Oman Intravenous Catheters Market Overview

- The Oman Intravenous Catheters Market is valued at USD 15 million, based on a five-year historical analysis and proportional allocation from the Middle East catheters market size. This growth is primarily driven by the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, a rise in surgical and minimally invasive procedures, and advancements in catheter technology including antimicrobial coatings and ultrasound-guided insertion. The demand for intravenous catheters is further supported by ongoing healthcare infrastructure modernization, government investments, and a heightened emphasis on infection control and patient safety in medical settings .

- Muscat, the capital city, remains the dominant market due to its concentration of tertiary hospitals, specialized medical centers, and advanced healthcare services. Salalah and Sohar are also significant contributors, with expanding healthcare capabilities and new hospital projects aimed at meeting the rising demand for medical services. Strategic investments in healthcare infrastructure, such as new hospital construction and digital health initiatives, reinforce the market leadership of these regions .

- The “Ministerial Decision No. 151/2023 on the Use of Safety-Engineered Medical Devices in Public Healthcare Facilities,” issued by the Ministry of Health, Oman in 2023, mandates the use of safety-engineered intravenous catheters in all public healthcare institutions. This regulation requires hospitals and clinics to procure and utilize catheters with integrated safety mechanisms to minimize needlestick injuries and enhance patient safety. Compliance is monitored through periodic audits, and non-compliance can result in procurement restrictions or administrative penalties .

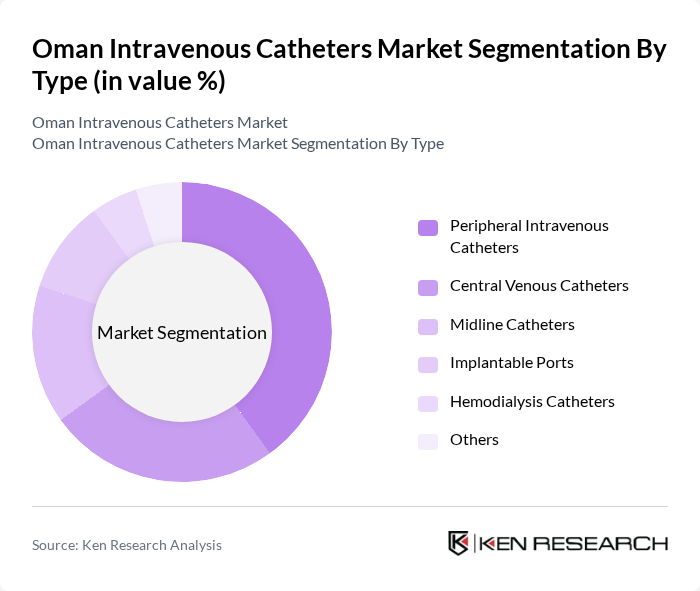

Oman Intravenous Catheters Market Segmentation

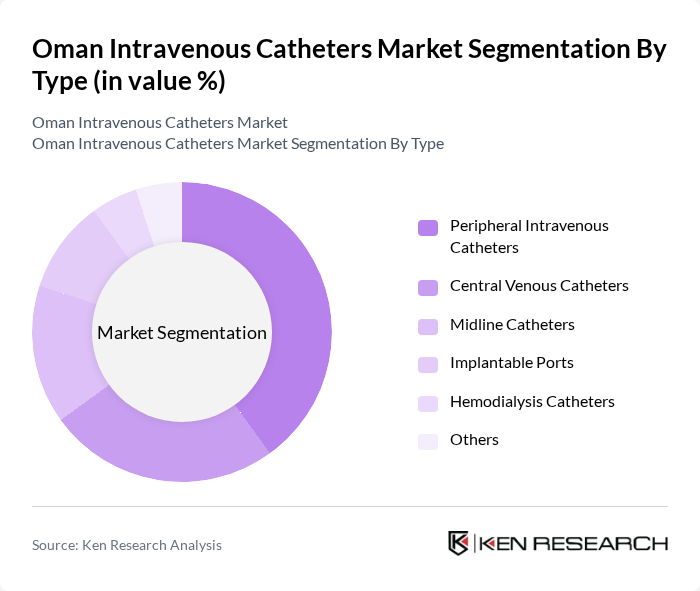

By Type:The market is segmented into Peripheral Intravenous Catheters, Central Venous Catheters, Midline Catheters, Implantable Ports, Hemodialysis Catheters, and Others. Peripheral Intravenous Catheters are the most widely used due to their ease of insertion, cost-effectiveness, and suitability for short-term therapies in emergency and inpatient settings. Central Venous Catheters are in high demand for critical care, oncology, and long-term therapies, while Midline Catheters and Implantable Ports are increasingly adopted for outpatient and home-based care, reflecting the shift toward minimally invasive and patient-centric treatment models .

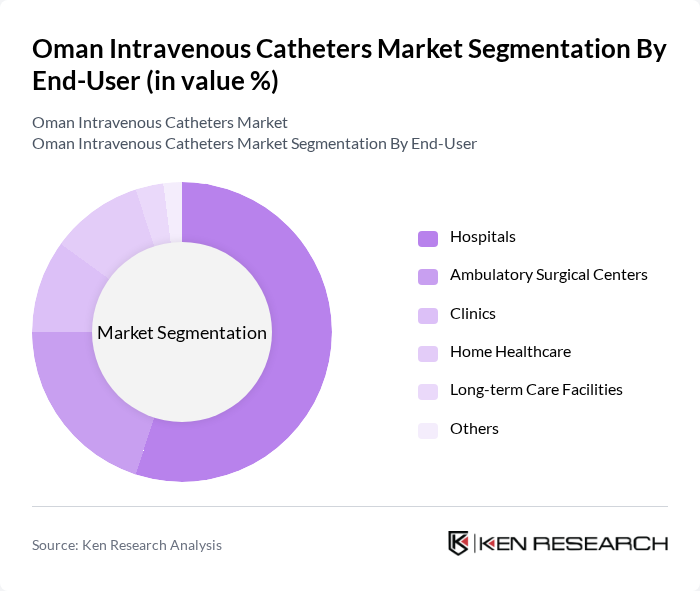

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Clinics, Home Healthcare, Long-term Care Facilities, and Others. Hospitals are the primary end-users, accounting for the largest share due to their role in acute care, surgery, and emergency medicine. Ambulatory Surgical Centers are experiencing robust growth as they expand advanced catheter use for outpatient procedures. The increasing adoption of home healthcare and long-term care services, driven by an aging population and chronic disease management needs, is fueling demand for catheters in non-hospital settings .

Oman Intravenous Catheters Market Competitive Landscape

The Oman Intravenous Catheters Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Smiths Medical (ICU Medical, Inc.), Terumo Corporation, Teleflex Incorporated, Vygon S.A., Cook Medical, Cardinal Health, Fresenius Kabi AG, Johnson & Johnson (Ethicon), 3M Company, ConvaTec Group PLC, Halyard Health, Inc. (now part of Owens & Minor), Nipro Corporation, AngioDynamics, Inc., Argon Medical Devices, Inc., Medinova Medical Supplies LLC, Healthcare Systems EST, Hysopemedica, and Saudi Mais Co. contribute to innovation, geographic expansion, and service delivery in this space.

Oman Intravenous Catheters Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and cardiovascular conditions in Oman is a significant growth driver for the intravenous catheters market. According to the World Health Organization, approximately 30% of the Omani population suffers from chronic diseases, leading to a higher demand for intravenous therapies. This trend is expected to increase healthcare utilization, with the Ministry of Health reporting a 20% annual increase in hospital admissions related to chronic disease management, further boosting catheter usage.

- Rising Demand for Minimally Invasive Procedures:The shift towards minimally invasive procedures in Oman is propelling the intravenous catheters market. The Omani healthcare sector has seen a 25% increase in such procedures over the past three years, driven by patient preference for reduced recovery times and lower complication rates. The Ministry of Health's investment in advanced surgical technologies, amounting to OMR 12 million in future, supports this trend, enhancing the demand for innovative catheter solutions that facilitate these procedures.

- Technological Advancements in Catheter Design:Innovations in catheter technology are significantly influencing market growth in Oman. The introduction of smart catheters, which monitor patient vitals and reduce infection risks, has gained traction. In future, the Omani government allocated OMR 6 million for research and development in medical devices, fostering advancements in catheter design. This investment is expected to enhance patient outcomes and increase the adoption of advanced catheters, contributing to market expansion.

Market Challenges

- High Cost of Advanced Catheters:The high cost associated with advanced intravenous catheters poses a significant challenge in Oman. Premium catheters can range from OMR 18 to OMR 35 each, which may limit their accessibility in public healthcare settings. The Ministry of Health's budget constraints, with a healthcare expenditure of OMR 1.8 billion in future, further complicate the procurement of these advanced devices, potentially hindering market growth.

- Limited Awareness Among Healthcare Professionals:A lack of awareness and training regarding the latest catheter technologies among healthcare professionals in Oman presents a challenge. Surveys indicate that only 45% of healthcare providers are familiar with advanced catheter options. This gap in knowledge can lead to underutilization of innovative products, impacting patient care and limiting market growth. The Ministry of Health's initiatives to enhance training programs are crucial to overcoming this barrier.

Oman Intravenous Catheters Market Future Outlook

The future of the intravenous catheters market in Oman appears promising, driven by ongoing healthcare reforms and technological advancements. The government's commitment to enhancing healthcare infrastructure, with an investment of OMR 250 million in future, is expected to facilitate better access to advanced medical devices. Additionally, the increasing integration of telemedicine and home healthcare solutions will likely reshape patient management, creating new avenues for catheter utilization and improving overall healthcare delivery in the region.

Market Opportunities

- Expansion of Healthcare Infrastructure:The ongoing expansion of healthcare facilities in Oman presents a significant opportunity for the intravenous catheters market. With the government planning to build 12 new hospitals in future, the demand for medical supplies, including catheters, is expected to rise substantially, enhancing market potential.

- Development of Eco-Friendly Catheters:The growing emphasis on sustainability in healthcare offers an opportunity for the development of eco-friendly catheters. As environmental concerns rise, manufacturers focusing on biodegradable materials can tap into a niche market, appealing to healthcare providers committed to reducing their ecological footprint.