Region:Middle East

Author(s):Dev

Product Code:KRAC2742

Pages:86

Published On:October 2025

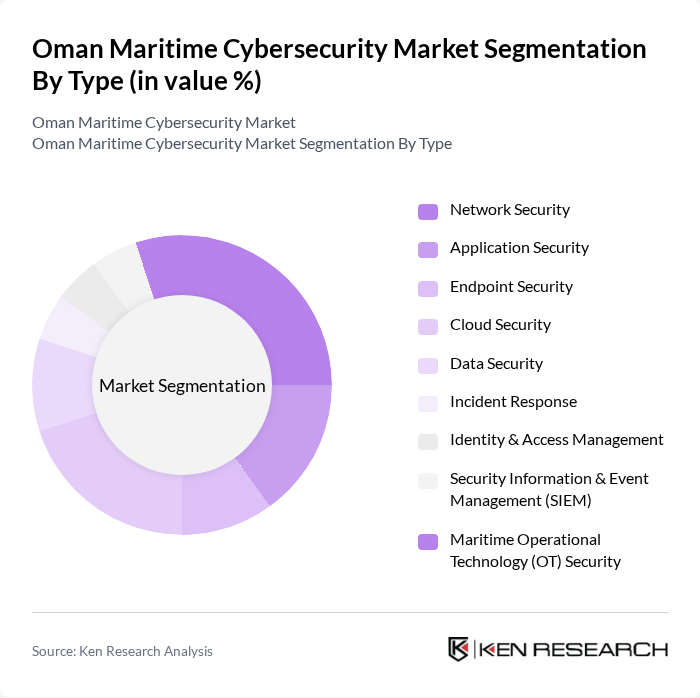

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Incident Response, Identity & Access Management, Security Information & Event Management (SIEM), and Maritime Operational Technology (OT) Security. Each of these sub-segments plays a crucial role in safeguarding maritime operations against cyber threats. Network Security and Cloud Security are witnessing the highest adoption due to the increasing reliance on digital platforms and cloud-based maritime management systems, while OT Security is gaining importance with the rise of autonomous and remotely operated vessels .

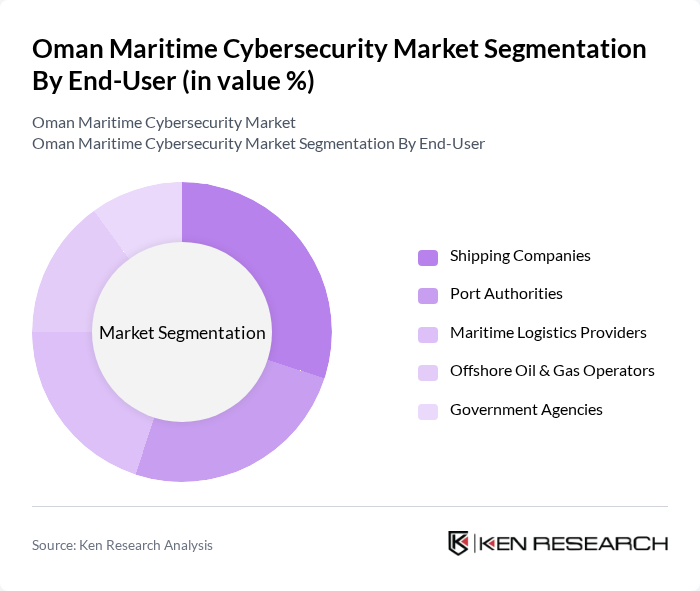

By End-User:The end-user segmentation includes Shipping Companies, Port Authorities, Maritime Logistics Providers, Offshore Oil & Gas Operators, and Government Agencies. Each of these sectors has unique cybersecurity needs, driven by the critical nature of their operations and the increasing threat landscape. Shipping Companies and Port Authorities represent the largest demand, reflecting the scale of Oman’s maritime trade and the strategic importance of its ports .

The Oman Maritime Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Data Park, Gulf Cybertech E-Solutions, Port of Salalah, Sohar Port and Freezone, Oman Shipping Company (Asyad Shipping), Asyad Group, International Maritime Organization (IMO) – Regional Presence, Cisco Systems Oman, Microsoft Oman, IBM Middle East (Oman), Darktrace, Naval Dome (a subsidiary of Check Point Software Technologies), ABS Group, Kaspersky Lab, Oman National CERT (OCERT) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Oman maritime cybersecurity market appears promising, driven by increasing investments in technology and regulatory compliance. As the sector embraces digital transformation, the integration of AI and machine learning into cybersecurity practices is expected to enhance threat detection and response capabilities. Furthermore, collaboration with global cybersecurity firms will likely foster innovation and knowledge transfer, positioning Oman as a regional leader in maritime cybersecurity solutions in the near future.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Incident Response Identity & Access Management Security Information & Event Management (SIEM) Maritime Operational Technology (OT) Security |

| By End-User | Shipping Companies Port Authorities Maritime Logistics Providers Offshore Oil & Gas Operators Government Agencies |

| By Application | Threat Intelligence & Monitoring Risk Assessment & Vulnerability Management Compliance Management (IMO, ISPS, NCA, etc.) Incident Management & Response Secure Ship-to-Shore Communications |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting & Advisory Services Managed Security Services (MSS) Security Audits & Penetration Testing Training and Awareness Services |

| By Region | Muscat Salalah Sohar Duqm |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-As-You-Go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shipping Companies Cybersecurity Practices | 40 | IT Managers, Cybersecurity Analysts |

| Port Authority Cybersecurity Measures | 40 | Port Security Officers, IT Directors |

| Logistics Providers Cybersecurity Strategies | 40 | Operations Managers, Risk Management Officers |

| Regulatory Compliance in Maritime Cybersecurity | 40 | Compliance Officers, Legal Advisors |

| Cybersecurity Training Programs in Maritime Sector | 40 | Training Coordinators, HR Managers |

The Oman Maritime Cybersecurity Market is valued at approximately USD 15 million, reflecting a five-year historical analysis and normalization against the overall Oman cybersecurity market and global maritime cybersecurity benchmarks.