Region:Asia

Author(s):Rebecca

Product Code:KRAE0963

Pages:99

Published On:December 2025

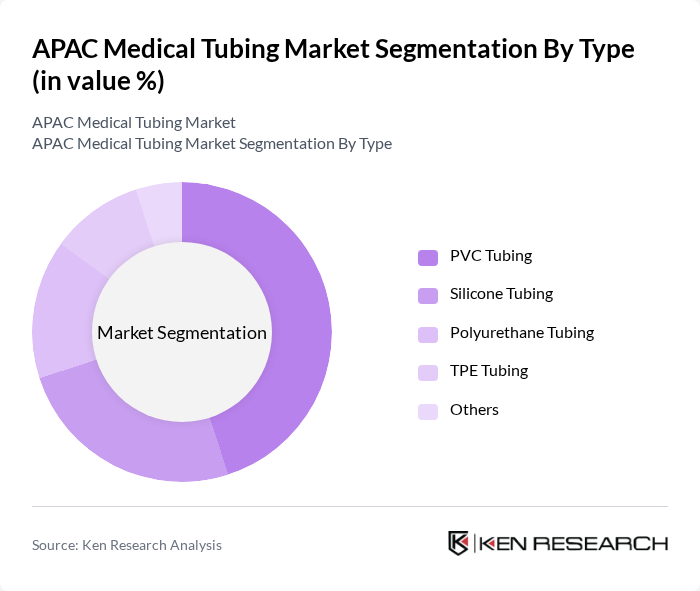

By Type:The market is segmented into various types of medical tubing, including PVC Tubing, Silicone Tubing, Polyurethane Tubing, TPE Tubing, and Others. Among these, PVC Tubing is the most widely used due to its cost-effectiveness and versatility in various medical applications. Silicone Tubing is gaining traction for its biocompatibility and flexibility, making it suitable for sensitive applications. The demand for Polyurethane Tubing is also increasing, particularly in high-performance applications.

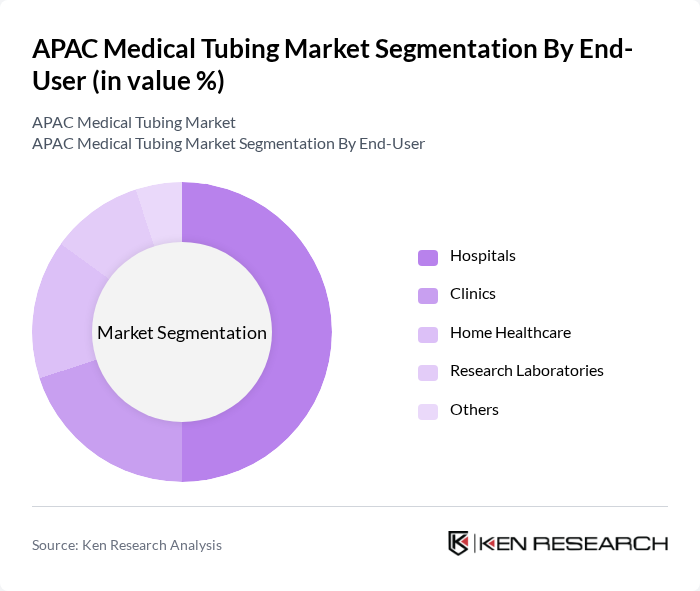

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Research Laboratories, and Others. Hospitals are the leading end-users of medical tubing, driven by the increasing number of surgical procedures and the need for various medical devices. Home healthcare is also emerging as a significant segment due to the growing trend of at-home treatments and monitoring, especially for chronic disease management.

The APAC Medical Tubing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Boston Scientific, B. Braun Melsungen AG, Teleflex Incorporated, Cook Medical, Johnson & Johnson, Terumo Corporation, Smiths Medical, ConvaTec Group, 3M Company, Stryker Corporation, Philips Healthcare, Halyard Health, Nipro Corporation, and Amcor contribute to innovation, geographic expansion, and service delivery in this space.

The APAC medical tubing market is poised for significant growth, driven by increasing healthcare investments and technological innovations. As healthcare infrastructure expands, particularly in emerging economies, the demand for advanced medical tubing solutions will rise. Furthermore, the integration of smart technologies and biocompatible materials will enhance product offerings. Companies are likely to focus on sustainability, leading to eco-friendly product development. This evolving landscape presents opportunities for growth and innovation in the medical tubing sector.

| Segment | Sub-Segments |

|---|---|

| By Type | PVC Tubing Silicone Tubing Polyurethane Tubing TPE Tubing Others |

| By End-User | Hospitals Clinics Home Healthcare Research Laboratories Others |

| By Region | North India South India East India West India |

| By Application | Cardiovascular Neurology Gastroenterology Urology Others |

| By Material | Thermoplastic Elastomers Polyethylene Polypropylene Nylon Others |

| By Manufacturing Process | Extrusion Injection Molding Blow Molding Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiovascular Medical Tubing | 100 | Cardiologists, Medical Device Engineers |

| Urology Medical Tubing | 80 | Urologists, Procurement Managers |

| Gastroenterology Medical Tubing | 70 | Gastroenterologists, Hospital Supply Chain Directors |

| General Surgical Tubing | 90 | Surgeons, Product Development Managers |

| Emerging Technologies in Medical Tubing | 60 | R&D Managers, Innovation Officers |

The APAC Medical Tubing Market is valued at approximately USD 3.30 billion, driven by the increasing demand for minimally invasive procedures and the rising prevalence of chronic diseases in the region.