Region:Middle East

Author(s):Rebecca

Product Code:KRAD4952

Pages:86

Published On:December 2025

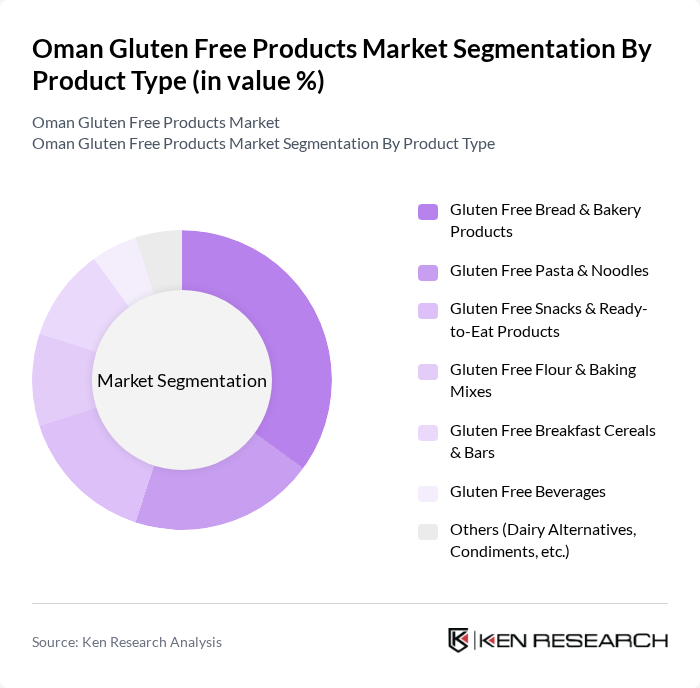

By Product Type:The product type segmentation includes various categories such as gluten-free bread and bakery products, pasta and noodles, snacks and ready-to-eat products, flour and baking mixes, breakfast cereals and bars, beverages, and others like dairy alternatives and condiments. This structure is consistent with global and regional gluten-free product classifications, where key segments comprise bakery, pasta and ready meals, snacks, and baby food or cereals. Among these, gluten-free bread and bakery products dominate the market due to their essential role in daily diets and the increasing demand for healthier alternatives, reflecting the broader trend that bakery products account for around one?third of gluten-free food value worldwide. Consumers are increasingly seeking gluten-free options for both health reasons and lifestyle choices, leading to a surge in product innovation such as gluten-free bread, cakes, cookies, and cereals, and greater availability across mainstream retail.

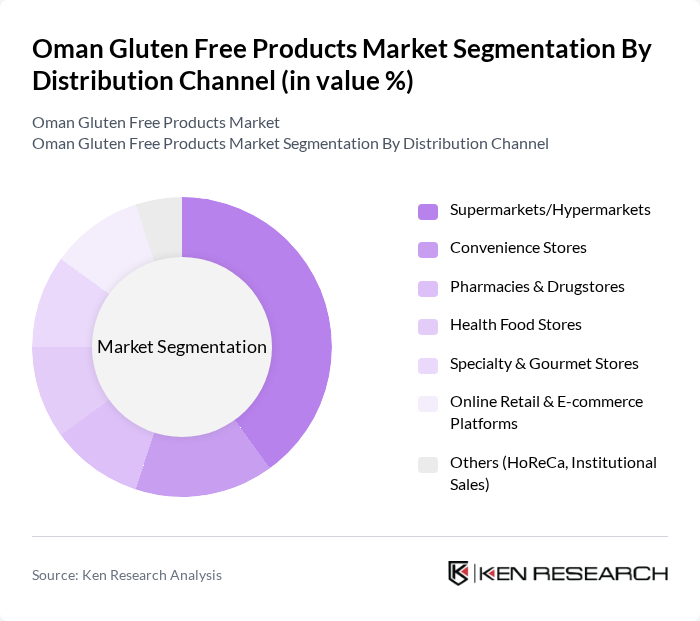

By Distribution Channel:The distribution channel segmentation encompasses supermarkets/hypermarkets, convenience stores, pharmacies and drugstores, health food stores, specialty and gourmet stores, online retail and e-commerce platforms, and others such as HoReCa and institutional sales. This aligns with the broader GCC gluten-free food products market, where hypermarkets and supermarkets dominate due to wide assortments and strong visibility, while online platforms and specialty retailers are gaining share. Supermarkets and hypermarkets lead this segment due to their extensive reach, frequent promotions, and dedicated health and free?from sections that make gluten-free products easier to find for consumers. The growing trend of online shopping in the Middle East, supported by grocery apps and omni-channel retailers, is also contributing to the expansion of e-commerce platforms, making gluten-free products more accessible to a broader audience and enabling better access to imported specialty brands.

The Oman Gluten Free Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Flour Mills Company SAOG (Al Farina, Sunwhite & related brands), Atyab Food Industries LLC (Oman Flour Mills Group), Khimji Ramdas LLC (FMCG & Food Distribution Division), Al Maya Group (Food Distribution – Oman Operations), Carrefour Oman (Majid Al Futtaim Retail LLC), LuLu Hypermarket Oman (EMKE Group), Al Meera Consumer Goods (GCC Retail – Oman Presence via Distribution Partners), Nestlé Middle East FZE – Oman Operations, Dr. Schär AG / SPA – Middle East & Oman Distribution, General Mills Inc. – Oman (Betty Crocker & Gluten Free Range), Barilla G. e R. Fratelli S.p.A. – Gluten Free Pasta in Oman, Schar / Gluten Free Bakery Brands via Local Importers, Marks & Spencer Food – Gluten Free Range in Oman, Local Health & Organic Stores (e.g., Al Safeer Health Food, Muscat), Key Online Grocery Platforms in Oman (e.g., Talabat Mart, Lulu Webstore) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gluten-free products market in Oman appears promising, driven by increasing health awareness and a growing consumer base seeking gluten-free options. Innovations in product development, particularly in plant-based alternatives, are expected to attract a broader audience. Additionally, the rise of e-commerce platforms will facilitate easier access to gluten-free products, enhancing market reach. As consumer preferences evolve, brands that adapt to these trends will likely thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gluten Free Bread & Bakery Products Gluten Free Pasta & Noodles Gluten Free Snacks & Ready-to-Eat Products Gluten Free Flour & Baking Mixes Gluten Free Breakfast Cereals & Bars Gluten Free Beverages Others (Dairy Alternatives, Condiments, etc.) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Pharmacies & Drugstores Health Food Stores Specialty & Gourmet Stores Online Retail & E-commerce Platforms Others (HoReCa, Institutional Sales) |

| By Consumer Demographics | Medical Need (Celiac Disease, Gluten Intolerance) Lifestyle Users (Health & Wellness Focused) Expatriates Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Others |

| By Packaging Type | Retail Packs (?1 kg / ?1 L) Family Packs (>1 kg / >1 L) On-the-go / Single-Serve Packs Bulk & Foodservice Packaging Others |

| By Region | Muscat Governorate Dhofar (incl. Salalah) Al Batinah (North & South, incl. Sohar) Ad Dakhiliyah (incl. Nizwa) Other Governorates (Al Sharqiyah, Al Wusta, Musandam, etc.) |

| By Price Range | Premium Mid-Range Economy Private Label / Value Packs |

| By Brand Type | International Branded Products Regional GCC Brands Private Label & In-store Bakery Niche & Organic / Health Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Gluten-Free Products | 120 | Store Managers, Product Buyers |

| Health and Wellness Professionals | 90 | Dietitians, Nutritionists |

| Consumer Insights on Gluten-Free Diets | 150 | Health-Conscious Consumers, Gluten-Intolerant Individuals |

| Manufacturers of Gluten-Free Products | 80 | Production Managers, Quality Assurance Officers |

| Distributors and Wholesalers | 70 | Logistics Coordinators, Sales Representatives |

The Oman Gluten Free Products Market is valued at approximately USD 50 million, reflecting its growth as a smaller yet significant contributor within the GCC gluten-free food market, which is estimated at USD 145150 million.