Region:Asia

Author(s):Shubham

Product Code:KRAA4966

Pages:90

Published On:September 2025

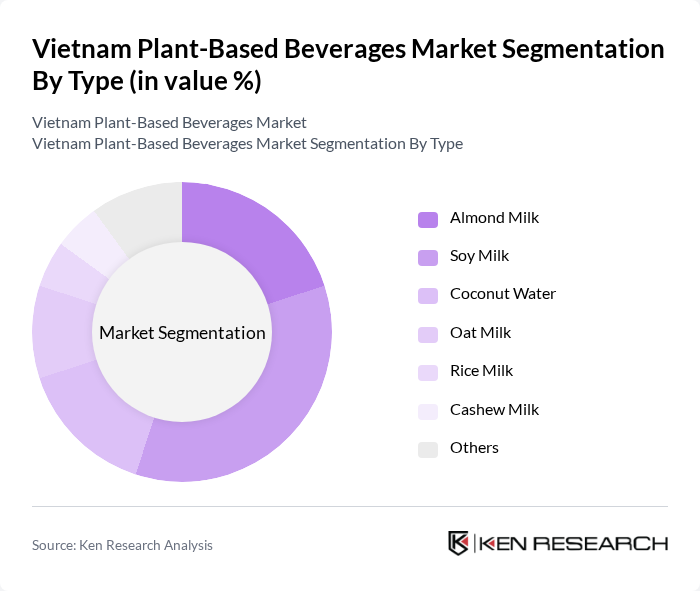

By Type:The plant-based beverages market is segmented into various types, including almond milk, soy milk, coconut water, oat milk, rice milk, cashew milk, and others. Among these, soy milk has emerged as the leading sub-segment due to its high protein content and versatility in culinary applications. The growing trend of lactose intolerance awareness has also contributed to the increasing preference for soy milk over traditional dairy options. Almond milk and coconut water are gaining traction as well, particularly among health-conscious consumers seeking low-calorie and nutrient-rich alternatives.

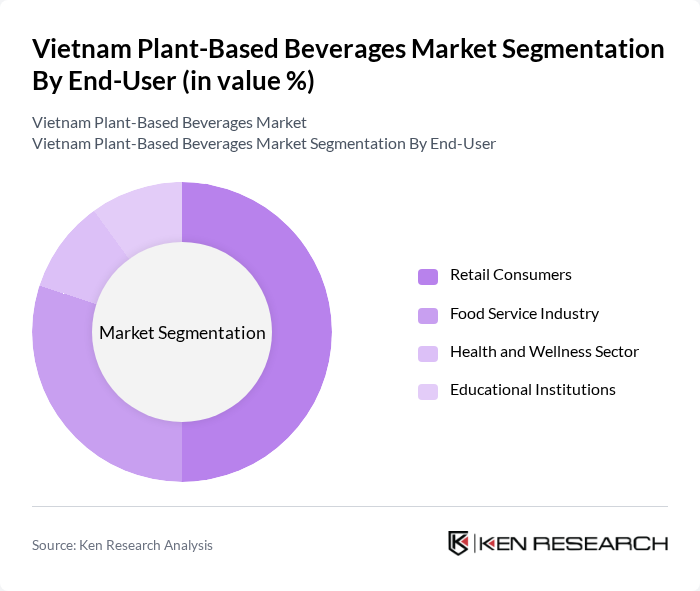

By End-User:The end-user segmentation includes retail consumers, the food service industry, the health and wellness sector, and educational institutions. Retail consumers represent the largest segment, driven by the increasing availability of plant-based beverages in supermarkets and online platforms. The food service industry is also a significant contributor, as cafes and restaurants increasingly offer plant-based options to cater to health-conscious diners. The health and wellness sector is witnessing a rise in demand for these beverages as part of a holistic approach to nutrition.

The Vietnam Plant-Based Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as TH True Milk, Nutifood, Vinasoy, FrieslandCampina Vietnam, Coca-Cola Vietnam, PepsiCo Vietnam, Ovaltine Vietnam, Foco, Vinamilk, TH Group, Green Farm, Nutrafol, Herbalife Vietnam, Organiq, An Phat Holdings contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam plant-based beverages market appears promising, driven by increasing health consciousness and sustainability trends. As consumer preferences shift, brands are likely to innovate with new flavors and formulations, catering to the growing demand for functional beverages. Additionally, the expansion of e-commerce will facilitate greater access to these products, enhancing market penetration. With ongoing government support for sustainable practices, the sector is poised for significant growth, potentially transforming the beverage landscape in Vietnam by the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Almond Milk Soy Milk Coconut Water Oat Milk Rice Milk Cashew Milk Others |

| By End-User | Retail Consumers Food Service Industry Health and Wellness Sector Educational Institutions |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Health Food Stores |

| By Packaging Type | Tetra Packs Glass Bottles Plastic Bottles Cans |

| By Flavor | Original Chocolate Vanilla Fruit Infusions |

| By Price Range | Premium Mid-Range Budget |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Plant-Based Beverages | 150 | Health-conscious Consumers, Millennials, Parents |

| Retail Distribution Channels for Plant-Based Products | 100 | Retail Managers, Category Buyers, Store Owners |

| Market Trends in Health and Wellness | 80 | Nutritionists, Fitness Trainers, Wellness Coaches |

| Impact of Marketing Strategies on Consumer Choices | 70 | Marketing Executives, Brand Managers, Advertising Specialists |

| Supply Chain Dynamics in Plant-Based Beverage Production | 60 | Supply Chain Managers, Production Supervisors, Quality Control Analysts |

The Vietnam Plant-Based Beverages Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness and a shift towards sustainable diets among consumers.