Region:Asia

Author(s):Shubham

Product Code:KRAD0886

Pages:87

Published On:December 2025

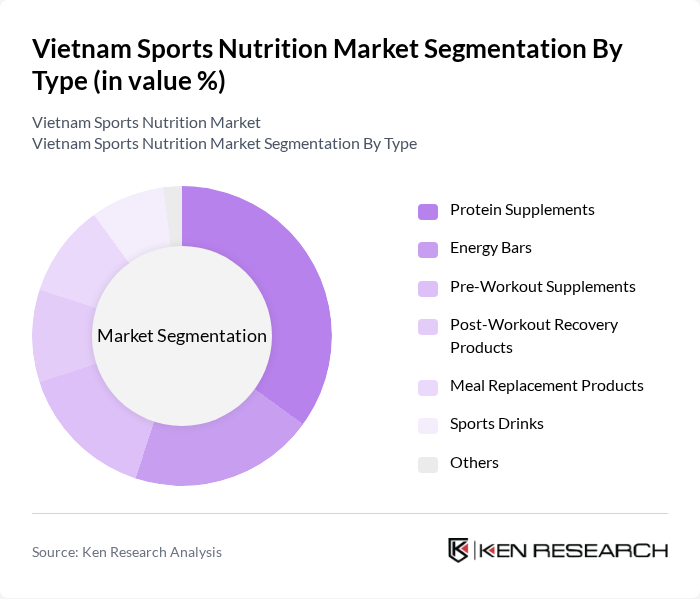

By Type:The sports nutrition market in Vietnam is segmented into various types, including protein supplements, energy bars, pre-workout supplements, post-workout recovery products, meal replacement products, sports drinks, and others. This aligns with the broader categorization in Vietnam’s nutraceuticals and sports nutrition industry, which highlights protein powders, sports drinks, and dietary supplements as key product groups used for performance, recovery, and general wellness. Among these, protein supplements dominate the market due to their essential role in muscle recovery and growth, particularly among athletes, gym-goers, and fitness enthusiasts, and this is supported by strong revenue growth in protein powder sales in Vietnam. The increasing trend of fitness, bodybuilding, and weight management has led to a surge in demand for these products, making them a staple in the diets of health-conscious consumers who are seeking convenient, high-protein options.

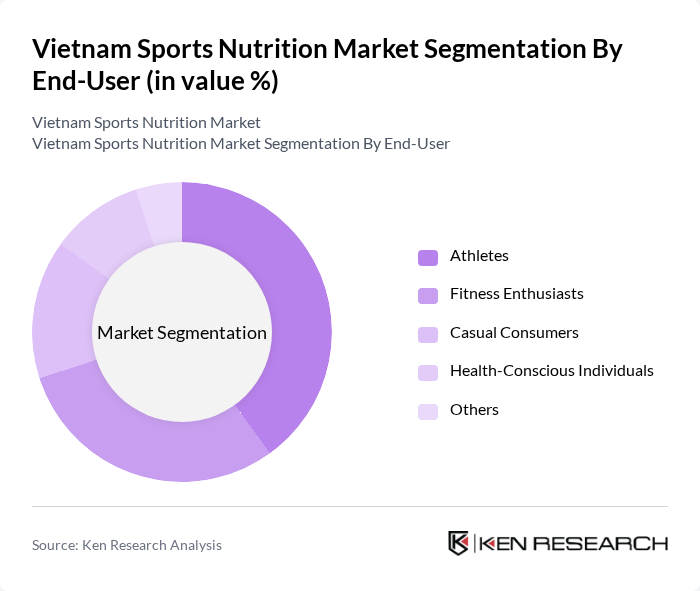

By End-User:The end-user segmentation of the sports nutrition market includes athletes, fitness enthusiasts, casual consumers, health-conscious individuals, and others. Athletes represent the largest segment, driven by their need for specialized nutrition to enhance performance and recovery, aligning with the strong demand for performance-oriented supplements observed in Vietnam’s sports nutrition outlook. This segment is followed closely by fitness enthusiasts who are increasingly adopting protein powders, energy products, and pre-workout supplements to support their active lifestyles, reflecting the rapid growth of gyms and organized fitness activities in major cities. The growing awareness of health and fitness among the general population is also contributing to the rise of casual consumers and health-conscious individuals who use sports nutrition products for weight management, energy, and general wellness.

The Vietnam Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutifood, Herbalife Vietnam, Max Protein, MuscleTech, Optimum Nutrition, Isagenix, Bodybuilding.com, GNC Vietnam, Quest Nutrition, MyProtein, BSN, Dymatize, Scivation, EAS Sports Nutrition, and ProMix Nutrition contribute to innovation, geographic expansion, and service delivery in this space, while broader nutraceutical and sports nutrition analyses for Vietnam also highlight Nutifood, Herbalife, Abbott, Amway, and GNC among the prominent brands serving performance and wellness-oriented consumers.

The Vietnam sports nutrition market is poised for significant growth driven by the ongoing digital transformation and increasing consumer health awareness. With the digital economy projected to expand further, e-commerce will likely become a dominant channel for sports nutrition products. Additionally, government initiatives aimed at improving infrastructure and combating counterfeit products will enhance market conditions, fostering a more trustworthy environment for consumers and businesses alike, ultimately leading to increased market participation and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Energy Bars Pre-Workout Supplements Post-Workout Recovery Products Meal Replacement Products Sports Drinks Others |

| By End-User | Athletes Fitness Enthusiasts Casual Consumers Health-Conscious Individuals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Gyms and Fitness Centers Pharmacies Others |

| By Packaging Type | Bottles Sachets Tubs Cans Others |

| By Ingredient Source | Animal-Based Plant-Based Synthetic Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Professional Athletes | 80 | Elite athletes across various sports disciplines |

| Fitness Enthusiasts | 120 | Regular gym-goers and fitness program participants |

| Nutritionists and Dietitians | 60 | Certified nutrition professionals with sports specialization |

| Sports Coaches | 50 | Coaches from schools, colleges, and professional teams |

| Health and Wellness Influencers | 40 | Social media influencers focused on fitness and nutrition |

The Vietnam Sports Nutrition Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing health consciousness, a booming fitness culture, and enhanced e-commerce accessibility across urban areas.