Region:Middle East

Author(s):Shubham

Product Code:KRAD5477

Pages:84

Published On:December 2025

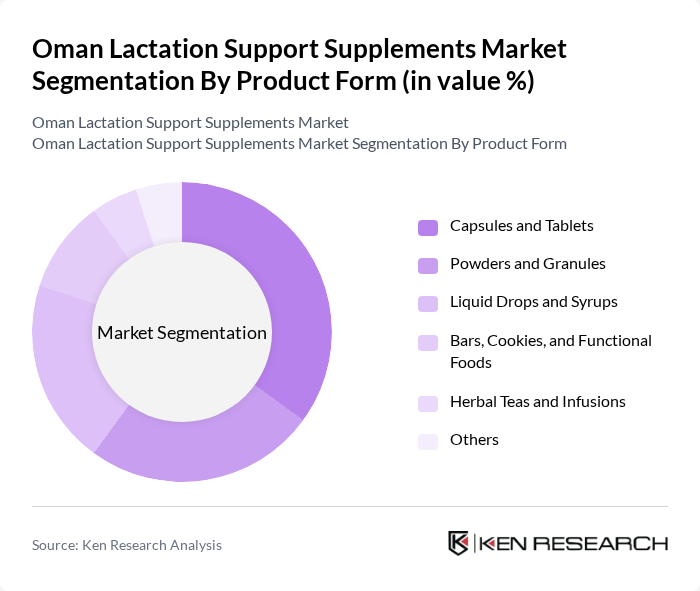

By Product Form:The market is segmented into various product forms, including capsules and tablets, powders and granules, liquid drops and syrups, bars, cookies, and functional foods, herbal teas and infusions, and others. This structure is consistent with the global lactation support supplements market, where tablets and capsules, powders, and liquid extracts are the dominant formats. Among these, capsules and tablets are the most popular due to their convenience, standardized dosing, and ease of consumption, particularly among busy mothers purchasing through pharmacies and modern trade channels. The demand for liquid drops and syrups is also growing, in line with global trends toward palatable, easy-to-swallow, and combination formulations, especially where products are co-positioned with infant and postnatal care ranges.

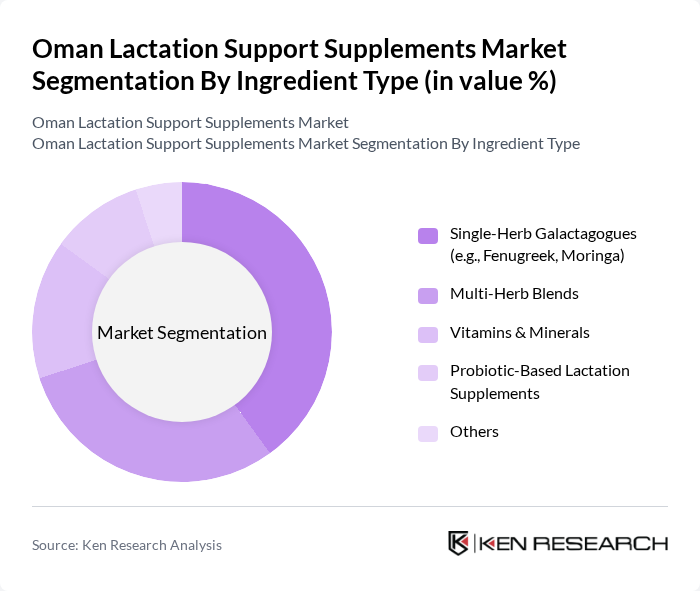

By Ingredient Type:The ingredient type segmentation includes single-herb galactagogues (e.g., fenugreek, moringa), multi-herb blends, vitamins & minerals, probiotic-based lactation supplements, and others. This is aligned with global ingredient patterns, where herbal galactagogues such as fenugreek, moringa, milk thistle, and fennel form the core of lactation formulations, often combined with vitamins and minerals. Single-herb galactagogues dominate the market due to their traditional use, strong consumer recognition, and evidence base from global clinical and ethnobotanical usage for enhancing milk supply. Multi-herb blends are gaining traction as they offer a holistic approach to lactation support, combining the benefits of various herbs with supportive nutrients and, increasingly, probiotics to address digestive comfort and overall maternal wellness.

The Oman Lactation Support Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Oman Trading Establishment – Nestlé Middle East), Abbott Laboratories (Abbott Nutrition Middle East), Danone S.A. (Nutricia Middle East & North Africa), Reckitt Benckiser Group plc (Mead Johnson Nutrition), Pfizer Inc. (Wyeth Nutrition), Bayer AG, Sanofi S.A., Himalaya Wellness Company, Dabur India Ltd., Euromedica Gulf LLC, Oman Pharmaceutical Products Co. LLC, Lifeline Pharma LLC, Life Pharmacy Group (Oman), Aster Pharmacy (Oman), Nesto Hypermarket / Lulu Group International (Mother & Baby Nutrition Range) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman lactation support supplements market appears promising, driven by increasing consumer awareness and a growing emphasis on maternal health. As e-commerce platforms expand, accessibility to quality products will improve, fostering market growth. Additionally, collaborations with healthcare providers are expected to enhance product credibility, encouraging more mothers to consider supplements as part of their postpartum care. These trends indicate a dynamic market poised for development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Form | Capsules and Tablets Powders and Granules Liquid Drops and Syrups Bars, Cookies, and Functional Foods Herbal Teas and Infusions Others |

| By Ingredient Type | Single-Herb Galactagogues (e.g., Fenugreek, Moringa) Multi-Herb Blends Vitamins & Minerals Probiotic-Based Lactation Supplements Others |

| By Consumer Profile | First-Time Mothers Multiparous Mothers Mothers with Identified Low Milk Supply High-Risk or C-Section Deliveries Others |

| By Distribution Channel | Hospital and Clinic Pharmacies Community Pharmacies Supermarkets and Hypermarkets Online Pharmacies and E-commerce Platforms Specialty Mother & Baby Stores Others |

| By Ingredient Source | Organic Conventional Halal-Certified Formulations Others |

| By Price Range | Value/Budget Mid-Range Premium/Imported Others |

| By Point of Recommendation | Obstetricians & Gynecologists Pediatricians & Neonatologists Lactation Consultants & Midwives Pharmacists Self-Prescribed / Peer-Influenced |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 60 | Lactation Consultants, Pediatricians |

| New Mothers | 120 | Women aged 20-40, Recent Mothers |

| Nutritionists and Dietitians | 50 | Maternal Health Specialists, Nutrition Experts |

| Retailers of Lactation Supplements | 40 | Pharmacy Managers, Health Store Owners |

| Health Policy Makers | 40 | Government Health Officials, NGO Representatives |

The Oman Lactation Support Supplements Market is valued at approximately USD 6 million, reflecting a growing demand driven by increased awareness of maternal health and breastfeeding initiatives.