Region:Middle East

Author(s):Dev

Product Code:KRAA9660

Pages:93

Published On:November 2025

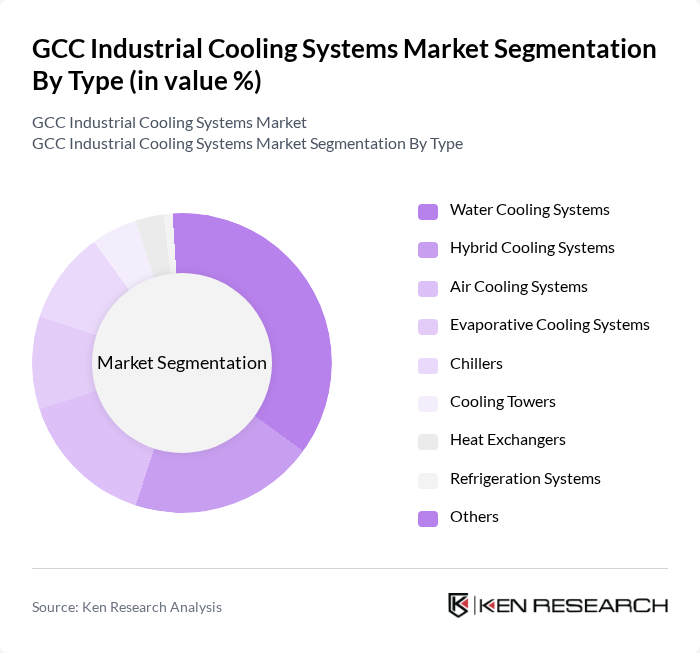

By Type:The market is segmented into Water Cooling Systems, Hybrid Cooling Systems, Air Cooling Systems, Evaporative Cooling Systems, Chillers, Cooling Towers, Heat Exchangers, Refrigeration Systems, and Others. Water Cooling Systems currently lead the market due to their superior efficiency and effectiveness in large-scale industrial applications. The rising focus on energy conservation, sustainability, and the need for reliable cooling solutions in power generation and manufacturing sectors are driving the demand for water cooling systems. Hybrid cooling systems are also gaining traction, supported by their operational flexibility and ability to optimize water and energy usage .

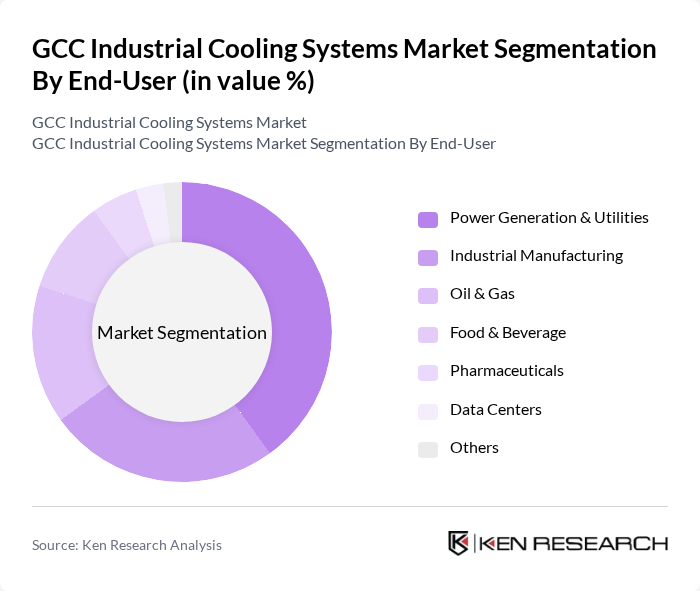

By End-User:The end-user segmentation includes Power Generation & Utilities, Industrial Manufacturing, Oil & Gas, Food & Beverage, Pharmaceuticals, Data Centers, and Others. Power Generation & Utilities is the dominant segment, driven by the need for efficient cooling solutions to manage heat generated during energy production. The increasing demand for electricity in the GCC region, coupled with the expansion of renewable energy projects and modernization of infrastructure, is further propelling the growth of this segment. Industrial Manufacturing and Oil & Gas sectors also maintain significant shares due to their energy-intensive operations and stringent safety requirements .

The GCC Industrial Cooling Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Controls International plc, Trane Technologies plc, Daikin Industries, Ltd., Carrier Global Corporation, Mitsubishi Electric Corporation, GEA Group AG, SPIG S.p.A. (part of Babcock Power), Hamon & Cie (International) S.A., Baltimore Aircoil Company (BAC), Emirates Industrial Cooling LLC, Alessa Industries (Saudi Arabia), Zamil Air Conditioners (Zamil Industrial Investment Co.), Al Shirawi Group (Dubai, UAE), Honeywell International Inc., Emerson Electric Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC industrial cooling systems market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt smart cooling solutions integrated with IoT technologies, operational efficiencies are expected to improve significantly. Furthermore, the ongoing transition towards renewable energy sources will likely enhance the viability of innovative cooling systems, positioning the region as a leader in sustainable industrial practices in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Water Cooling Systems Hybrid Cooling Systems Air Cooling Systems Evaporative Cooling Systems Chillers Cooling Towers Heat Exchangers Refrigeration Systems Others |

| By End-User | Power Generation & Utilities Industrial Manufacturing Oil & Gas Food & Beverage Pharmaceuticals Data Centers Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Application | Process Cooling Comfort Cooling Industrial Refrigeration Transport Cooling Others |

| By System Type | Centralized Systems Decentralized Systems Hybrid Systems Modular Systems Others |

| By Energy Source | Electric Gas Renewable Energy Others |

| By Maintenance Type | Preventive Maintenance Predictive Maintenance Corrective Maintenance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Cooling Systems | 100 | Plant Managers, Operations Directors |

| Petrochemical Industry Cooling Solutions | 80 | Process Engineers, Facility Managers |

| Food and Beverage Industry Refrigeration | 60 | Quality Control Managers, Supply Chain Coordinators |

| Data Center Cooling Technologies | 50 | IT Infrastructure Managers, Energy Efficiency Consultants |

| HVAC System Suppliers and Distributors | 70 | Sales Managers, Product Development Engineers |

The GCC Industrial Cooling Systems Market is valued at approximately USD 1.9 billion, driven by rapid industrialization, urbanization, and the demand for energy-efficient cooling solutions across various sectors, including manufacturing and data centers.