Region:Middle East

Author(s):Rebecca

Product Code:KRAC9808

Pages:95

Published On:November 2025

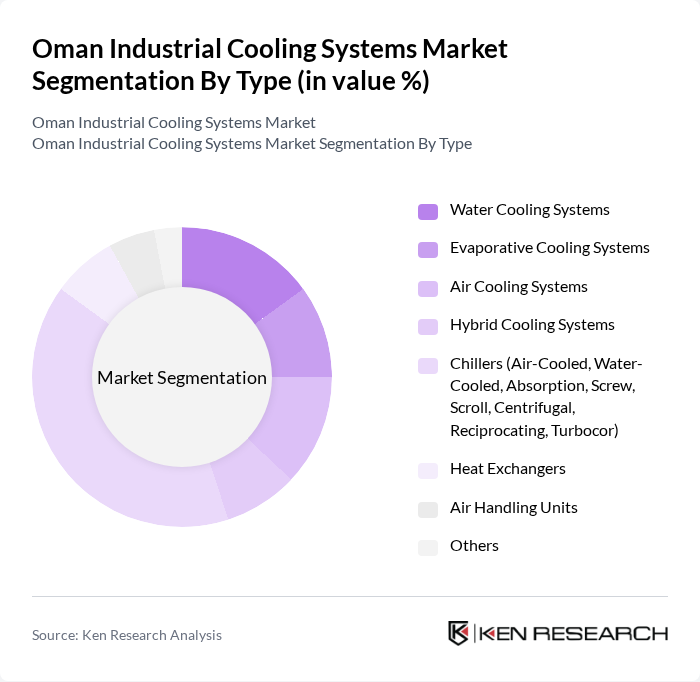

By Type:The market is segmented into Water Cooling Systems, Evaporative Cooling Systems, Air Cooling Systems, Hybrid Cooling Systems, Chillers (Air-Cooled, Water-Cooled, Absorption, Screw, Scroll, Centrifugal, Reciprocating, Turbocor), Heat Exchangers, Air Handling Units, and Others.Chillersare the most dominant segment, driven by their versatility and efficiency in large-scale industrial and commercial applications. The demand for energy-efficient chillers has surged as industries seek to reduce operational costs and comply with environmental regulations. Notably, the integration of smart controls and IoT capabilities in chillers is accelerating adoption, while evaporative and hybrid systems are gaining traction for their lower energy consumption and sustainability benefits .

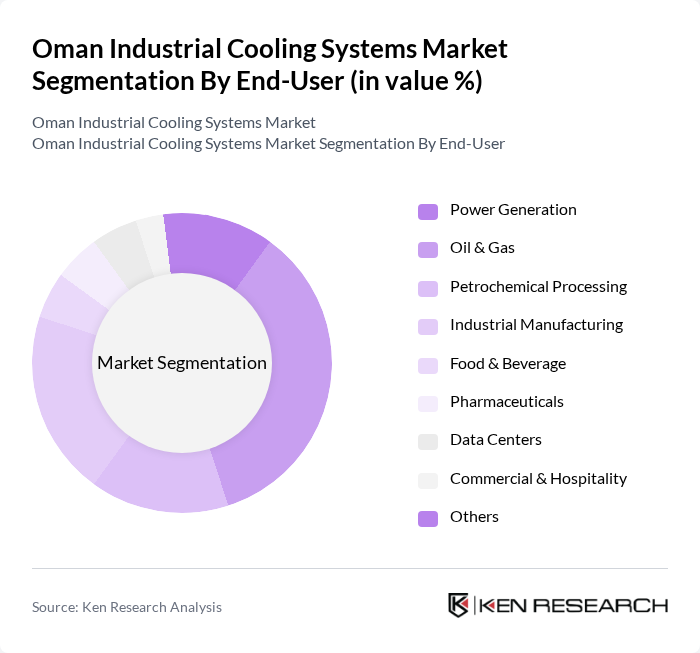

By End-User:The end-user segmentation includes Power Generation, Oil & Gas, Petrochemical Processing, Industrial Manufacturing, Food & Beverage, Pharmaceuticals, Data Centers, Commercial & Hospitality, and Others. TheOil & Gas sectoris the leading end-user, driven by the need for efficient cooling solutions in extraction and processing operations. Growth in this segment is supported by ongoing infrastructure investments and the increasing adoption of advanced cooling technologies to meet stringent energy efficiency and sustainability standards. Data centers and industrial manufacturing are also rapidly expanding end-user segments, reflecting Oman’s digital transformation and industrial diversification .

The Oman Industrial Cooling Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Engineering, Daikin Middle East and Africa, Trane Technologies, Johnson Controls International, Carrier Global Corporation, GEA Group, Emerson Electric Co., Mitsubishi Electric, Lennox International, York International, Blue Star Limited, Schneider Electric SE, Honeywell International Inc., Swegon Group AB, Aermec S.p.A., SPX Cooling Technologies, Baltimore Aircoil Company, Vertiv Group Corp., Rittal GmbH & Co. KG, EVAPCO, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman industrial cooling systems market is poised for significant transformation as industries increasingly prioritize energy efficiency and sustainability. With the government's commitment to reducing energy consumption and promoting renewable technologies, the market is expected to witness a shift towards smart and integrated cooling solutions. Additionally, the integration of IoT technologies will enhance operational efficiency, allowing for real-time monitoring and optimization of cooling systems. This evolving landscape presents opportunities for innovation and growth, positioning Oman as a leader in sustainable industrial cooling solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Water Cooling Systems Evaporative Cooling Systems Air Cooling Systems Hybrid Cooling Systems Chillers (Air-Cooled, Water-Cooled, Absorption, Screw, Scroll, Centrifugal, Reciprocating, Turbocor) Heat Exchangers Air Handling Units Others |

| By End-User | Power Generation Oil & Gas Petrochemical Processing Industrial Manufacturing Food & Beverage Pharmaceuticals Data Centers Commercial & Hospitality Others |

| By Region | Muscat Salalah Sohar Nizwa Duqm |

| By Technology | Vapor Compression Absorption Cooling Evaporative Cooling Liquid Cooling Free Cooling Others |

| By Application | Process Cooling Comfort Cooling Refrigeration District Cooling Data Center Cooling Others |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Cooling Systems | 100 | Plant Managers, Operations Directors |

| Food Processing Industry | 70 | Quality Assurance Managers, Production Supervisors |

| Pharmaceutical Cooling Solutions | 60 | Facility Managers, Compliance Officers |

| Data Center Cooling Systems | 50 | IT Managers, Infrastructure Directors |

| Commercial Building HVAC Systems | 80 | Building Managers, Energy Efficiency Consultants |

The Oman Industrial Cooling Systems Market is valued at approximately USD 350 million, reflecting a five-year historical analysis. This valuation aligns with the broader HVAC market in Oman, driven by the demand for energy-efficient cooling solutions across various industries.