including Low Alloy Steel, High Alloy Steel, Stainless Steel, Tool Steel, and Others. Among these, Low Alloy Steel is currently the dominant segment due to its versatility and cost-effectiveness, making it a preferred choice in automotive and construction applications. High Alloy Steel follows closely, driven by its superior corrosion resistance and strength, particularly in specialized applications like aerospace and oil & gas. The demand for Stainless Steel is also significant, especially in consumer goods and kitchenware, while Tool Steel is favored in manufacturing processes requiring high durability.

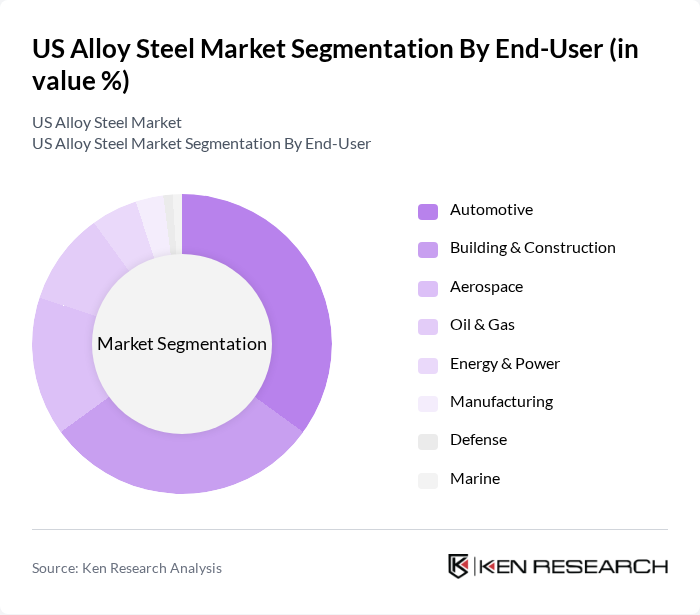

By End-User:The end-user segmentation includes Automotive, Building & Construction, Aerospace, Oil & Gas, Energy & Power, Manufacturing, Defense, and Marine. The Automotive sector is the leading end-user, driven by the need for lightweight yet strong materials to enhance fuel efficiency and safety. Building & Construction follows, as alloy steel is essential for structural integrity in various projects. The Aerospace and Oil & Gas sectors also contribute significantly, requiring high-performance materials that can withstand extreme conditions. Manufacturing and Defense sectors are growing, with increasing investments in advanced technologies and infrastructure.

The US Alloy Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nucor Corporation, Cleveland-Cliffs Inc. (AK Steel), United States Steel Corporation, ArcelorMittal USA, Carpenter Technology Corporation, Allegheny Technologies Incorporated, TimkenSteel Corporation, Commercial Metals Company, Worthington Industries, Inc., V&M Star, SSAB Americas, Schnitzer Steel Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US alloy steel market is poised for significant transformation driven by sustainability initiatives and technological advancements. As industries increasingly prioritize eco-friendly practices, the demand for recycled alloy steel is expected to rise in future, aligning with the circular economy trend. Additionally, innovations in lightweight alloys will cater to the automotive and aerospace sectors, enhancing performance while reducing environmental impact. These trends indicate a robust future for the alloy steel market, with opportunities for growth and adaptation in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Low Alloy Steel High Alloy Steel Stainless Steel Tool Steel Others |

| By End-User | Automotive Building & Construction Aerospace Oil & Gas Energy & Power Manufacturing Defense Marine |

| By Application | Structural Components Machinery Parts Automotive Components Tooling Powertrain Components Others |

| By Manufacturing Process | Hot Rolling Cold Rolling Forging Casting Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Northeast Midwest South West Others |

| By Product Form | Bars and Rods Sheets and Plates Tubes and Pipes Wire Flat Products Longs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Alloy Steel Usage | 110 | Procurement Managers, Design Engineers 9 |

| Construction Industry Applications | 85 | Project Managers, Structural Engineers 9 |

| Manufacturing Sector Demand | 95 | Operations Managers, Supply Chain Analysts 9 |

| Energy Sector Alloy Steel Requirements | 75 | Technical Directors, Material Scientists 9 |

| Research and Development Insights | 65 | R&D Managers, Innovation Leads 7 |

The US Alloy Steel Market is valued at approximately USD 30 billion, reflecting a five-year historical analysis. This valuation is driven by increasing demand from sectors such as automotive, construction, and manufacturing, which require high-strength materials for enhanced performance and durability.