Region:Middle East

Author(s):Shubham

Product Code:KRAA8752

Pages:97

Published On:November 2025

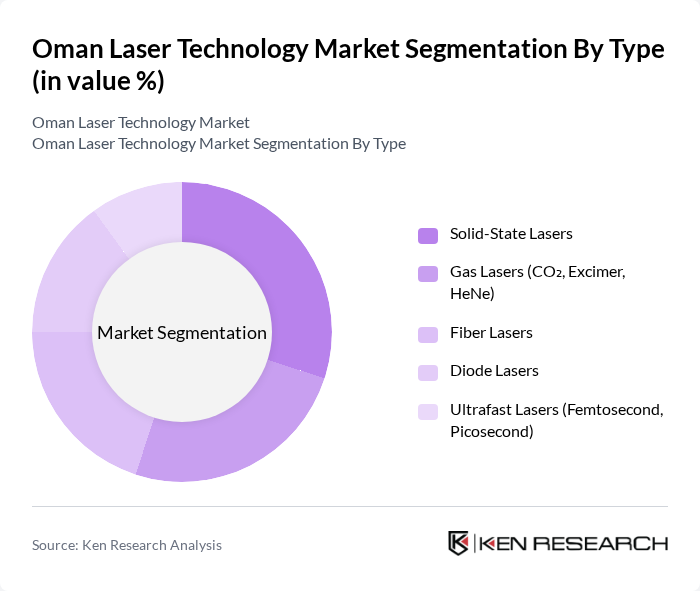

By Type:The market is segmented into various types of lasers, including Solid-State Lasers, Gas Lasers (CO?, Excimer, HeNe), Fiber Lasers, Diode Lasers, and Ultrafast Lasers (Femtosecond, Picosecond). Each type serves distinct applications across healthcare (medical diagnostics, dermatology), manufacturing (cutting, welding, engraving), telecommunications (optical data transmission), and research, contributing to the overall growth of the market.

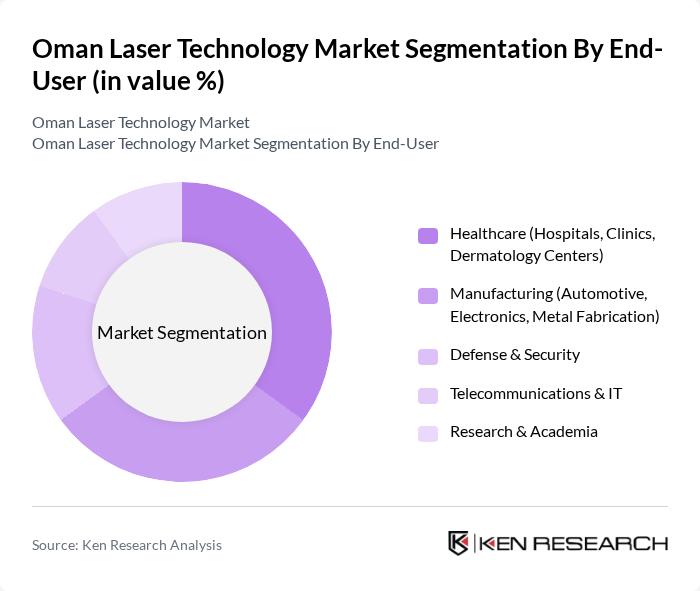

By End-User:The end-user segmentation includes Healthcare (Hospitals, Clinics, Dermatology Centers), Manufacturing (Automotive, Electronics, Metal Fabrication), Defense & Security, Telecommunications & IT, and Research & Academia. Each sector utilizes laser technology for specific applications: healthcare for diagnostics and therapy, manufacturing for precision material processing, defense for security and targeting systems, telecommunications for optical communications, and academia for advanced research.

The Oman Laser Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Fiber Optic Co. SAOG, Al-Futtaim Engineering (Oman Division), Gulf Laser Systems LLC, Oman Medical Supplies & Services Co. LLC, Muscat Electronics LLC, Lasertech LLC Oman, Al Maha Engineering LLC, Oman Industrial Services & Laser Solutions LLC, Al Balagh Trading & Contracting Co. (Laser Division), Oman Laser Applications LLC, Laser Innovations LLC Oman, Al Hazm Technologies LLC, Oman Advanced Laser Solutions LLC, Laser Dynamics LLC Oman, Oman Laser Engineering LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman laser technology market is poised for significant growth, driven by advancements in precision manufacturing and medical applications. As industries increasingly recognize the efficiency and accuracy of laser systems, adoption rates are expected to rise. Furthermore, government initiatives aimed at enhancing technological capabilities will likely foster innovation. The integration of artificial intelligence with laser technologies is anticipated to create new applications, further expanding the market landscape and attracting investments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid-State Lasers Gas Lasers (CO?, Excimer, HeNe) Fiber Lasers Diode Lasers Ultrafast Lasers (Femtosecond, Picosecond) |

| By End-User | Healthcare (Hospitals, Clinics, Dermatology Centers) Manufacturing (Automotive, Electronics, Metal Fabrication) Defense & Security Telecommunications & IT Research & Academia |

| By Application | Material Processing (Cutting, Welding, Marking, Engraving) Medical Applications (Surgery, Ophthalmology, Aesthetics) Optical Communication Scientific Research Security & Defense Systems |

| By Technology | Laser Cutting Laser Engraving Laser Marking Laser Welding Laser Cladding & Surface Treatment |

| By Industry Vertical | Automotive Aerospace Electronics & Semiconductors Construction & Infrastructure Oil & Gas Others |

| By Region | Muscat Salalah Sohar Nizwa Duqm Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Public-Private Partnerships Venture Capital & Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Laser Applications | 100 | Healthcare Administrators, Medical Device Engineers |

| Industrial Laser Cutting and Welding | 80 | Manufacturing Managers, Production Engineers |

| Telecommunications Laser Technologies | 70 | Network Engineers, Telecom Project Managers |

| Defense and Security Laser Systems | 40 | Defense Analysts, Procurement Officers |

| Research and Development in Laser Technology | 50 | R&D Managers, University Researchers |

The Oman Laser Technology Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by advancements in laser technology and increasing applications across various sectors, particularly healthcare and manufacturing.