Oman Hormone Therapy Market Overview

- The Oman Hormone Therapy Market is valued at USD 16 million, based on a five-year historical analysis. This growth is primarily driven by an increasing prevalence of hormonal disorders, rising awareness about hormone replacement therapies, and advancements in medical technology. The market is also supported by a growing geriatric population, which is more susceptible to hormonal imbalances, thereby increasing the demand for effective treatment options. Recent trends include the adoption of personalized hormone therapies, the integration of telemedicine for remote consultations, and a shift toward bioidentical hormone formulations for improved safety and efficacy .

- Muscat, the capital city, is the dominant market hub due to its advanced healthcare infrastructure and concentration of specialized medical facilities. Other significant cities include Salalah and Sohar, where there is a growing demand for hormone therapies driven by increasing healthcare access and rising health awareness among the population. These cities are witnessing a surge in healthcare investments, further solidifying their positions in the market .

- The Regulation of Pharmaceutical Products and Establishments, issued by the Ministry of Health of Oman in 2023, mandates that all hormone therapy products must undergo rigorous clinical trials and obtain approval from the Ministry of Health before being marketed. This regulation aims to ensure the safety and efficacy of hormone therapies, thereby enhancing patient trust and promoting responsible prescribing practices among healthcare providers .

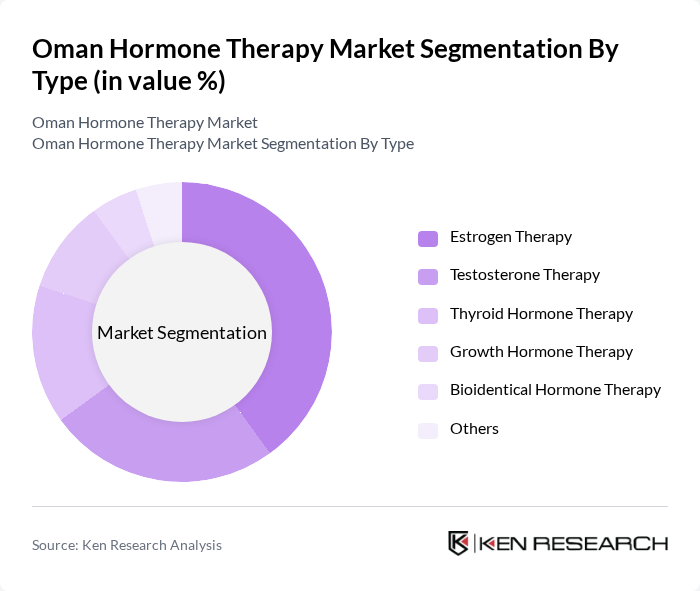

Oman Hormone Therapy Market Segmentation

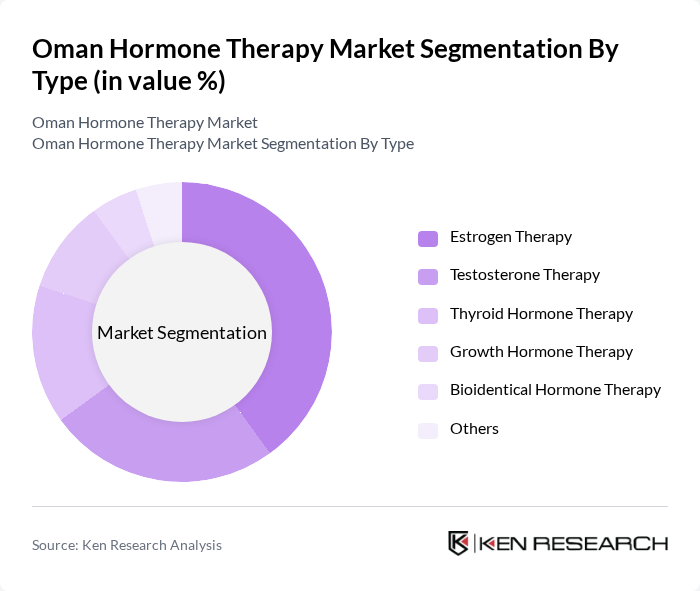

By Type:The hormone therapy market can be segmented into various types, including Estrogen Therapy, Testosterone Therapy, Thyroid Hormone Therapy, Growth Hormone Therapy, Bioidentical Hormone Therapy, and Others. Among these, Estrogen Therapy is currently the leading sub-segment due to its widespread use in treating menopausal symptoms and hormonal imbalances in women. The increasing awareness and acceptance of hormone therapies, particularly for menopause management and reproductive health, have contributed to the growth of this segment. The adoption of bioidentical hormone therapies is also rising, reflecting a broader trend toward personalized and safer hormone treatments .

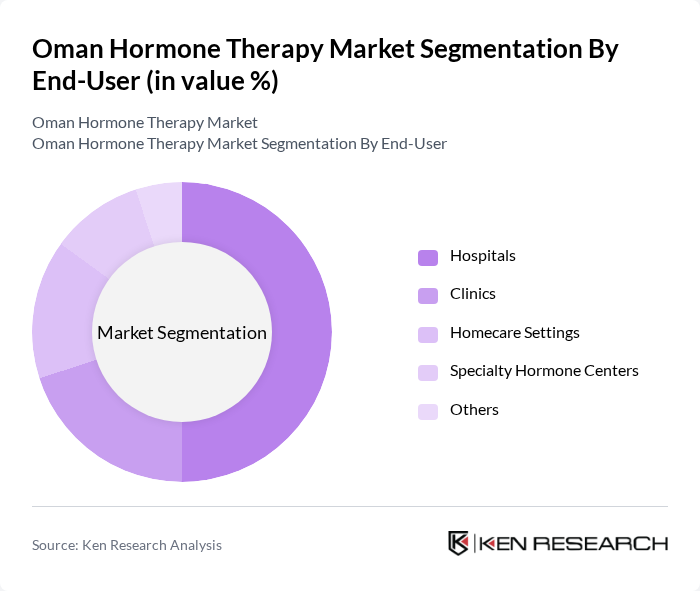

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Settings, Specialty Hormone Centers, and Others. Hospitals are the leading end-user segment, primarily due to their comprehensive facilities and access to specialized healthcare professionals. The trend towards outpatient care and the increasing number of hormone therapy procedures performed in hospitals contribute to their dominance in this segment. Clinics and specialty hormone centers are also gaining traction, supported by the growing demand for personalized and convenient hormone therapy services .

Oman Hormone Therapy Market Competitive Landscape

The Oman Hormone Therapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca, Pfizer Inc., Novartis AG, Merck KGaA, AbbVie Inc., Sanofi S.A., Bayer AG, Novo Nordisk A/S, GlaxoSmithKline plc (GSK), Amgen Inc., Johnson & Johnson, Eli Lilly and Company, Boehringer Ingelheim, Ferring Pharmaceuticals, Endo International plc, Oman Pharmaceutical Products Co. LLC, Julphar (Gulf Pharmaceutical Industries), Hikma Pharmaceuticals plc contribute to innovation, geographic expansion, and service delivery in this space.

Oman Hormone Therapy Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Hormonal Disorders:The prevalence of hormonal disorders in Oman is rising, with an estimated 1.6 million individuals affected by conditions such as diabetes and thyroid disorders. According to the Oman Ministry of Health, the incidence of diabetes alone is projected to reach 1.3 million in the future. This growing patient population is driving demand for hormone therapy, as effective treatment options become increasingly necessary to manage these chronic conditions and improve quality of life.

- Rising Awareness About Hormone Therapy Benefits:Public awareness campaigns and educational initiatives have significantly increased knowledge about hormone therapy's benefits in Oman. Reports indicate that over 65% of the population is now aware of hormone replacement therapy (HRT) options. This heightened awareness is crucial, as it encourages individuals suffering from hormonal imbalances to seek treatment, thereby expanding the market for hormone therapy services and products in the region.

- Advancements in Hormone Therapy Technologies:Technological advancements in hormone therapy, such as the development of bioidentical hormones and innovative delivery systems, are enhancing treatment efficacy. The introduction of transdermal patches and subcutaneous implants has improved patient compliance and outcomes. The Oman healthcare sector is expected to invest approximately OMR 60 million in new medical technologies in the future, further supporting the growth of hormone therapy options available to patients.

Market Challenges

- High Cost of Hormone Therapy Treatments:The financial burden of hormone therapy remains a significant challenge in Oman, with average treatment costs ranging from OMR 250 to OMR 600 per month. Many patients struggle to afford these expenses, particularly in a country where the average monthly income is around OMR 1,200. This economic barrier limits access to necessary treatments, hindering market growth and patient outcomes.

- Limited Access to Healthcare Facilities:Access to healthcare facilities in Oman is uneven, particularly in rural areas where only 35% of the population has access to specialized hormone therapy services. The World Health Organization reports that Oman has approximately 2.7 physicians per 1,000 people, which is below the global average. This shortage of healthcare professionals and facilities restricts patient access to hormone therapy, posing a challenge to market expansion.

Oman Hormone Therapy Market Future Outlook

The future of the Oman hormone therapy market appears promising, driven by increasing healthcare investments and a growing focus on preventive care. As the government allocates more resources to healthcare infrastructure, the availability of hormone therapy services is expected to improve. Additionally, the integration of telemedicine will facilitate access to hormone therapy consultations, particularly for patients in remote areas, enhancing treatment accessibility and adherence to therapy regimens.

Market Opportunities

- Expansion of Telemedicine Services:The rise of telemedicine in Oman presents a significant opportunity for hormone therapy providers. With an estimated 45% of the population using smartphones, telehealth platforms can facilitate remote consultations, making hormone therapy more accessible. This shift can lead to increased patient engagement and adherence to treatment plans, ultimately driving market growth.

- Development of Personalized Hormone Therapies:The trend towards personalized medicine is gaining traction in Oman, with a growing demand for tailored hormone therapies. By leveraging genetic testing and patient-specific data, healthcare providers can create customized treatment plans that enhance efficacy and minimize side effects. This innovation is expected to attract more patients seeking effective and individualized hormone therapy solutions.