Greece Nutraceuticals Market Overview

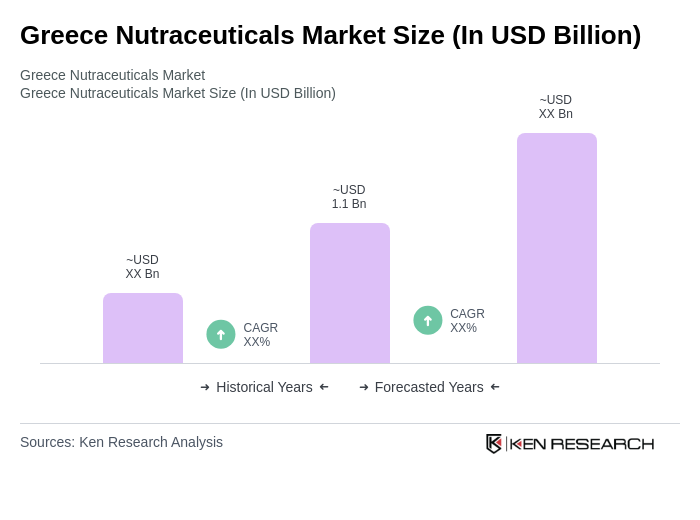

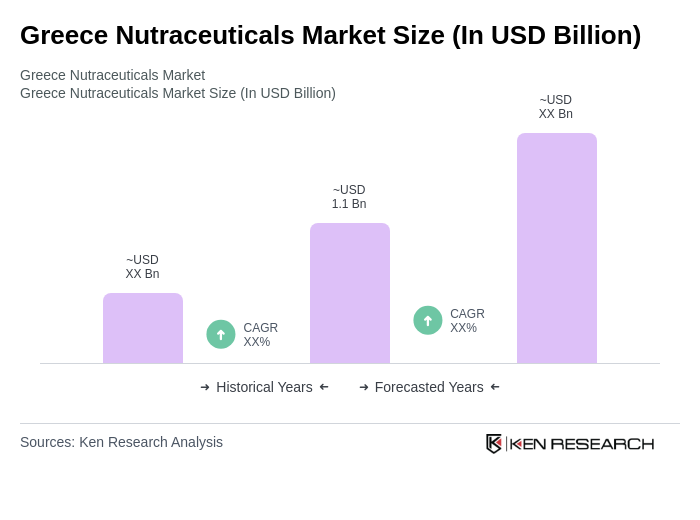

- The Greece Nutraceuticals Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rising trend in preventive healthcare, and the growing demand for natural and organic products. The market has seen a significant uptick in the consumption of dietary supplements and functional foods, reflecting a shift towards healthier lifestyles. Recent trends highlight the expansion of e-commerce, rising demand for probiotics and herbal supplements, and a strong preference for scientifically supported, clean-label products. These factors are further supported by an aging population and heightened consumer focus on immunity, energy, and long-term wellness .

- Athens and Thessaloniki are the dominant cities in the Greece Nutraceuticals Market, primarily due to their large populations and urbanization trends. These cities have a higher concentration of health-conscious consumers and a robust retail infrastructure, which facilitates the distribution of nutraceutical products. Additionally, the presence of numerous health and wellness events in these cities further boosts market growth .

- The Greek government regulates nutraceutical products under the “Ministerial Decision No. 131451/2019 on Food Supplements,” issued by the Ministry of Rural Development and Food. This regulation mandates that all nutraceuticals must undergo notification to the National Organization for Medicines (EOF) prior to market entry, with requirements for safety, efficacy, and labeling compliance. The legislation aims to protect consumers and enhance the credibility of the nutraceutical industry in Greece by enforcing standards for product composition, claims, and traceability .

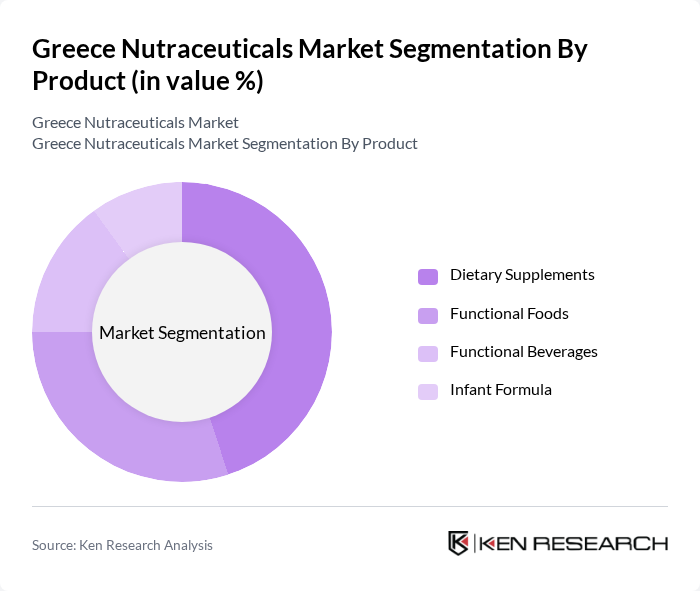

Greece Nutraceuticals Market Segmentation

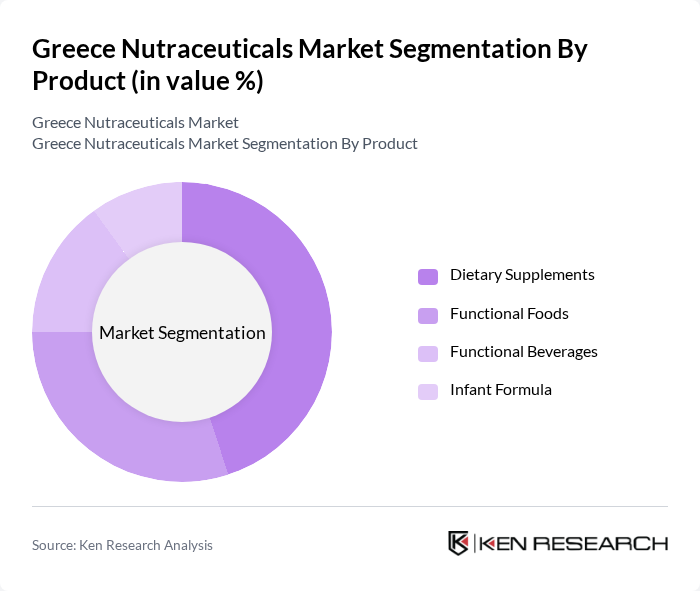

By Product:The nutraceuticals market can be segmented into four main product categories: Dietary Supplements, Functional Foods, Functional Beverages, and Infant Formula. Among these, Dietary Supplements are the most popular, driven by increasing consumer awareness regarding health and wellness. Functional Foods are also gaining traction as consumers seek food products that offer health benefits beyond basic nutrition. Functional Beverages are emerging as a convenient option for health-conscious individuals, while Infant Formula is essential for parents seeking nutritional solutions for their children. The market is experiencing a notable rise in demand for probiotics, herbal, and plant-based supplements, reflecting a broader shift toward natural and holistic health solutions .

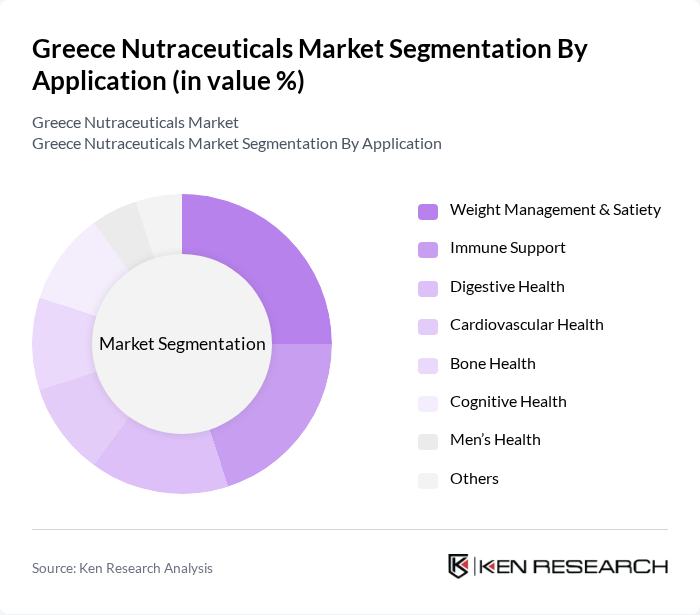

By Application:The applications of nutraceuticals can be categorized into several segments, including Weight Management & Satiety, Immune Support, Digestive Health, Cardiovascular Health, Bone Health, Cognitive Health, Men’s Health, and Others. Weight Management & Satiety is a leading application area, driven by the increasing prevalence of obesity and related health issues. Immune Support has gained importance, especially in light of recent global health challenges, while Digestive Health products are popular due to rising awareness of gut health. The market is also seeing increased demand for products supporting bone and cognitive health, particularly among older adults, and a growing interest in personalized nutrition .

Greece Nutraceuticals Market Competitive Landscape

The Greece Nutraceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Nestlé S.A., GNC Holdings, Inc., DSM Nutritional Products, Nature's Way Products, LLC, Blackmores Limited, Swisse Wellness Pty Ltd., Solgar Inc., NOW Foods, Garden of Life, LLC, Nature's Bounty Co., BioCare Copenhagen A/S, TSI Health Sciences, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

Greece Nutraceuticals Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Greek population is becoming increasingly health-conscious, with 65% of adults actively seeking healthier lifestyle choices. This trend is supported by a rise in health-related expenditures, which reached €3.8 billion in future. The World Health Organization reported that 75% of Greeks are now aware of the benefits of nutraceuticals, driving demand for products that promote wellness and disease prevention. This growing awareness is a significant catalyst for the nutraceuticals market in Greece.

- Rising Demand for Preventive Healthcare:The Greek healthcare system is shifting towards preventive care, with government initiatives allocating €1.5 billion to preventive health programs in future. This shift is reflected in the increasing sales of nutraceuticals, which are perceived as essential for maintaining health and preventing chronic diseases. The demand for supplements that support immune health and overall well-being is expected to rise, further propelling the market's growth in Greece.

- Growth of E-commerce Platforms:E-commerce sales of nutraceuticals in Greece surged to €500 million in future, driven by the convenience of online shopping and increased internet penetration, which reached 90%. The COVID-19 pandemic accelerated this trend, with 45% of consumers now preferring to purchase health products online. This shift not only expands market reach but also enhances consumer access to a diverse range of nutraceutical products, fostering market growth.

Market Challenges

- Stringent Regulatory Framework:The Greek nutraceuticals market faces significant challenges due to strict regulations imposed by the European Food Safety Authority (EFSA). Compliance costs can exceed €250,000 for new product approvals, creating barriers for smaller companies. Additionally, the lengthy approval process can delay product launches, hindering innovation and market entry, which poses a challenge for growth in this competitive landscape.

- Consumer Skepticism:Despite the growing market, consumer skepticism remains a challenge, with 50% of Greeks expressing doubts about the efficacy of nutraceuticals. This skepticism is often fueled by misinformation and a lack of understanding of product benefits. As a result, companies must invest in education and transparent marketing strategies to build trust and credibility, which can strain resources and impact overall market growth.

Greece Nutraceuticals Market Future Outlook

The Greece nutraceuticals market is poised for significant evolution, driven by trends such as personalized nutrition and the increasing integration of technology in health monitoring. As consumers seek tailored health solutions, companies are likely to invest in innovative product formulations that cater to specific health needs. Additionally, the focus on sustainability will shape product development, with brands prioritizing eco-friendly sourcing and packaging, aligning with consumer values and enhancing market competitiveness.

Market Opportunities

- Innovation in Product Formulations:There is a growing opportunity for companies to innovate in product formulations, particularly in areas like functional foods and personalized supplements. With the market for personalized nutrition projected to reach €1.2 billion in future, brands that leverage advanced research and development can capture a significant share of this emerging segment.

- Expansion into Emerging Markets:Greek nutraceutical companies have the potential to expand into emerging markets in Southeast Europe, where demand for health products is increasing. With a combined population of over 55 million and rising disposable incomes, these markets present lucrative opportunities for growth, allowing Greek brands to diversify their revenue streams and enhance their global presence.