Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8155

Pages:98

Published On:November 2025

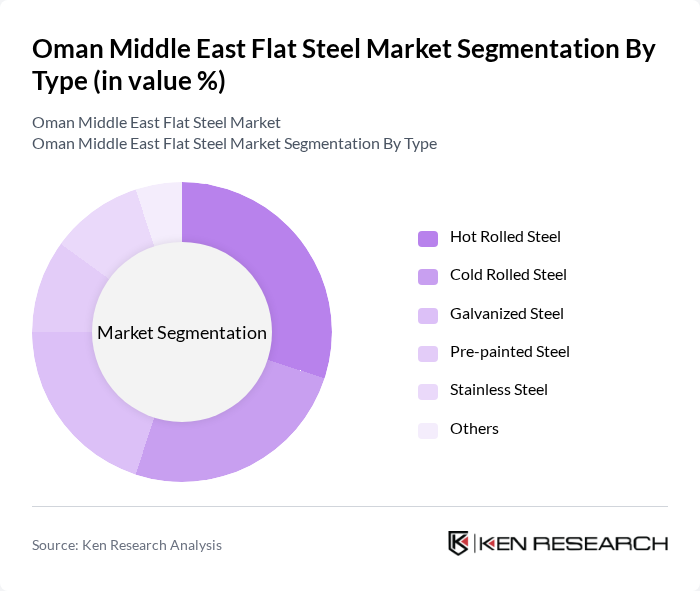

By Type:The flat steel market can be segmented into various types, including Hot Rolled Steel, Cold Rolled Steel, Galvanized Steel, Pre-painted Steel, Stainless Steel, and Others. Each type serves distinct applications across industries, with varying demand dynamics based on consumer preferences and technological advancements.

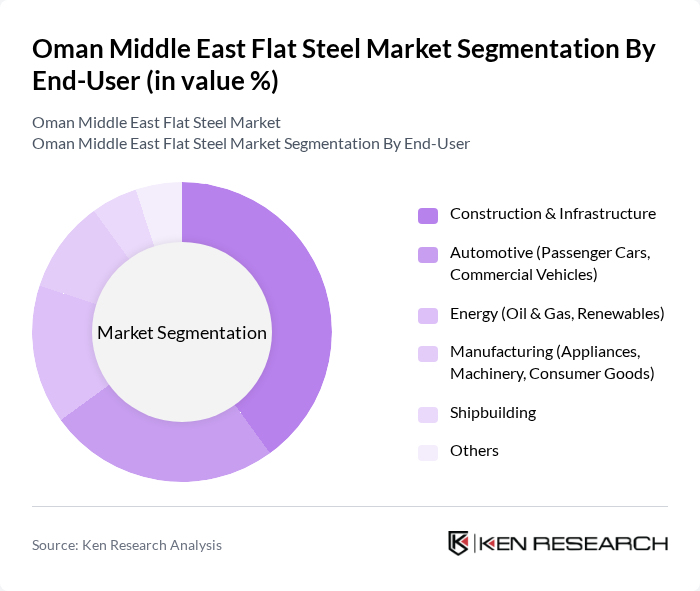

By End-User:The end-user segmentation includes Construction & Infrastructure, Automotive (Passenger Cars, Commercial Vehicles), Energy (Oil & Gas, Renewables), Manufacturing (Appliances, Machinery, Consumer Goods), Shipbuilding, and Others. The construction sector is the largest consumer of flat steel, driven by ongoing infrastructure projects and urbanization trends.

The Oman Middle East Flat Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Steel Rolling Company LLC, Al Jazeera Steel Products Co. SAOG, Sohar Steel LLC, United Steel Company (SULB Oman), Muscat Steel Industries Co. LLC, Gulf Steel Industries LLC, Al Anwar Investments SAOG, Al Batinah Steel & Aluminum Co. LLC, Al Fajr Metal Industries LLC, Al Hodaifi Group, Al Mufeed Trading LLC, Oman National Engineering & Investment Co. SAOG, Oman Cables Industry SAOG, Al Jazeera Metal Products LLC, Oman Metal Industries LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman flat steel market is poised for significant growth, driven by increasing construction activities and government initiatives aimed at industrial diversification. As infrastructure investments rise, particularly in transportation and utilities, the demand for flat steel products will likely surge. Additionally, the shift towards sustainable manufacturing practices and eco-friendly production methods will shape the industry’s future, encouraging innovation and attracting investments. Overall, the market is expected to adapt to evolving consumer preferences and regulatory frameworks, ensuring resilience and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Hot Rolled Steel Cold Rolled Steel Galvanized Steel Pre-painted Steel Stainless Steel Others |

| By End-User | Construction & Infrastructure Automotive (Passenger Cars, Commercial Vehicles) Energy (Oil & Gas, Renewables) Manufacturing (Appliances, Machinery, Consumer Goods) Shipbuilding Others |

| By Application | Structural Components Pipes & Tubes Tanks & Vessels Automotive Body Panels Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Product Form | Sheets Plates Coils Strips Others |

| By Manufacturing Process | Electric Arc Furnace (EAF) Basic Oxygen Furnace (BOF) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Flat Steel Usage | 100 | Project Managers, Procurement Officers |

| Automotive Industry Steel Requirements | 60 | Supply Chain Managers, Product Development Engineers |

| Manufacturing Sector Steel Consumption | 50 | Operations Managers, Quality Control Supervisors |

| Retail Distribution of Flat Steel Products | 40 | Sales Managers, Inventory Control Specialists |

| Government Infrastructure Projects | 40 | Policy Makers, Project Coordinators |

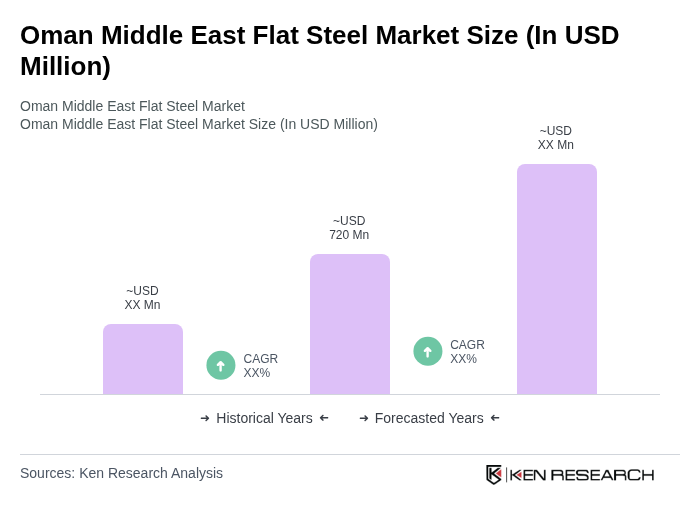

The Oman Middle East Flat Steel Market is valued at approximately USD 720 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand in construction, automotive, and manufacturing sectors, alongside government initiatives for infrastructure development.