Oman Fitness Tracker Market Overview

- The Oman Fitness Tracker Market is valued at USD 55 million, based on a five-year historical analysis and normalization from regional digital fitness and wearable device data. This growth is primarily driven by increasing health consciousness among the population, the rise of digital health technologies, and a growing trend towards fitness and wellness activities. The demand for fitness trackers has surged as consumers seek to monitor their health metrics and improve their overall fitness levels. Key market drivers include the proliferation of wearable health devices, integration with smartphones, and the adoption of advanced health monitoring features such as ECG and SpO2 tracking .

- Muscat, the capital city, is a dominant player in the Oman Fitness Tracker Market due to its urban population's increasing disposable income and awareness of health and fitness. Other cities like Salalah and Sohar are also contributing to market growth, driven by a younger demographic that is more inclined towards adopting technology for health monitoring. The expansion of fitness centers and wellness programs in these urban areas further supports market development .

- In 2023, the Omani government implemented the “National Strategy for Noncommunicable Diseases, 2020–2030” issued by the Ministry of Health, which includes operational targets for increasing physical activity and promoting healthy lifestyles. This strategy supports initiatives such as public health campaigns, subsidies for fitness-related products, and the integration of digital health monitoring—including fitness trackers—into preventive healthcare programs. Compliance requirements include reporting and monitoring of physical activity indicators at the national level .

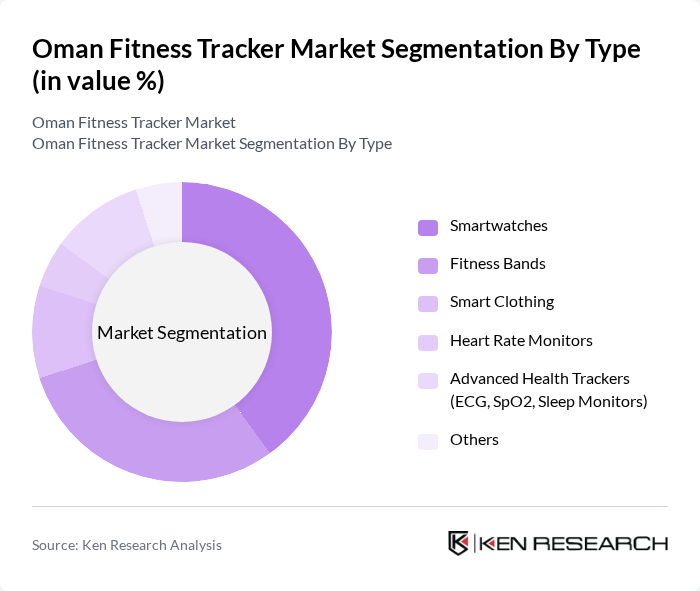

Oman Fitness Tracker Market Segmentation

By Type:The market is segmented into various types of fitness trackers, including smartwatches, fitness bands, smart clothing, heart rate monitors, advanced health trackers (ECG, SpO2, sleep monitors), and others. Among these, smartwatches and fitness bands are the most popular due to their multifunctionality, ease of use, and integration with mobile health apps. The trend towards wearable technology, particularly devices with advanced health monitoring and longer battery life, has led to a significant increase in adoption, especially among tech-savvy and health-conscious consumers .

By End-User:The end-user segmentation includes individual consumers, corporate wellness programs, healthcare providers, fitness centers, government and public sector initiatives, and others. Individual consumers dominate the market, driven by the increasing trend of personal health management and fitness tracking. Corporate wellness programs are also gaining traction as companies invest in employee health and productivity, while healthcare providers are increasingly leveraging wearable data for preventive care and remote monitoring .

Oman Fitness Tracker Market Competitive Landscape

The Oman Fitness Tracker Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fitbit Inc., Garmin Ltd., Apple Inc., Samsung Electronics Co., Ltd., Xiaomi Corporation, Huawei Technologies Co., Ltd., Polar Electro Oy, Suunto Oy, Withings SA, Zepp Health Corporation (Amazfit), Whoop Inc., Honor Device Co., Ltd., Misfit (Fossil Group, Inc.), TomTom International BV, Jabra (GN Audio A/S), Realme (Realme Chongqing Mobile Telecommunications Corp., Ltd.), Oppo (Guangdong Oppo Mobile Telecommunications Corp., Ltd.), Noise (Gonoise), boAt (Imagine Marketing Limited) contribute to innovation, geographic expansion, and service delivery in this space.

Oman Fitness Tracker Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The health awareness in Oman has surged, with 72% of the population actively seeking ways to improve their well-being. The World Health Organization reported that chronic diseases account for 72% of deaths in Oman, prompting citizens to adopt healthier lifestyles. This shift has led to a growing demand for fitness trackers, which provide users with real-time health data, encouraging proactive health management and lifestyle changes.

- Rise in Fitness Enthusiasts:The number of fitness enthusiasts in Oman has increased significantly, with over 35% of the population engaging in regular physical activities. According to the Oman Ministry of Sports Affairs, participation in fitness programs has risen by 25% in the last two years. This trend is driving the demand for fitness trackers, as individuals seek tools to monitor their progress and enhance their workout experiences, contributing to market growth.

- Technological Advancements:The rapid advancement of technology has made fitness trackers more accessible and feature-rich. In future, the average price of fitness trackers is projected to decrease by 15%, making them more affordable for consumers. Enhanced features such as heart rate monitoring, GPS tracking, and sleep analysis are attracting tech-savvy consumers. This technological evolution is expected to boost adoption rates, further propelling market growth in Oman.

Market Challenges

- High Price Sensitivity:Oman’s fitness tracker market faces significant price sensitivity, with 45% of consumers indicating that cost is a primary factor in their purchasing decisions. The average disposable income in Oman is approximately $19,000, which limits the ability of many consumers to invest in higher-end fitness trackers. This challenge necessitates manufacturers to offer a range of products at various price points to cater to different consumer segments.

- Limited Consumer Awareness:Despite the growing interest in fitness, consumer awareness regarding the benefits of fitness trackers remains low, with only 35% of the population familiar with their functionalities. A report by the Oman Consumer Protection Authority indicates that many potential users are unaware of how these devices can enhance their fitness journeys. This lack of awareness poses a challenge for market penetration and necessitates targeted marketing efforts to educate consumers.

Oman Fitness Tracker Market Future Outlook

The Oman fitness tracker market is poised for significant growth, driven by increasing health consciousness and technological innovations. As more consumers prioritize fitness, the integration of advanced features in trackers will enhance user engagement. Additionally, partnerships with local gyms and health organizations will likely promote product adoption. The market is expected to evolve with a focus on personalized health solutions, catering to the unique needs of Omani consumers, thereby fostering a more health-oriented society.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Oman presents a significant opportunity for fitness tracker sales. With online retail expected to increase by 20% in future, brands can leverage digital platforms to reach a broader audience. This shift allows for targeted marketing strategies and improved customer engagement, ultimately driving sales and brand loyalty in the fitness tracker segment.

- Collaborations with Fitness Centers:Collaborating with local fitness centers can enhance brand visibility and credibility. In future, over 50 new fitness centers are projected to open in Oman, providing an ideal platform for fitness tracker brands to showcase their products. Such partnerships can facilitate product trials and demonstrations, encouraging consumers to adopt fitness trackers as part of their fitness routines.